THE VOICE OF INTERNATIONAL LITHUANIA

|

VilNews has its own Google archive! Type a word in the above search box to find any article.

You can also follow us on Facebook. We have two different pages. Click to open and join.

|

It’s the economy, stupid *

THE LITHUANIAN ECONOMY: INNOVATE OR DIE

By Valdas (Val) Samonis , PhD, CPC

RRU and INET, http://www.about.me/val.

* When Bill Clinton ran for President in 1992, Democratic strategist James Carville famously posted a large sign in the campaign’s “war room” that read: “It’s the economy, stupid!” Carville wanted to remind his candidate and those working for him to keep their focus where he felt it belonged: the economy.

“DEDICATED TO THOSE WHOSE BLOOD AND BRAINS MADE FREE LITHUANIA POSSIBLE”

ABSTRACT. This paper takes a comparative policy look at the Lithuanian (LT) economy during the intellectually and practically interesting period (2000-2015) of the coincidence of a middle-income growth trap, that LT found itself in alongside other transition economies, and a policy response to the Great Financial Crisis (GFC) that started in 2008. The paper argues that the LT policy response (a radical and classical austerity) was wrong and unenlightened because it coincided with strong and continuing deflationary forces in the EU and the global economy which forces were predictable, given the right policy guidance. Those forces were caused primarily by high debts of the EU countries and the mismanagement of both monetary and fiscal policies of the Eurozone during the misguided efforts to get out of GFC by the EU. Also, the paper makes a point that LT austerity, and the resulting sharp drop in GDP and employment in LT, stimulated emigration of young people (and the related worsening of other demographics) which processes took huge dimensions thereby undercutting even the future enlightened efforts to get out of the middle-income growth trap by LT. Consequently, the country is now on the trajectory (development path) similar to that of a dog that chases its own tail. A strong effort by new generation of policymakers is badly needed to jolt the country out of that wrong trajectory and to offer the chance of escaping the middle-income growth trap via innovations. The paper points to some useful if debatable characteristics of this future effort.

Introduction

The 2000-2015 period is remarkable for Lithuania in that the strategic changes implemented during it are related to and stemming from the most important systemic decisions of Lithuania (after regaining its independence in 1990) to orient itself, its evolution of politics and rules of business, towards the standards of modern market-based western democracies. Such changes are evidenced by strategic policy events which took place during the above mentioned period – the integration of Lithuania to the European Union as well as NATO (2004), accompanied by several other achievements (e.g. becoming a WTO member).

However, in parallel, LT has been running out of the traditional low- to middle-income countries (European and global) competitive advantages that rely on low wages for comparatively pretty well educated society. This is called the “middle-income trap” in the economic literature. In LT case, some of the very achievements (EU accession) contributed to the early appearance of this trap due to “demonstration effect” in consumption and the resultant intense emigration of young people in search for “greener pastures” in the West.

Enter the Great Financial Crisis That Started in 2008

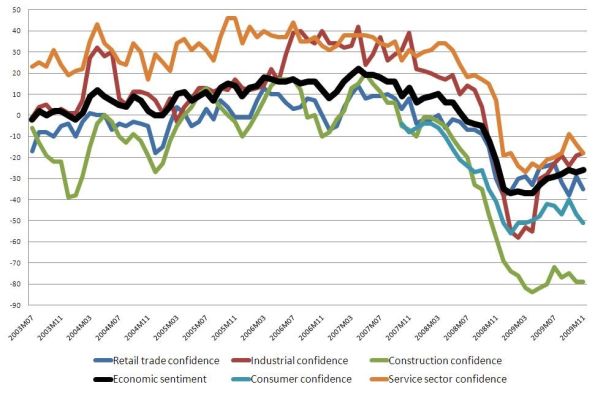

LITHUANIAN ECONOMIC SENTIMENT INDICATOR AND ITS COMPONENTS

https://en.wikipedia.org/wiki/Economy_of_Lithuania

The Great Financial Crisis started in 2008 with the collapse of the investment firm Lehman Brothers in the USA. The crisis was caused by the severe shortage of regulation (supervision) of the US banks (over 8000 of them) by the US Federal Reserve System (the US central bank, then under the Governor Alan Greenspan) and the George W. Bush Administration. In absence of the proper governmental roles (now called macro-prudential regulation), the US banks and the Wall Street investment houses have been “inventing” the ways to earn money the “easy way” (e.g. very risky derivatives, etc.) using the naiveté of the clients and the shortage of their knowledge of economics/finance, esp. mortgage borrowers (the so called subprime mortgage crisis). Via intensifying linkages in the globalized economy, the Great Financial Crisis crossed the Atlantic and hit the Eurozone much harder than the USA because the Eurozone relies primarily on banks for financial intermediation and has a common currency . Also, the Eurozone countries have lots of public and private debt that is not properly accounted given interdependencies created by the integration processes. The Goldman Sachs recently published a piece of research that boldly described events in the world’s emerging markets, or EM, as the “third wave” of the financial crisis that began in 2008, the first wave being the US subprime-housing crisis, and the second wave – the Eurozone sovereign-debt crisis.

“Expansionary Austerity” Is a Contradiction in Terms

Recently, there has been a number of studies proving that the “expansionary austerity” is a contradiction in terms. One, authored by Oliver Blanchard from the IMF, and a young colleague Daniel Leigh, showed how economists had systematically underestimated the negative effects of austerity by using standard assumptions that a dollar in government spending cuts reduced economic activity by only 50 cents. But Blanchard and Leigh found that in countries that were already in recession (the case of EU), and in which (Eurozone) the central-bank interventions were limited by the fact that interest rates were already at zero, the “multiplier” turned out to be much higher: A dollar of belt-tightening could result in more than a dollar of lost output. That is what happened in Lithuania. Another study found that in advanced nations, it would be better to let the country gradually grow out of its high debt levels than to try to pay down the debt by belt-tightening (austerity).

The Deflationary Vortex: Welcome Back to the “Dirty Thirties”

Austerity is often a positive sum game; but it is a catastrophic blunder for Lithuania (LT) to have done it in a deflating EU and a deflating global economy that was the result of the Great Financial Crisis. Any more sophisticated understanding of the global economy and the 2008 initialized recession would have revamped that policy fundamentally and fast. Now LT pays for this huge blunder with the catastrophic emigration of the best young people on top of over 20% GDP decline, suddenly. Due to a glaring shortage of knowledge on the part of the LT Government, LT repeated most major mistakes of the European Great Depression that started in 1929. Combined with the lingering Soviet legacies, this is a catastrophic blow to LT economy and society. I argued that line since very long ago, a lone voice crying in the wilderness of LT and Diaspora policy discussions.

The deflationary vortex will be pulling down the economy, deepening deflation (increasing the burdens of public and private debt, etc.), and decreasing employment (bankruptcies, etc.) to levels unheard of before. The deflationary vortex is a very dangerous (and poorly understood) phenomenon and can last years, literally obliterating the economy, its productivity, and driving most of the skilled people abroad. The above is a lesson from the 1930s Great Depression.

But, for the first time in human history, the picture is further dangerously complicated by some one thousand trillion in toxic derivatives sloshing around the global economy. Produced by the Great Financial Crisis, those derivatives are like financial AIDS but no bank will tell you that!

Too deep austerity in the EU imposed horrible costs on the societies (esp. middle class) and will actually substantially increase the public debt of deep austerity countries (like LT) because, as a result of austerity, the output has dropped horrendously (some 20-25%) and now growing in some countries (e.g. LT) only very slowly, compared to similar development level countries (China, other Asia).

Austerity: The Case of Lithuania

When the Great Financial Crisis hit Europe in 2008, LT was experiencing its destabilizing effects rather sharply. So the LT Government came up with a classical austerity policy as a response to crisis thinking that this crisis is a simple overconsumption crisis characteristic of traditional run-of-the mill recessions. The LT austerity policy involved sharp cuts in governments spending and public wages (over 30%) and some sharp increases in taxes. The overall effects of the LT austerity policy included over 20% drop of GDP (2009) and worsening of the deflationary tendencies that were put in motion by the financial crisis.

This austerity policy of the Kubilius Government was initially somewhat necessary because communists/nomenklatura plundered the LT economy by rent-seeking policies under former governments all the way from the Brazauskas Government (but esp. Kirkilas Government) and just put their people (nomenklatura) in posh EU jobs. The number of bureaucrats under the Kirkilas Government rose fivefold, etc. PM Kubilius was so ambitious that he did not even ask for the standard IMF help but let LT pay close to 10% interest on non-IMF private sector loans, a huge sacrifice. That was a grave mistake. Even though broadly necessary given the disastrous communist nomenklatura legacies, the austerity policy was way too deep and way too long. Against such horrendous output collapse (over 20%), modest growth has decades to work before it overcomes this kind of downturn and lifts LT up any more substantially; this is the basic small numbers law known for statistical/mathematical researchers.

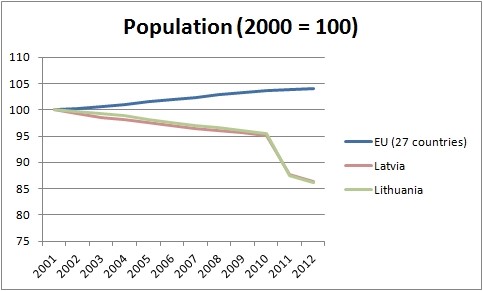

LT austerity policies and the resulting sharp drop in GDP and employment stimulated the emigration of young people (and the related worsening of other demographics) which processes took huge dimensions thereby undercutting even the future enlightened efforts to get out of the middle-income growth trap by LT.

Some Theoretical Interpretations of Financial Crises

In the pre-global era, crises were usually caused by underinvestment, overconsumption or premature consumption of the fruits of early economic development which phenomena usually led to the general economic disequilibrium in the economies affected. Such crises were fuelled by loose monetary and/or fiscal policies (macroeconomic policies) whereby governments sought “easy” ways to please the electorate, those “easy” ways are known under the umbrella term “populism”. While this kind of crisis is not extinct in the global economy, a different kind of crisis is now possible and even more dangerous because we don’t fully grasp its nature, mechanisms and, consequently, we are not yet able to adequately cope with it, especially in the era of high debts globally.

Contrary to the old experience, the new kind of crises is caused by overinvestment and/or mis-investment, domestic or foreign. Factors which appear to facilitate the birth of the new kind of crises predominantly stem from the interaction of macro-economy and micro-economy or, in other words, from misallocation of the government’s role in economic development in the global digital era. With the exception of Prof. Paul Krugman who pointed to them several years ago, the new dangers have escaped the attention of the great majority of analysts. These factors are the following:

- Less than transparent mechanisms of corporate governance and finance, esp. not well defined or excessive roles of political and/or other noneconomic criteria in corporate decision-making. These problems were usually masked by the solidarity philosophy prevailing in large banks and firms (e.g. top Wall Street firms) and/or inadequacies of bankruptcy or other exit processes which in many Western economies ensure that investors suffer consequences of their mis-investments. With some unessential differences, same happened to the US with Fannie Mae and Freddie Mac, two quasi-governmental mortgage giants;

- Less than transparent and/or adequate domestic or international supervision of banks and financial systems in general. Contrary to detailed industrial policies, there is a proper role for the government in managing the financial systems. In a nutshell, it is a role of a macro-prudential supervisor who sees to it that there are no undue systemic risks in the overall functioning of financial markets. This is a question of appropriate laws and their consistent enforcement based on adequate disclosure and transparency. Such a supervisory role has been missing in European or American economies, where cozy relations between supervisors and financial institutions (“crony capitalism/socialism”) or a bona fide “abandonment” were a norm rather than exception. This problem was compounded by the general underdevelopment or mis-development of those financial institutions and/or financial products which are suitable to today’s global digital/knowledge economy;

- High speed of international capital flows in today’s global digital economy can cause overinvestment and/or mis-investment before it is too late for rather slow self-correcting mechanisms (e.g. based on the Efficient Market Hypothesis) to make any appreciable difference and prevent the outbreak of a crisis.

In sum, inadequacies at micro- and macro-levels in political-economic systems of many countries, and especially inadequacies in the interaction of these two levels, are quickly exposed in the global digital/knowledge economy and result in crises which cannot be contained, let alone solved or prevented, by traditional national or international (e.g IMF) mechanisms. This calls for new systemic solutions, new financial architecture which is better aligned with the nature of the global digital economy. Such solutions should be adopted at both national and global levels. At the national level, I propose a single institution with wide-ranging supervisory powers over the entire financial system of a given country, a sort of Superintendent of Financial Institutions and/or a National Development Council. These proposals are to be developed.

I am not against the use of austerity in principle, in justified cases and with justified and thought out model, e.g. like it was done in Canada or New Zealand in the 1990s. Most people do not understand that now we have a repetition (at least in Europe) of the Great Depression (1929-1933-1946), not your regular run-of-the-mill short-term cyclical downturn. This is one in 85-90 years balance-sheet depression (Kondratieff Downturn) that will require about a decade or rather more to de-leverage most of the accumulated debt in both private and public sectors of the many nations including emerging markets like China. In general, the scholarly level of austerity discussions reminds me of medieval “theological” disputes of how many devils can dance on the tip of a needle.

Given very dangerous European and global financial-economic and strategic predicaments, LT needs to adopt very bold and innovative ways to “sell” to the world its extreme austerity sacrifices during the continuing period of global Great Recession/Depression and its earlier periods of bold systemic transformations as well. This proposal is a new strategy to globalize LT financial-economic ties (optimize global integration, optimization of LT global competitive advantages, etc) so that the nation is no longer badly cornered and unduly dependent on the moribund European Union which is distracted and disoriented by the cacophony of austerity/profligacy controversies, and actually rewarding free riders by default.

By now it is rather clear that Europe alone cannot properly reward the financial virtue and sacrifice of the LT people for the sake of the future (investment) which is the most distinguishing trait of a responsible nation and a mature leadership; hence the need for LT to go before the entire “global village”. Such globalization can provide huge and underappreciated benefits for a nation like LT.

I have developed a conceptual-analytical framework of a research and advisory project “LitShares Strategy for Globalizing Lithuania’s Sources of Growth” that is designed to use the extremely painful LT austerity and turn it into LT competitive advantages globally so LT can start a serious and sustainable growth and high value added job creation that would stem the dangerous bleeding of young, educated people and return them to virtual and dual-mode networks working for LT.

This LitShares or lietakcijos (LTS) proposal is still to be developed to a greater detail and “hands-on” policy relevance; this as an example of policy innovations needed.

In Lieu of Conclusions

Austerity is sometimes good. But it is a catastrophic blunder for Lithuania (LT) to have done it in a deflating EU and global economy. Any more sophisticated understanding of the global economy and the 2007-8 started Great Recession would have revamped that policy fundamentally and fast. Now LT pays for this huge blunder with the catastrophic emigration of the best young people on top of over 20% GDP decline. Due to a glaring shortage of knowledge on the part of the LT Government, LT repeated most major mistakes of the European Great Depression that started in 1929. Combined with the lingering Soviet legacies, this is a catastrophic blow to LT economy and society. I argued that line since very long ago, a lone voice crying in the wilderness of LT politics!

The illusions regarding the EU contribution to Europe’s development are dissipating quickly. The latest research shows that. For example, comparative household wealth studies show that German households net worth is only some $70K; US $320K, Canada $360K. Neither EU nor Germany have developed any strategy to overcome deep EU problems; Germany has Ordnungspolitik that is just a poor substitute for any serious financial-economic and/or competitiveness strategy and aims first of all at stability (Stabilitaet) and promotes Fortress Germany (Festung Deutschland) mentality; this will hardly change. The EU has 7 % of global population, 25% of global GDP, and over 50% of socialistic welfare payments. Nobody in Europe can afford that! The EU is heading for turmoil, decline, “balkanization”, and political/economic strife, emigration. Germany has already psychologically sort of left EU, esp. the famous Mittelstand firms that trade fully globally: Asia, North America. In the near future, only some 30% of Germany’s trade will be with Europe ; who will then even care about Europe? Germany is globalizing very quickly, becoming another Switzerland and they are right to do so.

So LT has to do a similar change in strategy towards globalization, perhaps in recollection or reference to the Grand Duchy of Lithuania that was rather global in scope for those times. Evidence-based policies should use conclusions stemming from data-driven comparisons of policies and their effects, not some simplified, doctrinaire austerity tenets, etc. This is probably only possible with the new, younger generation of policymakers who should come up soon with innovative solutions or LT will be further descending into the irreversible decline on the outskirts of the struggling or collapsing European Union.

End of Paper.

Valdas (Val) Samonis, Toronto, Canada.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

VilNews e-magazine is published in Vilnius, Lithuania. Editor-in-Chief: Mr. Aage Myhre. Inquires to the editors: editor@VilNews.com.

Code of Ethics: See Section 2 – about VilNews. VilNews is not responsible for content on external links/web pages.

HOW TO ADVERTISE IN VILNEWS.

All content is copyrighted © 2011. UAB ‘VilNews’.

Click on the buttons to open and read each of VilNews' 18 sub-sections

Click on the buttons to open and read each of VilNews' 18 sub-sections

The Tragedy of the LT Economic Policy (Austerity) Is: "If no one trusts that swelling will rise, it won't," is the way Prof. Krugman put it. "The best way to be at all beyond any doubt of raising expansion is to go with a changed financial administration with a burst of monetary boost." AND THAT IS CONTRARY TO LT AUSTERITY!

The Tragedy of the LT Economic Policy (Austerity) Is: “If nobody believes that inflation will rise, it won’t,” is how Prof. Krugman put it. “The only way to be at all sure of raising inflation is to accompany a changed monetary regime with a burst of fiscal stimulus.” AND THAT IS CONTRARY TO LT AUSTERITY!

Read more at https://www.project-syndicate.org/commentary/bern…