THE VOICE OF INTERNATIONAL LITHUANIA

|

VilNews has its own Google archive! Type a word in the above search box to find any article.

You can also follow us on Facebook. We have two different pages. Click to open and join.

|

Business, economy, investments

- Posted by - (7) Comment

into a Tech Park in Vilnius

Communication Coordinator

Vilnius Tech Park

Two private investors, together with their partners, offered to municipality to lease the buildings for 25 years and invest nearly 8 m euro to the renovation of the heavily rundown buildings. The agreement has been made. While keeping their original looks and historical value (there are some fragments of decorated floors, etc. left that will be kept), the buildings are about to be reborn as 8 000 sq meter space for startups and related infrastructure.

Read more...- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (2) Comment

It’s the economy, stupid *

THE LITHUANIAN ECONOMY: INNOVATE OR DIE

By Valdas (Val) Samonis , PhD, CPC

RRU and INET, http://www.about.me/val.

* When Bill Clinton ran for President in 1992, Democratic strategist James Carville famously posted a large sign in the campaign’s “war room” that read: “It’s the economy, stupid!” Carville wanted to remind his candidate and those working for him to keep their focus where he felt it belonged: the economy.

“DEDICATED TO THOSE WHOSE BLOOD AND BRAINS MADE FREE LITHUANIA POSSIBLE”

ABSTRACT. This paper takes a comparative policy look at the Lithuanian (LT) economy during the intellectually and practically interesting period (2000-2015) of the coincidence of a middle-income growth trap, that LT found itself in alongside other transition economies, and a policy response to the Great Financial Crisis (GFC) that started in 2008. The paper argues that the LT policy response (a radical and classical austerity) was wrong and unenlightened because it coincided with strong and continuing deflationary forces in the EU and the global economy which forces were predictable, given the right policy guidance. Those forces were caused primarily by high debts of the EU countries and the mismanagement of both monetary and fiscal policies of the Eurozone during the misguided efforts to get out of GFC by the EU. Also, the paper makes a point that LT austerity, and the resulting sharp drop in GDP and employment in LT, stimulated emigration of young people (and the related worsening of other demographics) which processes took huge dimensions thereby undercutting even the future enlightened efforts to get out of the middle-income growth trap by LT. Consequently, the country is now on the trajectory (development path) similar to that of a dog that chases its own tail. A strong effort by new generation of policymakers is badly needed to jolt the country out of that wrong trajectory and to offer the chance of escaping the middle-income growth trap via innovations. The paper points to some useful if debatable characteristics of this future effort. Read more…

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (0) Comment

Closer bilateral ties

China – Lithuania

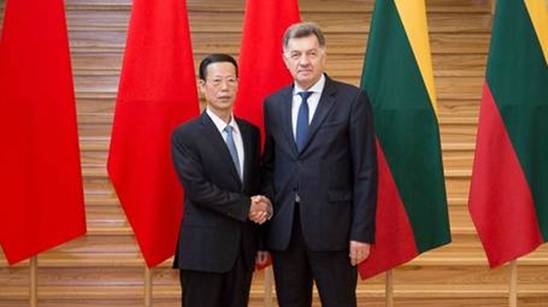

CHINESE VICE PREMIER ZHANG GAOLI AND

CHINESE VICE PREMIER ZHANG GAOLI AND

LITHUANIAN PRIME MINISTER ALGIRDAS BUTKEVICIUS

Zhang urged the two countries to further enhance mutual

Zhang said both sides should strive for breakthroughs in cooperation on major projects in infrastructure development and other areas. He said China is willing to participate in the construction of the Rail Baltic project in an appropriate form in a bid to complement each other and achieve mutual benefit and win-win situation.

Read more...- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (3) Comment

Baltics path to euro in

a sea of Eurozone turmoil

Dr. Stasys Backaitis |

Lithuania will hold the Presidency of the Council of the European Union in the second half of 2013, starting from the 1st of July. VilNews has on this background asked readers to annotate and analyze factors that have to do with Europe, the EU, the euro and Lithuania. This is one of the posts we have received. An article by Dr. Stasys Backaitis, |

|

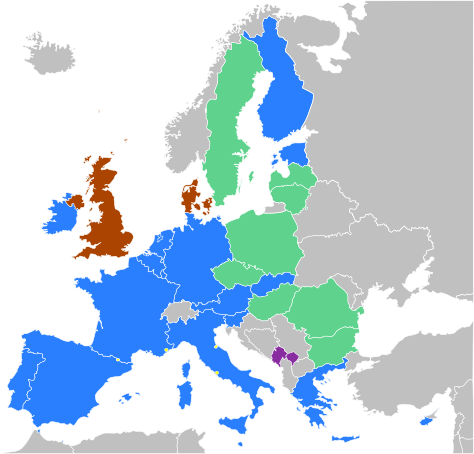

EU Eurozone (17) |

The promise

For most of the southern EU countries the euro may seem like chains to a captive, but for Latvia’s and Lithuania’s governments and their elites, acceptance into the eurozone (EZ) symbolizes freedom and independence. To the Baltics, membership in the EZ reinforces each country's integration into the west and is the final big step in liberation from their historical tormentor, Russia. Following Latvia, Lithuania is eagerly awaiting the green light to be admitted to the EZ in the next year or two. That was also the message by the Nobel Committee last year, when it awarded the EU the Nobel Peace Prize for its role in “the advancement of peace and reconciliation, democracy and human rights as well as political freedom”. The message echoed by the Continent’s politicians, in the words of German Chancellor Angela Merkel, is the choice between continued integration or a return to “centuries of hatred and blood spill”.

The EU message is hammered home relentlessly by the EU

politicians,

who believe their citizens face a stark choice, in the words

of Chancellor

Angela Merkel of Germany, between continued integration and a

return

to “centuries of hatred and blood spill.”

Benefits of membership

This euphoria seems to be rather a strange contradiction, as deep financial problems in Greece, Portugal, Spain, and several other countries have rattled the foundations of EU and particularly the integrity of the eurozone. Now that the Czech Republic, Poland as well as Hungary are having second thoughts of joining the euroclub, and England is outright rejecting the thought, why are the Baltic countries so eager to join it?

Lithuanian Finance Minister, Rimantas Sadzius, echoed Dombrovski, by saying in a Bloomberg Brussels interview on May 13, 2013 that joining the euro will help his country’s economy by boosting its ability to attract international financing. “We would have a huge improvement of the investment climate in Lithuania almost overnight,” Sadzius said. He noted that “Lithuania risks isolation if it slows its march to the common currency, now that Finland and Estonia have joined the 17-nation euro bloc and Latvia has been invited to join it in 2014.” Assuming it can meet all economic and fiscal targets, Lithuania is aiming for acceptance into the eurozone in 2015. “We want to participate in the decision-making of the euro zone,” Sadzius said. “We see our future here.”

According to the Guardian, Latvia's prime minister, Valdis Dombrovskis,” joining the euro makes economic sense”. It will bring budget savings, promote foreign direct investment and underpin the recovery from an economic collapse in 2008-11. But it's not all finance and economics. For the Baltic States, long at the mercy of an imperial Russia, whether tsarist or communist, and now wary of Vladimir Putin, the euro would affirm gain rather than loss of sovereignty.

The Baltic States wanted to join the eurozone in 2008, but was stopped by the financial collapse in the EU. Their housing and consumption bubble, fuelled by cheap credit from the Swedish and Danish banks that dominate the Baltic banking sector, burst and sent the economy into a tailspin, more in Latvia and Lithuania and somewhat less in Estonia. Their economies shrank by nearly 25%, civil service jobs and wages were slashed, numerous social, education, and health services frozen and some axed. As a result unemployment tripled, property prices collapsed by up to 70%, and an estimated 10% of the population, mainly young people, emigrated.

Yet in the last year and a half, the Baltic countries went back from bust to boom. Because of their previous belt tightening economic policies and self imposed fiscal constraints, they became the fastest growing in the entire EU region, up to 5% last year.

Dombrovskis and his Lithuanian counterparts argue that, unlike Greece and the other southern rim eurozone members, the recovery of their countries is solid and sustainable, based on manufacturing and exports and not by easy credit of the boom years of the last decade. The achievements are something no other eurozone members have managed to pull off, by imposing austerity measures and spending cuts as tough or tougher than any in the eurozone without causing public unrest or social upheavals.

|

Lithuanian Finance Minister, Rimantas Sadzius, said in a Bloomberg Brussels interview on May 13, 2013 that joining the euro will help Lithuania’s economy by boosting its ability to attract international financing. “We would have a huge improvement of the investment climate in Lithuania almost overnight,” Sadzius said. He noted that “Lithuania risks isolation if it slows its march to the common currency, now that Finland and Estonia have joined the 17-nation euro bloc and Latvia has been invited to join it in 2014.” |

|

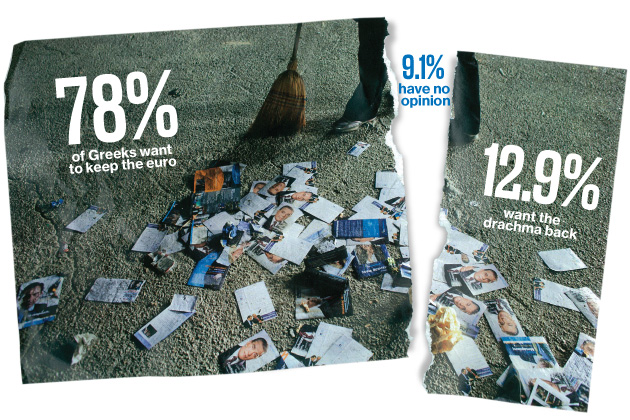

Managing hazards

Are the Baltic States over the hump, and will not experience the euro sickness that is shaking the southern EU rim? Based particularly on Greece’s and Portugal’s debilitating experience, there is convincing evidence that euro’s initial lure leads most financially unendowed, less industrialized and poor in natural resources countries, subsequently to very painful downfall.

Estonia’s Prime Minister Andrus Ansip noted at the Baltic Development Forum in Riga on May 30, 2013 that Latvia and Lithuania’s joining the euro area will make the Baltic States even more attractive to investors and will boost economic growth in the region. “Joining the euro area was and is very important to us. After joining the euro area, foreign investment in Estonia went up 10.4% within a year while unemployment decreased significantly”. According to the Prime Minister, the use of a common currency also increases trade with other European Union member states and generates economic growth.

In a 1961 paper Robert Mundell noted that common currency is a matter of balancing advantages against disadvantages. Economically, the advantages are reductions in the costs of trade-eliminating the need to buy and sell currencies, to hedge exchange rate risks with futures or swaps, and the like. Economic disadvantages stem from the fact that a country with a shared currency cannot respond independently to external shocks by using monetary instruments like changes in interest rates or exchange rates. Mundell also recognized a role for political factors in the choice of currency arrangements. Interestingly, at that time, he saw the question of common currency as purely academic, “hardly within the realm of political feasibility that national currencies would ever be abandoned in favor of any other arrangement.” Little did he know of what would happen in 2000 and beyond years.

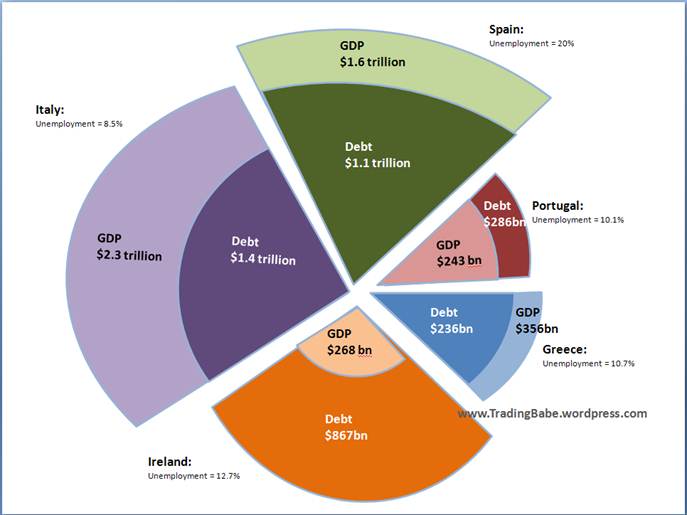

If joining the eurozone stimulates economies and helps to reduce unemployment, why is the opposite happening to the southern rim of EU?* People in the southern rim countries appear to believe that the euro project has locked them in economic chains, rather than advancing democracy, liberalism, and human rights. As is, the euro has taken the weaker less industrialized member states to an extraordinary test of resilience. Large segments of the southern EZ citizens see themselves cast in an economic prison, with Germany as the jailer and the common currency as the bars. They view the future as continued stagnation, characterized by aging societies with expensive welfare burdens and large segments of the young people sitting idle and , unable to find work.. It is a horrendous stress, unseen in the history of modern Europe, and particularly devastating to the youth segment. Of the population. In the Continent’s sick-man economies, the jobless rate for those under 25 now staggers the imagination: more than 40 percent in Italy, more than 50 percent in Spain, and more than 60 percent in Greece.

If

joining the eurozone stimulates economies and helps to reduce

unemployment,

why is the opposite happening to the southern rim of EU?

Stepping stones to success

Upon joining the eurozone, countries such as Greece, Spain, Italy, and Portugal are almost certainly no better off than if they would have kept their own currencies a decade ago. "The introduction of the euro created a lot of wrong signals and distortions," says Uri Dadush, an economist at the Carnegie Endowment in Washington, DC and author of the excellent new study “Paradigm Lost, The Euro in Crisis”. The euro provided benefits, such as reduced transactions costs, inexpensive loans to finance internal projects, etc., but also caused very serious problems at pay-back time these countries now face."

Monetary union has damaged their economies in two major ways. First, inexpensive borrowing, that made the euro look so appealing, caused booms in domestic consumption. However, it also raised enormously overall costs, especially for labor. As a consequence it lowered dramatically their competitiveness both compared to stronger euro zone members such as Germany and France and with respect to countries that didn't join the euro like Britain and Sweden.

Second, the easy credit enticed the southern rim governments to borrow and spend lavishly. As a result, they are now struggling with potentially ruinous levels of debt. Both problems were just what Friedman would have predicted, that, a single monetary policy and one-size-fits-all interest rates simply won't work for economies as different as mighty Germany and as wobbling as Greece or Spain. It turned to be ruinous even to the more prosperous Italy and Ireland, whose stronger economies suffered from the same wrong signals.

Since joining the eurozone, the southern EU economies have lost ground to their stronger trading partners in competitiveness. Their costs for making products or even growing fruits and vegetables, especially for export, have increased sharply and became uncompetitive The best measure, called Real Effective Exchange Rate or REER index, calculated by the EEC for 35 nations, indicates that the main culprit in the unbalance is the cost of labor.

Since 1989, the competitiveness ratings fell 9% for Greece, 16% for Spain and Italy, and 26% for Ireland, which was renowned as a mighty exporter. Now, everyone of them is struggling with costs that are between 16% to 31% above the norm. According to the index, labor and other expenses in Italy and Spain are now one-third higher than in the UK. This indeed is not a good denominator for resolving high unemployment problems.

Latvia’s and Lithuania’s integration into Europe must be viewed through the lens of powerful historical forces and very dangerous and unpredictable neighbors. For both countries deeper integration into the EU is the only right way to go. But the euro evidently might not be necessarily the right symbol of that forward movement, or if it is, it must be handled with extreme sense of balance, which in a climate of intense political rivalry is very difficult to carry out. The euro is most often viewed as a political project, one that will bring the nations of Europe into a greater and deeper union. But joining the euro at a moment when history is fiercely contesting this vision, might be euphoria to some and disaster to others. The majority of Baltic populations is on the cautious side and wants to see first how the EZ will resolve its own problems. Will politicians listen?

Although Latvia and Lithuania appear to meet the criteria set by EU to be admitted to the eurozone club, it does not tell the whole story. Membership in the eurozone may not always be easy, because each of the countries faces unique problems and because the euro itself is in a highly fragile circumstance.

First; it is not likely that inflation in both Latvia and Lithuania will continue to stay as low as it is now. Experience by southern rim euro countries indicates that a relatively poor country with a fixed exchange rate, upon availability of “cheap” money, will experience faster inflation than its larger trading partners. Yet to counteract these negative effects, the euro member countries cannot use monetary policies and exchange rates to manage their changing inflation rates.

Second; faster real growth and faster inflation will make management of fiscal policy more difficult. During the boom years of cheap and easy money in 2004 to 2007, the governments, yielding to populist pressures, raised government salaries, minimum wages, and social benefits with little worry about consequences. The resulting overheating of the economies intensified the crash that followed the global economic crisis in 2008 and 2009. As a result, even more severe austerity measures were required than would otherwise be needed. To avoid repetition of that scenario careful fiscal management is an absolute necessity.

Third, both Latvia and Lithuania face a difficult demographic situation. The population reproduction rates in the last decade are well below replacement levels, accompanied by steadily increasing number of retirees per worker. The rising burden to support pensions, increasing healthcare needs of the aging population, and lack of employment opportunity induced emigration of large numbers of mostly young people. As a consequence, falling revenues, increasing outlays, and high unemployment made the financial situation very difficult to control.

Since

joining the eurozone, the southern EU economies have lost ground to their

stronger trading partners in competitiveness. Their costs for making products

or even growing fruits and vegetables, especially for export, have increased

sharply and became uncompetitive The best measure, called Real Effective

Exchange Rate or REER index, calculated by the EEC for 35 nations, indicates

that the main culprit in the unbalance is the cost of labor. Since 1989, the

competitiveness ratings fell 9% for Greece, 16% for Spain and Italy, and 26%

for Ireland, which was renowned as a mighty exporter. Now, everyone of them is

struggling with costs that are between 16%

to 31% above the norm. According to the index, labor and other expenses in

Italy and Spain

are now one-third higher than in the UK.

The bottom line

The governments of Lithuania and Latvia appear to realize that they are dealing with a very fragile economic and geopolitical situation, but in their judgment, the quest for insuring security and protection of their countries’ sovereignty are worth many sacrifices and hardships. In their many speeches, the respective politicians suggest that success in dealing with the 2008-2012 world economic crisis is a living proof that the austerity measures taken were sufficient to navigate safely through extremely devastating situations, and that the recipes of the European Commission do work and helped to achieve the planned results.

If becoming eurozone members is a way for the Baltic countries to insure security and protection of their sovereignty, then it is a reasonable risk, provided it is guarded by good governance and sound administration of fiscal policies. Of most importance is that the Baltic politicians do not succumb to the lures of easy money and irresponsible spending. Even when debt is incurred, the borrowed funds should be invested in long-term economic growth and job creation, improved competitiveness, quality of work, and with focus of achieving positive balance of trade. The Baltic politicians need to realize that their small countries are not equipped and cannot compete in traditional mass manufacturing with highly industrialized countries. Rather the countries can excel by being frugal and competing through product uniqueness, excellence in quality, innovation and unexcelled services. Their success of rising from economic ashes of 2008-2012 is a proof of their ability to meet these challenges.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (0) Comment

What’s wrong with Europe

and how to fix it?

Valdas Samonis |

Lithuania will hold the Presidency of the Council of the European Union in the second half of 2013, starting from the 1st of July. VilNews has on this background asked readers to annotate and analyze factors that have to do with Europe, the EU, the euro and Lithuania. This is one of the posts we have received. An article by Valdas Samonis, PhD, CPC |

Cutting through the EU bureaucratic gobbledygook

Part 2

The more I am into my research on my forthcoming book

"INSIDER CRONY SOCIALISM", the more I see the parallels

between the Gorbachev's USSR and Barroso's EU!

Collapsing EUSSR under Reformer Barrosov?

Pray that God gives more wisdom to European Leaders!

I have to admit it.

The more I am into my research on my forthcoming book "INSIDER CRONY SOCIALISM", the more I see the parallels between the Gorbachev's USSR and Barroso's EU!

According to the numbers circulating in the European financial press, the EU outstanding debt is some euro 40 trillion!

The practically only EU paymaster's (Germany') GDP is some euro 2,5 trillion. I will not insult your intelligence; just compare the two!

For the first time in human history, the picture is further dangerously complicated by some one thousand trillion in toxic derivatives sloshing around the global economy. It is like financial AIDS and no bank will tell you that!

In terms of financial intermediation, Europe relies on banks much more than any other major region of the world economy.

On June 26, the EU agreed to a couple of years of reforms towards the European Banking Union (EBU), a very complex bank supervision, etc, arrangement that leaves some countries out, some in, to different and obfuscated extents, etc.

Coming to the Gorby/USSR parallel, when the central planning from Moscow (sorry: Frankfurt/Brussels!) doesn't work, the solution proposed by the planners is more centralized planning rather than letting nations or EU sub-regions to find their own workable solutions.

Germans are wise as usual; they exempted the great majority of their banks (that serve the German economy) from the EBU and will regulate them from Berlin, not Frankfurt (ECB)! Voila!

If I were a young European, I would buy my transatlantic ticket today; one way!

Pray that God gives more wisdom to European Leaders; as the Lithuanian Bishops suggests when the LT Presidency of the EU starts on July 01, 2013.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (3) Comment

Lithuania’s 3 nightmares

By Kestutis Eidukonis, VilNews CEO

At the beginning of this month, I had the great privilege of representing the PLB (World Lithuanian Community) in its bi-annual meeting with members of the Seimas (Parliament). This joint commission meets twice a year and consists of ten members elected by the World Lithuanian Community and ten members of the Seimas, one from each party. The commission has two co-chairs one from the PLB and one from the Seimas. The co-chair from the PLB was Dr. Jonas Prunskis and the co-chair from the Seimas was Ona Valiukevičiūte.

The areas of debate and concern for the commission were:

- The 2014 Lithuanian Song Festival which will take place July 2-6 in 2014

- The preservation of the Lithuanian language in Lithuania, as an official EU language and abroad by the Lithuanian diaspora.

- The ability of Lithuanian Citizens to hold on to their Lithuanian Citizenship in spite of having another citizenship,

- The improvement of economic conditions in Lithuania so as to improve investment and job creation.

- The absolute imperative of having energy independence.

Out of all these areas the one that attracted the most debate, was the one concerning citizenship. In fact all these areas tied together. All members of the commission agreed that the most important problem facing Lithuania is the massive emigration taking place today. Preservation of Lithuanian song language and Lithuanian citizenship are all tied to improving the Lithuanian economy and energy sector so that Lithuanian citizens would not only not have a reason to leave, but also that the ones who left, would have a reason to return! Creating good high paying private sector jobs is the key to stopping the depopulation of Lithuania.

Interestingly enough not all members of the commission agreed as to what needs to be done.

As an observer of the Lithuanian Economic and Political Renaissance I have been impressed by some of the steps taken by the government to improve the business climate in Lithuania, but there is a total lack of political will by any political fraction to tackle head on the real problems that hold Lithuania back from becoming a true Baltic Tiger.

1. The government of Lithuania and the social safety net of Lithuania is too large for the population to support. With an approximate 37.7% of GDP - the size of the Government is a factor that needs to be addressed. Everyone agrees that there are too many governmental departments, but no one agrees on which one to cut and by how much. It is true that there are a large number of dedicated civil servants, but it is true that there are quite a few unnecessary, redundant departments staffed with wayward relatives who could not make it in the private sector. Lithuania is trying to be Norway, but without the North Sea Oil Fields.

2. The total tax rate on the Lithuanian people is way too high. I realize that, when compared to other EU countries Lithuania is not that high - but keep in mind that the best stimulus that can be given to the Lithuanian economy is the ability for companies to invest and for individuals to buy or to save. As the government continues to grab close to 40 % of the GDP and still find budget short falls the national debt will continue to increase, the cost of servicing the debt will continue to increase. These percentages do not include the payments all companies have to make to the Social Security System. If these payments are included the burden on Lithuanians is even greater. Some people also do not realize that Corporations do not pay taxes they merely collect them for the government. All taxes including social security are passed on the average consumer in the price of the item or service being sold. This tax burden keeps the velocity of money low, and unnecessarily depresses the GDP thus, slowing economic growth. It is interesting that a large number of uninformed politicians are calling for even more taxes such as a tax on property, autos, and financial transactions. This kind of talk has a way of scaring away investors, who need to plan in advance and need economic and political certainty. This periodic desire of politicians to squeeze the neck of the "Golden Goose" to extract even more eggs almost always backfires - all one has to do is to look at the "shadow economy" which officially stands at 30% - but is estimated by some to be as high as 50%. It is an interesting paradox that decreasing tax rates increases state revenue dramatically while increasing the tax rate does the opposite. The high tax rate also has a highly corrosive effect on people's faith in the government. The people see government officials living "high" while they have to struggle, in their minds this then justifies working the "shadow economy".

3. The high cost of energy is another huge drag on the economy. Every Lithuanian living near the borders who can, gets his fuel outside the country. The cost of heating, transportation and energy for manufacturing is included in all products and services made in Lithuania. Without energy independence we will continue to have a huge disadvantage in attracting investment either foreign or domestic. The government is playing around with the Ignalina project and with other energy providers. This will result in increasing the costs to the point of the projects becoming uneconomical. Thankfully the LNG plant is moving ahead and on schedule. But there is no substitute for having and being able to sell energy.

In summary if we want to stop the waves of emigration we need to turn the country around. The question is who has the will and the guts to do it?

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

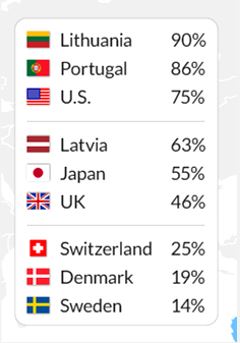

Over the past three years the share of EU citizens who want to be self-employed has fallen from 45% to 37%

- Posted by - (2) Comment

Brussels, Belgium — Over the past three years the share of European Union (EU) citizens who want to be self-employed has fallen from 45% to 37%, reports European Commission (EC). This year EC highlighted the need for more entrepreneurs in order to return the EU to economic growth and higher levels of employment.

However, historical, cultural and economic background of diverse European countries has significant effects on attitudes towards entrepreneurs in European countries. Lack of in-depth knowledge might determine future revival of entrepreneurship in Europe, reveals the study by Lithuanian Free Market Institute (LFMI) today presented in Brussels.

“It is a positive trend in Europe to turn to entrepreneurs and acknowledge their role in creating economic growth. Yet, without knowing the mistakes of the past, there is no future. This is especially important then considering New Member States, such as Lithuania or Bulgaria, which still carry a burden of post-communist past. Therefore, only full understanding of entrepreneurial situation per country can guarantee that necessary measures will be taken and they actually will give wanted results”, says Zilvinas Silenas, President of LFMI.

In line with the acknowledged need to revive entrepreneurial spirit of Europe, LFMI conducted an international in-depth study in two New EU Member States, Lithuania and Bulgaria, and for comparative reasons in two non-EU countries – Georgia and Kyrgyzstan. The aim of the current study was to determine attitudes towards entrepreneurs in countries sharing the same post-communist past and underlying historical, cultural and economic reasons of such attitudes.

How to get rid of the “exploiter” image of the entrepreneurs?

According to study results, New Member States tend not to trust entrepreneurs. Only a third of Lithuanians (31%) trust entrepreneurs, whereas in Bulgaria only one fifth (19%) of citizens do so. The research has also shown, that the large part of population, while evaluating, if they trust or not entrepreneurs, stay neutral. Neutral position was held by 33% of citizens in Bulgaria and 38% citizens of Lithuania. In comparison, in Georgia and Kyrgyzstan trust rate is higher – almost a half of the population said that they trust entrepreneurs.

Moreover, 67% of Lithuanians and 69% Bulgarians agree or tend to agree with the statement that “Entrepreneurs get rich by exploiting other people’s work”.

“The Soviet period was characterized by full nationalization and central planning of economic activities, by demonization of entrepreneurs. In all the countries the communist period did the most significant damage by stopping the development of entrepreneurship and creating a strong association between business and exploitation. Entrepreneurship is a natural process, which organically develops from the natural needs of a society, and the natural ability of entrepreneurs to fulfill these needs. Any top-down intervention in this process may be harmful and may hamper progress. Especially, if this intervention creates a negative image of entrepreneurship”, says Zilvinas Silenas.

According to anthropologist Prof. P. Subacius, study results show that in the mindset of post-communist rule people, there is not only a lack of trust, but a lack of favorable depiction and understanding of enterprising as such.

Entrepreneurship needs creativity and innovation, doesn’t it?

Majority (74%) of Lithuanians think that economic growth is created by entrepreneurs and businesses. In Bulgaria more than a half (55%) of population sees entrepreneurial efforts as the main source of economic growth. In Bulgaria as well as in Lithuania around a quarter of respondents thought that the government is the source of economic growth.

In Georgia and Kyrgyzstan about a half of respondents think that entrepreneurs and businesses create wealth for the society. In these countries there were slightly more people who think that the government is the source of economic growth in Kyrgyzstan (30%) and Georgia (34%) of respondents chose this answer.

“The differences between EU and non-EU countries are logical. In Kyrgyzstan the state sector is still dominant and, therefore, people see more important role for the state. During last decade there were significant economic and political reforms in Georgia. These reforms contributed to the economic growth and the people took this into account, when answering the survey. The optimistic sign from EU perspective is that the majority of the populations in two EU countries realize that businessmen are the creators of wealth in a society and that entrepreneurship requires a lot of hard work, risk taking and these qualities are admired”, claims Z. Silenas.

According to the study, the most common associations for Lithuanians, which arise when talking about entrepreneurs are social status (39% of Lithuanians chose the answer), hard work (39%), luxury (32%), risk (31%). These were followed by creativity (23%), ingenuity and innovation (21%), corruption (20%), bankruptcy (15%), crime (9%), charity (10%).

In Bulgaria many people associate entrepreneurs with corruption (23.4%). Ingenuity and innovation is only the seventh most frequently mentioned association out of ten – it was mentioned by only 14.3% against 23.4% for "corruption", 34.3% for "luxury" and 40.9% for "hard work".

According to scholars, recent data shows that for post-communist country residents it is easier to associate entrepreneurs with hard work as these qualities are more prominent in their culture and history. However, scholars admit that creativity, which is a fundamental quality in entrepreneurship, should receive more recognition from society.

“Results of the research warn that citizens of New EU States do not fully understand the function of the entrepreneur. When we think about the measures to encourage entrepreneurship in Europe, we must take this into account. Public understanding should come first. Only then support, advice or any other measures can give good results”, says Zilvinas Silenas.

However, lack of creativity in New EU Member States might be caused not only by the communist rule. In contrast, in Georgia people think that entrepreneurship and creativity goes hand in hand (64% of Georgians chose this answer).

No freedom, no businesses

When asked, what measures, residents believe, would mostly help to encourage entrepreneurship in Lithuania, the majority (62%) said lower taxes and less regulation by the government would help. Also a large share of population (45%) thinks that a larger government aid would help. A better public opinion (14%), better conditions for getting a loan (12%) and better education (12%) were less common among answers.

A large share of population in Bulgaria (39%) also thinks that lower taxes and less government regulation would help entrepreneurs. 24% of Bulgarians though that business needs more help from the state.

Both of these countries have the highest shadow economies from the EU-27 countries, which can be linked to high taxation and regulatory burden.

“The study shows that citizens clearly depict the problem of current economic climate, followed by huge unemployment. In times of high unemployment, people are willing to sacrifice the ability to have a higher wage and all the benefits that official employment brings in order to have any kind of job and to gain some marketable skills. Sometimes during rough periods the laws designed to give people security and a better future, ruin their chances of employment, and better prospects in life. Therefore, regulatory burden, taxation are the fields to be revised if we want to encourage entrepreneurship in Eastern European countries”, says Z. Silenas.

The research on the profile of an entrepreneur in the post-communist countries, which seeks to evaluate the image and with the help from historians, sociologists, experts of religious studies, anthropologists find the reasons for such an image, is a part of an international project. The project was made possible through the support of a grant from the John Templeton Foundation. The project is implemented by LFMI with partners – Institute for Market Economics (Bulgaria), Central Asian Free Market Institute (Kyrgyzstan) and New School of Economics School (Georgia).

The Lithuanian Free Market Institute (LFMI) is a private non-profit non-partisan organization established in 1990 to promote the ideas of individual freedom and responsibility, free market, and limited government. Our goal is to help advance general interests of the people of Lithuania who can best be realized in a free market as every individual pursues his or her objectives – without any privileges, protection or restrictions – by serving the society and not relying on the government apparatus.

The LFMI‘s team conducts research on key economic and economic policy issues, develops conceptual reform packages, drafts and evaluates legislative proposals and aids government institutions by advising how to better implement the principles of free market in Lithuania. LFMI also conducts sociological surveys, issues economic literature and organizes conferences, workshops, and lectures. Educational activities are an integral component of LFMI‘s work aimed at making free market ideas a part of the Lithuanian society‘s life.

Visit www.freema.org

MEDIA CONTACT:

Vidmante Sirgedaite, Communication Officer

Lithuanian Free Market Institute

3A Šeimyniškių St., LT-09312 Vilnius, Lithuania

Tel. 00370-5-250-0281,

Mobile: 00370-653-70777

E-mail: Vidmante@lrinka.lt

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (1) Comment

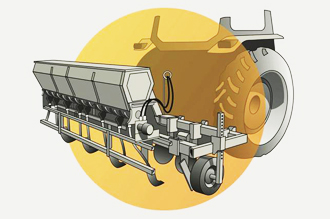

American company opens agricultural plant in Vilnius district

Kinze Manufacturing Inc., the second largest planting and seeding equipment manufacturer in the United States, will open a production facility in Vilnius District along the highway to Druskininkai. The facility will manufacture the company’s agricultural machinery product line, planters/seeders, to support its growing market in neighbouring countries including Russia, Ukraine, Czech Republic, Bulgaria and Hungary. It will open in autumn 2013 and start with 10 employees. In a few years the manufacturer will eventually employ 250 welders, mechanics, CNC operators and other specialists in its Lithuanian operations.

“This is our first plant abroad geared to increasing sales in Russia, Ukraine and the whole of the European Union,” commented Susanne Kinzenbaw Veatch, Vice President and Chief Marketing Officer of Kinze Manufacturing, Inc. “We were looking to expand in Eastern Europe and were considering Slovakia, Poland or Lithuania. We chose Lithuania because the local workforce is undoubtedly productive and cost-effective. Also we were very impressed by the country’s long-standing manufacturing traditions and the degree to which public institutions were attentive to our business needs.”

Kinze Manufacturing Inc. will develop the production plant in three stages. The initial assembly line will open this year and use both imported and locally-sourced components. In 2015, the manufacturer will open a welding and color-coating unit that will be partially reliant on components manufactured in-house; while by 2017 the facility will become fully-fledged, ranging in its functions from steel-processing to end-product assembly lines.

As a part of its shared value investment policy, the agricultural equipment manufacturer will also support local educational institutions and foster the skills of the next generation. The firm will work with universities as well as other professional schools and centers for engineering and production training. It will offer students internships in the manufacturing facility as well as hands-on learning opportunities in advanced manufacturing technology and production processes.

“Expanding manufacturing base is one of Lithuania’s key economic policy priorities,” said Prime Minister Algirdas Butkevičius. “Kinze’s investment is a validation that our competitive advantage is reinvented national legacy: advanced mechanical engineering skills, proximity to CIS markets, quality infrastructure.. This will be a major step in furthering our goal of developing a metal and machinery cluster. This is critical since manufacturing contributes most to export figures and provides majority of private sector research and development investments..”

According to Milda Darguzaite, Managing Director at Invest Lithuania, Kinze Manufacturing Inc. project is going to have a significant positive impact on Lithuania‘s national economy. “Kinze is globally distinguished for its high professional quality standards and business integrity. From the manufacturing perspective, the company’s long lasting traditions in innovation will greatly contribute to Lithuania‘s engineering skillset, and will take us further in terms of new product development, process optimization and quality control”. This is another great indication of Lithuania‘s achievements in winning over investors with sophisticated manufacturing needs.

About Kinze:

Founded more than 46 years ago on the premise of innovation, Kinze Manufacturing, Inc., markets its planters and grain carts globally and is known for a number of industry “firsts.” Kinze operates with core values of integrity, customer focus, excellence, innovation and mutual respect. Kinze Manufacturing is the recognized technology leader and innovator of planters for row-crop production and grain auger carts. Kinze employees spend their nights and weekends farming, putting them in a unique position to be both manufacturers and customers of the planters and grain carts they build. For more information, visit the Kinze Manufacturing website at www.kinze.com.

©Copyright 2013 by Kinze Manufacturing, Inc. All rights reserved. Kinze® and the Kinze™ logo are trademarks owned by Kinze Manufacturing, Inc. Kinze Manufacturing, Inc. reserves the right to make changes in engineering, design and specifications, or add improvements at any time without notice or obligation.

About Invest Lithuania:

Invest Lithuania is a Lithuanian government agency that provides free advice and introductions to on the ground experts for global companies interested in doing business in Lithuania.

The agency serves as a point of contact for foreign companies, and guides international businesses through every step of the process of setting up operations in Lithuania.

Invest Lithuania also provides information on Lithuania's highly-skilled yet cost-competitive labour force, tax incentives, and financing options.

The agency has worked with numerous well-known global companies that have taken advantage of Lithuania's many incentives to expand their businesses by placing some aspects of their operations in Lithuania.

For more information:

Dalius Morkvėnas | Head of Marketing and Communication Department at Invest Lithuania

Tel.: (85) 212 07 76, (8 630) 09 188 | Email:. dalius@investlithuania.com

Brooke Baxley | Karwoski & Courage Public Relations

Tel.: +1 (612) 342 9817 | b.baxley@creativepr.com

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (2) Comment

How can Lithuania

learn from Iceland?

Lithuanian President Dalia Grybauskaitė with the Ambassador of Iceland, Elin Flygenring.

The Icelandic government failed to convince its own citizens in the elections this weekend, and the conservative opposition claimed poll win as voters returned parties that ruled over 2008 financial collapse back to power.

But the present Icelandic government has, nevertheless, something important to teach the eurozone, according to an Icelandic economics professor.

While droves of businesses have had to close its doors in Euro cities like Rome and Athens, the business community in Reykjavik avoided mass death. But it could have gone differently, says economics professor Thórólfur Matthíasson at the University of Iceland.

He has called the crisis that hit Iceland in 2008, the perfect storm. A financial sector ten times larger than Iceland's GDP collapsed. The Icelandic krona lost over half the value. Inflation rose far and fast.

Up to 90 percent of Icelandic companies were in danger of getting bankrupt, but many of them could point to future, long term opportunities. The solution Iceland chose, and Matthíasson participated in, was to facilitate the corporate debts.

Both government, banks and individuals went into talks about impairment. The result was win-win, says Matthíasson.

Banks got customers who could handle their debts. Businesses avoided extensive closures. Icelanders avoided unemployment and social deprivation.

- The banks could have pushed for bankruptcy in many companies, but have instead really done their very best to look for common sense in the matter, says the economics professor.

- Firms are left with the maximum debt burden they can bear, but without getting any gift of money from the banks, he maintains.

Something similar was done for a number of individuals and families who were in danger of bankruptcy, often with debts of 110 percent of the value of their properties written down.

- It has helped those who bought when house prices were at their highest, says Matthíasson.

- In this way we avoided that a bad situation became even worse. It is the Icelandic way, he says and believes many European governments and creditors would do well to study this direction of choice.

But there are still many families who are struggling under a heavy debt burden, and Icelanders are tired of the harsh emergency. Saturday voters punished governing parties in everything choice.

While several European countries still are struggling with recession, Iceland is again growing. Matthíasson is optimistic on the economy's behalf.

- We work a lot more than the average Norwegians and Danes, but by working more, we have managed to keep up the standard of living. And we should not forget that unemployment is at 4-5 percent, which is far below what is the case elsewhere, says the economics professor.

- The conditions are there, the question is whether we have the sense to do the right thing out of it, he says and thinks bad management could cost much.

Iceland, five years after the crisis continue strict capital controls, which puts severe limitations on industry opportunities abroad.

There is no normalization in sight as long as capital controls are there. And there's no good plan for how it will be removed, according Matthíasson and think it's going to stay like that for years.

- If we do not enter currency cooperation with others, it will take us a very long time. All in all, this will be a project of 20 to 30 years. We may not have as strict capital controls at the end of the period, but the first ten years certainly, he says.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (0) Comment

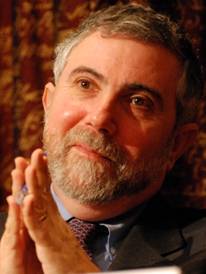

The economic argument is over -

Paul Krugman has won

For the past five years, a fierce war of words and policies has been fought in America and other economically challenged countries around the world.

On one side were economists and politicians who wanted to increase government spending to offset weakness in the private sector. This "stimulus" spending, economists like Paul Krugman argued, would help reduce unemployment and prop up economic growth until the private sector healed itself and began to spend again.

On the other side were economists and politicians who wanted to cut spending to reduce deficits and "restore confidence."

Government stimulus, these folks argued, would only increase debt loads, which were already alarmingly high. If governments did not cut spending, countries would soon cross a deadly debt-to-GDP threshold, after which economic growth would be permanently impaired. The countries would also be beset by hyper-inflation, as bond investors suddenly freaked out and demanded higher interest rates. Once government spending was cut, this theory went, deficits would shrink and "confidence" would return.

This debate has not just been academic.

Those in favor of economic stimulus won a brief victory in the depths of the financial crisis, with countries like the U.S. implementing stimulus packages. But the so-called "Austerians" fought back. And in the past several years, government policies in Europe and the U.S. have been shaped by the belief that governments had to cut spending or risk collapsing under the weight of staggering debts.

Over the course of this debate, evidence has gradually piled up that, however well-intentioned they might be, the "Austerians" were wrong. Japan, for example, has continued to increase its debt-to-GDP ratio well beyond the supposed collapse threshold, and its interest rates have remained stubbornly low. More notably, in Europe, countries that embraced (or were forced to adopt) austerity, like the U.K. and Greece, have endured multiple recessions (and, in the case of Greece, a depression). Moreover, because smaller economies produced less tax revenue, the countries' deficits also remained strikingly high.

So the empirical evidence increasingly favored the Nobel-prize winning Paul Krugman and the other economists and politicians arguing that governments could continue to spend aggressively until economic health was restored.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (8) Comment

THE ECONOMIST:

If you had to be reborn

anywhere, you would

want to be a Viking

The Nordic countries are inventing the new capitalism,

says the Economist editorial. The front of the magazine

shows a seemingly overweight, bearded Viking,

aptly titled "The Next Supermodel".

Politicians from other parts of the world could learn much of Scandinavia, the Economist writes in this weekend edition.

The Nordic countries are inventing the new capitalism, says the Economist editorial. The front of the magazine shows a seemingly overweight, bearded Viking, aptly titled "The Next Supermodel".

The four Nordic countries Sweden, Denmark, Finland and Norway do well on one international poll after another. They are often found on top of the tables in various rankings of competitiveness of purchasing power, and even happiness.

Norway, for example, has for several years been at the top in a UN ranking of the best countries to live in. The rating is calculated as part of the human development index (Human Development Index), which is an attempt to create a measure of how we are doing, that of the good life.

It encompasses not only economic indicators but also looks at health, education and income.

Politicians from other countries should learn from the Nordic model, says the Economist. It pertains to the heavily indebted countries such as in southern Europe.

The Nordic countries have managed to find solutions to reform their public sectors, so that the state is far more efficient and better able to adapt to new needs, says the Economist.

The Economist devotes a large part of its special report of 14 pages to the development in Sweden, which is reaping considerable praise. The Swedish public sector accounted for 67 percent of the country's gross domestic product (the sum of goods and services) in 1993, while the proportion has now fallen to 49 percent.

Sweden’s Finance Minister Anders Borg has also managed to present a state budget actually goes into balance.

Focus on the largest Nordic country is undoubtedly a feather in the cap of the conservative Prime Minister Fredrik Reinfeldt, who has gradually gained considerable authority also within the EU during the discussions on economic and political reforms.

Norway's unique position as a major energy exporter contributes to the country’s position slightly to the side of the three other Nordic countries. But also Norway has started to reform the public sector, says the Economist.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (2) Comment

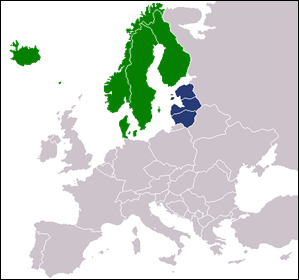

Lithuania’s best future

lies in a Nordic union

“Russia can turn the lights out on Lithuania and the other two Baltic states any time it pleases. And they can't turn them back on without Russia’s permission. Not only does this small, central European nation, as well as its neighbors Latvia and Estonia, not have access to the Russian owned-switch, but, to a large extent, it also depends on energy supplies from Russia to power its electricity generating plants; power that is needed for energy and economic independence. Lithuania as well as the other Baltic countries, being poor in energy resources, are facing a tough future and are seeking solutions.”

This was what Dr. Stan Backaitis wrote here in VilNews in 2011. We have also published articles stating that Lithuania’s dependence on Russia, to a certain degree also EU, should be reduced. We have stated that the neighbours to the north in many cases would be much more attractive partners.

Lithuania has powerful Nordic neighbours, all with AAA credit rating.. These countries, however, are successful in many different ways, not least with regard to social welfare, health care, education, rule of law, transparency, press freedom and a very good balance between government, business, education, science, and more.

What the three Baltic States now face is that being members of the EU is not enough. The economic crisis, and partly also questions on defence and security, have led to new forms of cooperation, and our small nations far north in Europe are not always invited to become active participants.

It is therefore my opinion that a tight collaboration with the other Nordic countries is the way to go. Together we are large enough to be heard and our common identity and cultural background is a good basis for cooperation.

In the 13th century, an alliance of Northern European towns called the Hanseatic League created what historian Fernand Braudel called a “common civilization created by trading.” Today’s expanded list of Hansa states share Germanic and Scandinavian cultural roots. Germany and the Scandinavian countries have found their niches by selling high-value goods to developed nations, as well as to burgeoning markets in Russia, China, and India.

Widely admired for their generous welfare systems, Denmark, Finland, Norway, Sweden and Germany have liberalized their economies in recent years. They account for six of the top eight countries on the Legatum Prosperity Index and boast some of the world’s highest savings rates (25 percent or more), as well as impressive levels of employment, education, and technological innovation.

“In strategies that we are developing for the next twenty years emphasize that it is important for the Baltic States to become more harmonized and catch up with Scandinavian countries. Integration with Nordic countries is an important objective,” said Andrius Kubilius, Lithuania’s former prime minister, in a meeting in Tallinn last year.

I think he is right.

Aage Myhre, Editor-in-Chief

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

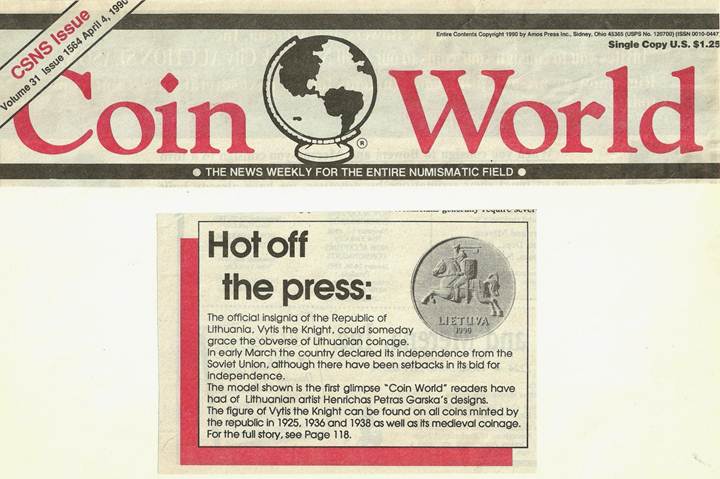

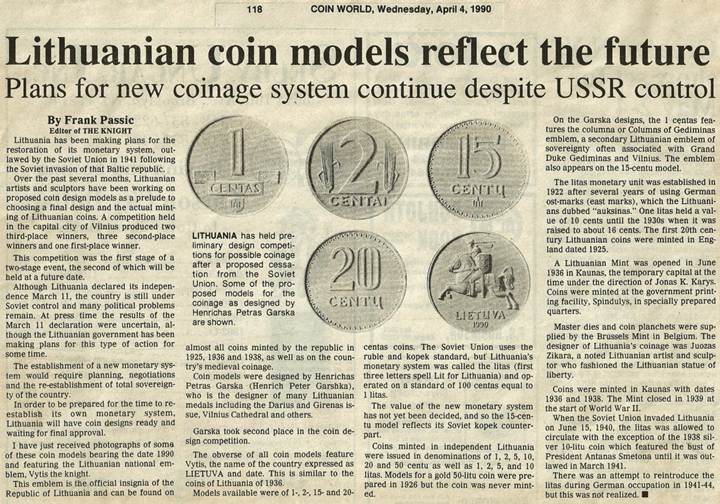

New Lithuanian coins, of 1939-design, were bravely planned already in 1990

- Posted by - (0) Comment

|

Dear readers,

|

|

Message from Frank Passic, Albion, Michigan, USA.

Labas Aage,

Enjoying your rembrances of 22 years ago. During that period I was promoting Lithuania in the American numismatic press. A decade earlier, a main U.S. coin catalog publisher, Krause Publications, had dropped the individual listings of Lithuania's pre-WWII independent coinage under the "L's" and put them under the USSR listing under its new geography policy. After we collectors over here protested, they wouldn't budge, and instead said that when Lithuania became independent again they would then list Lithuanian coins under the "L's," but that Lithuania was part of the USSR and that that's how the coins would be listed in their catalogs. To my glee, I was able to write them a letter during this period informing them that Lithuania was again independent and that they should list Lithuanian coins under the "L's" again along with the other countries of the world in their Standard Catalog of World Coins. They did just that and Lithuanian coins are listed under the "L's", not USSR or "Baltic."

It was an exciting time for me to be writing about Lithuanian numismatics as the numismatic events unfolded and to share them with the American numismatic community. Attached is one of my articles that appeared in the major coin newspaper COIN WORLD of Sidney, OH, November 16, 1992.

Keep up the good work,

Frank Passic, Albion, Michigan, USA.

Frank Passic article from April 1990

Frank Passic article from November 1992

Read also:

Lithuanian camps in postwar Germany issued their own money!

https://vilnews.com/?p=12074

Vagnorkės – Talonas 20 year anniversary

https://vilnews.com/?p=8458

First and second round of Lithuanian Litas

https://vilnews.com/?p=9066

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (1) Comment

|

|

KAUNAS IN FOCUS 24 NOV – 26 DEC 2012 |

|

|

Kaunas, Lithuania's second largest city and former capital, is receiving much attention in VilNews now as 2012 is coming to an end. We focus on history, business, culture, innovation, tourism and more. We would also like to hear from you who have your personal Kaunas story to tell... Send us your Kaunas story!

|

||

|

Thinking of business?

|

||

|

Kitron to invest in Kaunas

|

||

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (0) Comment

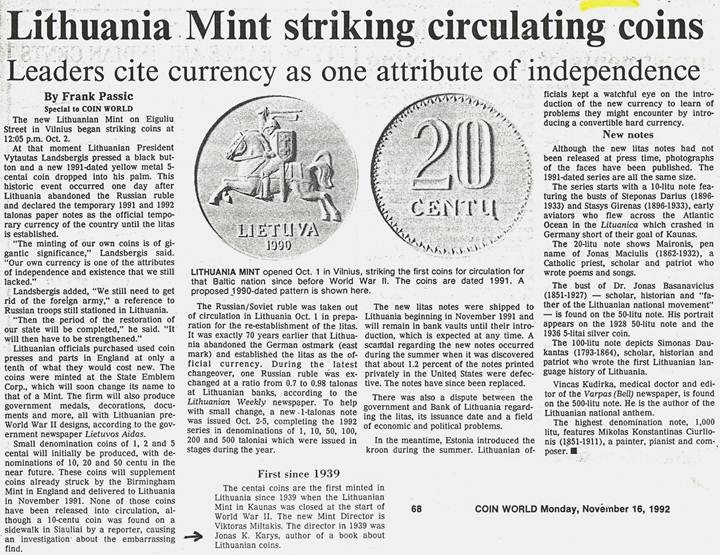

Kaunas FEZ – the ideal

place for new business

Kaunas FEZ (Free Economic Zone) is a 534 ha industrial

development area which offers tax incentives.

Key advantages include:

· Considerable tax incentives;

· Excellent geographic location, coupled with high quality road and railroad connections;

· Adjacent to Kaunas Airport (at present 17 flight directions to the Western European Countries) ;

· Close to ice-free Klaipeda Seaport;

· Stable and constantly growing Lithuanian economy;

· Highly skilled and inexpensive workforce;

· Well developed infrastructure;

· Inconsiderable cultural and linguistic barrier;

· Good investment climate;

· Safety of business in the FEZ.

Watch presentation of the Kaunas FEZ:

http://www.ftz.lt/index.php/presentation/183?vid=60

For more information, see: www.ftz.lt

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (3) Comment

Electric cars made in Lithuania!

Kaunas electronics manufacturer ELINTA has come a long way in developing a new electric car here in Kaunas. These three gentlemen are behind the success: Dr. Vytautas Jokužis, Laurynas Jokužis and Dr. Vladas Lašas.

Since 1994 Elinta has also been selling products from some of the most advanced European companies. They were the first to bring the products of SIEMENS, PHOENIX CONTACT, and RITTAL to Lithuania.

With time Elinta gained significance in the field of Lithuanian industry automation. With the aim to optimise its performance ELINTA modernised its organisation by relocating different types of activities to secondary companies: UAB Elinvision, UAB Elintos matavimo sistemos, UAB Elinta VS.

As a mother company, UAB Elinta coordinates the activities of its subsidiaries. It is involved in scientific-research work, employee training and other fields, necessary for the activities of the Company Group. Currently Elinta has Sales Department which sells automation elements, and an Assembly Department which assembles automation and electricity cabinets.

UAB Elinta VS is a manufacturing company, involved in technological process automation. The main areas for automation activities include heat and electricity production, water supply and cleaning, waste disposal, production of sugar, artificial fertilizers, bio fuel, and etc. The company performs designing, programming, management systems implementation and maintenance work. One of the projects was Kaunas wastewater treatment plant.

UAB Elinvision designs and produces computer vision systems, signal measurement and processing systems. These systems can be successfully applied in automation of production quality inspection in a number of industries. The company produces three-dimensional scanners (3D) for production of orthopaedic and regular shoes and granule size monitoring systems for fertiliser industry. 3 D scanners are knownmore than in 30 countries around the world.

UAB Elintos MS supplies measurement and calibration equipment, process calibrators, testing and adjustment systems, data collection instruments and feeding sources for industrial enterprises.

Elinta has always been an inovative company, suggesting new ideas, solutions for interprises and society. Latest idea that has grown from a project to real creation is Elinta Electric vehicle. Elinta was the company that established the first electric vehicle charging point in Lithuania

Company CEO dr. Vytautas Jokužis and his colleague Vladas Lašas pays a lot of attention to ideas of young scientists, implementation and promotion of entrepreneurship. They inspire young people to create new technologies, innovative ideas.

Now Elinta has grown to company that has about 80 employees, always active in taking part in different innovative projects, collaborates with universities, always open to the society.

Dr. Vytatuas Jokužis and Dr. Vladas Lašas with one of the company’s new intelligent products, a three-dimensional scanner (3D) for production of orthopaedic and regular shoes

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

Click on the buttons to open and read each of VilNews' 18 sub-sections

Click on the buttons to open and read each of VilNews' 18 sub-sections

.jpg)