THE VOICE OF INTERNATIONAL LITHUANIA

|

VilNews has its own Google archive! Type a word in the above search box to find any article.

You can also follow us on Facebook. We have two different pages. Click to open and join.

|

Baltics path to euro in

a sea of Eurozone turmoil

Dr. Stasys Backaitis |

Lithuania will hold the Presidency of the Council of the European Union in the second half of 2013, starting from the 1st of July. VilNews has on this background asked readers to annotate and analyze factors that have to do with Europe, the EU, the euro and Lithuania. This is one of the posts we have received. An article by Dr. Stasys Backaitis, |

|

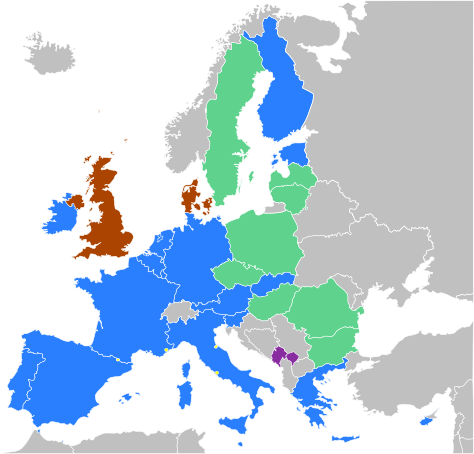

EU Eurozone (17) |

The promise

For most of the southern EU countries the euro may seem like chains to a captive, but for Latvia’s and Lithuania’s governments and their elites, acceptance into the eurozone (EZ) symbolizes freedom and independence. To the Baltics, membership in the EZ reinforces each country's integration into the west and is the final big step in liberation from their historical tormentor, Russia. Following Latvia, Lithuania is eagerly awaiting the green light to be admitted to the EZ in the next year or two. That was also the message by the Nobel Committee last year, when it awarded the EU the Nobel Peace Prize for its role in “the advancement of peace and reconciliation, democracy and human rights as well as political freedom”. The message echoed by the Continent’s politicians, in the words of German Chancellor Angela Merkel, is the choice between continued integration or a return to “centuries of hatred and blood spill”.

The EU message is hammered home relentlessly by the EU

politicians,

who believe their citizens face a stark choice, in the words

of Chancellor

Angela Merkel of Germany, between continued integration and a

return

to “centuries of hatred and blood spill.”

Benefits of membership

This euphoria seems to be rather a strange contradiction, as deep financial problems in Greece, Portugal, Spain, and several other countries have rattled the foundations of EU and particularly the integrity of the eurozone. Now that the Czech Republic, Poland as well as Hungary are having second thoughts of joining the euroclub, and England is outright rejecting the thought, why are the Baltic countries so eager to join it?

Lithuanian Finance Minister, Rimantas Sadzius, echoed Dombrovski, by saying in a Bloomberg Brussels interview on May 13, 2013 that joining the euro will help his country’s economy by boosting its ability to attract international financing. “We would have a huge improvement of the investment climate in Lithuania almost overnight,” Sadzius said. He noted that “Lithuania risks isolation if it slows its march to the common currency, now that Finland and Estonia have joined the 17-nation euro bloc and Latvia has been invited to join it in 2014.” Assuming it can meet all economic and fiscal targets, Lithuania is aiming for acceptance into the eurozone in 2015. “We want to participate in the decision-making of the euro zone,” Sadzius said. “We see our future here.”

According to the Guardian, Latvia's prime minister, Valdis Dombrovskis,” joining the euro makes economic sense”. It will bring budget savings, promote foreign direct investment and underpin the recovery from an economic collapse in 2008-11. But it's not all finance and economics. For the Baltic States, long at the mercy of an imperial Russia, whether tsarist or communist, and now wary of Vladimir Putin, the euro would affirm gain rather than loss of sovereignty.

The Baltic States wanted to join the eurozone in 2008, but was stopped by the financial collapse in the EU. Their housing and consumption bubble, fuelled by cheap credit from the Swedish and Danish banks that dominate the Baltic banking sector, burst and sent the economy into a tailspin, more in Latvia and Lithuania and somewhat less in Estonia. Their economies shrank by nearly 25%, civil service jobs and wages were slashed, numerous social, education, and health services frozen and some axed. As a result unemployment tripled, property prices collapsed by up to 70%, and an estimated 10% of the population, mainly young people, emigrated.

Yet in the last year and a half, the Baltic countries went back from bust to boom. Because of their previous belt tightening economic policies and self imposed fiscal constraints, they became the fastest growing in the entire EU region, up to 5% last year.

Dombrovskis and his Lithuanian counterparts argue that, unlike Greece and the other southern rim eurozone members, the recovery of their countries is solid and sustainable, based on manufacturing and exports and not by easy credit of the boom years of the last decade. The achievements are something no other eurozone members have managed to pull off, by imposing austerity measures and spending cuts as tough or tougher than any in the eurozone without causing public unrest or social upheavals.

|

Lithuanian Finance Minister, Rimantas Sadzius, said in a Bloomberg Brussels interview on May 13, 2013 that joining the euro will help Lithuania’s economy by boosting its ability to attract international financing. “We would have a huge improvement of the investment climate in Lithuania almost overnight,” Sadzius said. He noted that “Lithuania risks isolation if it slows its march to the common currency, now that Finland and Estonia have joined the 17-nation euro bloc and Latvia has been invited to join it in 2014.” |

|

Managing hazards

Are the Baltic States over the hump, and will not experience the euro sickness that is shaking the southern EU rim? Based particularly on Greece’s and Portugal’s debilitating experience, there is convincing evidence that euro’s initial lure leads most financially unendowed, less industrialized and poor in natural resources countries, subsequently to very painful downfall.

Estonia’s Prime Minister Andrus Ansip noted at the Baltic Development Forum in Riga on May 30, 2013 that Latvia and Lithuania’s joining the euro area will make the Baltic States even more attractive to investors and will boost economic growth in the region. “Joining the euro area was and is very important to us. After joining the euro area, foreign investment in Estonia went up 10.4% within a year while unemployment decreased significantly”. According to the Prime Minister, the use of a common currency also increases trade with other European Union member states and generates economic growth.

In a 1961 paper Robert Mundell noted that common currency is a matter of balancing advantages against disadvantages. Economically, the advantages are reductions in the costs of trade-eliminating the need to buy and sell currencies, to hedge exchange rate risks with futures or swaps, and the like. Economic disadvantages stem from the fact that a country with a shared currency cannot respond independently to external shocks by using monetary instruments like changes in interest rates or exchange rates. Mundell also recognized a role for political factors in the choice of currency arrangements. Interestingly, at that time, he saw the question of common currency as purely academic, “hardly within the realm of political feasibility that national currencies would ever be abandoned in favor of any other arrangement.” Little did he know of what would happen in 2000 and beyond years.

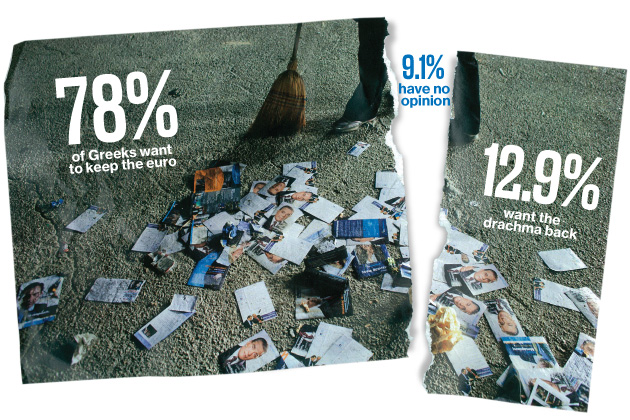

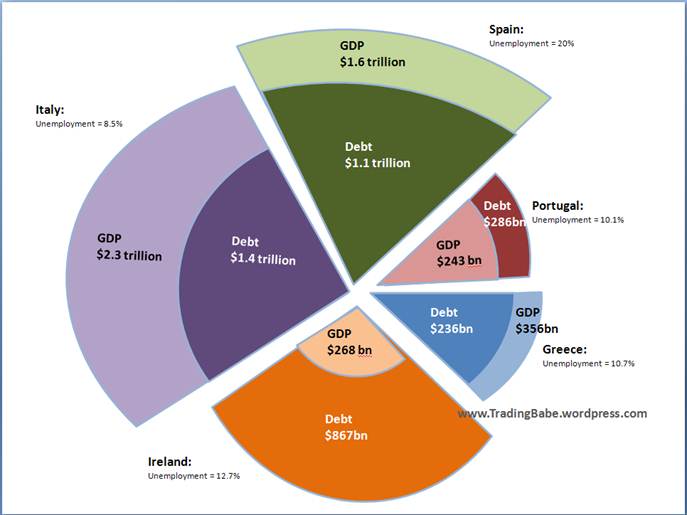

If joining the eurozone stimulates economies and helps to reduce unemployment, why is the opposite happening to the southern rim of EU?* People in the southern rim countries appear to believe that the euro project has locked them in economic chains, rather than advancing democracy, liberalism, and human rights. As is, the euro has taken the weaker less industrialized member states to an extraordinary test of resilience. Large segments of the southern EZ citizens see themselves cast in an economic prison, with Germany as the jailer and the common currency as the bars. They view the future as continued stagnation, characterized by aging societies with expensive welfare burdens and large segments of the young people sitting idle and , unable to find work.. It is a horrendous stress, unseen in the history of modern Europe, and particularly devastating to the youth segment. Of the population. In the Continent’s sick-man economies, the jobless rate for those under 25 now staggers the imagination: more than 40 percent in Italy, more than 50 percent in Spain, and more than 60 percent in Greece.

If

joining the eurozone stimulates economies and helps to reduce

unemployment,

why is the opposite happening to the southern rim of EU?

Stepping stones to success

Upon joining the eurozone, countries such as Greece, Spain, Italy, and Portugal are almost certainly no better off than if they would have kept their own currencies a decade ago. "The introduction of the euro created a lot of wrong signals and distortions," says Uri Dadush, an economist at the Carnegie Endowment in Washington, DC and author of the excellent new study “Paradigm Lost, The Euro in Crisis”. The euro provided benefits, such as reduced transactions costs, inexpensive loans to finance internal projects, etc., but also caused very serious problems at pay-back time these countries now face."

Monetary union has damaged their economies in two major ways. First, inexpensive borrowing, that made the euro look so appealing, caused booms in domestic consumption. However, it also raised enormously overall costs, especially for labor. As a consequence it lowered dramatically their competitiveness both compared to stronger euro zone members such as Germany and France and with respect to countries that didn't join the euro like Britain and Sweden.

Second, the easy credit enticed the southern rim governments to borrow and spend lavishly. As a result, they are now struggling with potentially ruinous levels of debt. Both problems were just what Friedman would have predicted, that, a single monetary policy and one-size-fits-all interest rates simply won't work for economies as different as mighty Germany and as wobbling as Greece or Spain. It turned to be ruinous even to the more prosperous Italy and Ireland, whose stronger economies suffered from the same wrong signals.

Since joining the eurozone, the southern EU economies have lost ground to their stronger trading partners in competitiveness. Their costs for making products or even growing fruits and vegetables, especially for export, have increased sharply and became uncompetitive The best measure, called Real Effective Exchange Rate or REER index, calculated by the EEC for 35 nations, indicates that the main culprit in the unbalance is the cost of labor.

Since 1989, the competitiveness ratings fell 9% for Greece, 16% for Spain and Italy, and 26% for Ireland, which was renowned as a mighty exporter. Now, everyone of them is struggling with costs that are between 16% to 31% above the norm. According to the index, labor and other expenses in Italy and Spain are now one-third higher than in the UK. This indeed is not a good denominator for resolving high unemployment problems.

Latvia’s and Lithuania’s integration into Europe must be viewed through the lens of powerful historical forces and very dangerous and unpredictable neighbors. For both countries deeper integration into the EU is the only right way to go. But the euro evidently might not be necessarily the right symbol of that forward movement, or if it is, it must be handled with extreme sense of balance, which in a climate of intense political rivalry is very difficult to carry out. The euro is most often viewed as a political project, one that will bring the nations of Europe into a greater and deeper union. But joining the euro at a moment when history is fiercely contesting this vision, might be euphoria to some and disaster to others. The majority of Baltic populations is on the cautious side and wants to see first how the EZ will resolve its own problems. Will politicians listen?

Although Latvia and Lithuania appear to meet the criteria set by EU to be admitted to the eurozone club, it does not tell the whole story. Membership in the eurozone may not always be easy, because each of the countries faces unique problems and because the euro itself is in a highly fragile circumstance.

First; it is not likely that inflation in both Latvia and Lithuania will continue to stay as low as it is now. Experience by southern rim euro countries indicates that a relatively poor country with a fixed exchange rate, upon availability of “cheap” money, will experience faster inflation than its larger trading partners. Yet to counteract these negative effects, the euro member countries cannot use monetary policies and exchange rates to manage their changing inflation rates.

Second; faster real growth and faster inflation will make management of fiscal policy more difficult. During the boom years of cheap and easy money in 2004 to 2007, the governments, yielding to populist pressures, raised government salaries, minimum wages, and social benefits with little worry about consequences. The resulting overheating of the economies intensified the crash that followed the global economic crisis in 2008 and 2009. As a result, even more severe austerity measures were required than would otherwise be needed. To avoid repetition of that scenario careful fiscal management is an absolute necessity.

Third, both Latvia and Lithuania face a difficult demographic situation. The population reproduction rates in the last decade are well below replacement levels, accompanied by steadily increasing number of retirees per worker. The rising burden to support pensions, increasing healthcare needs of the aging population, and lack of employment opportunity induced emigration of large numbers of mostly young people. As a consequence, falling revenues, increasing outlays, and high unemployment made the financial situation very difficult to control.

Since

joining the eurozone, the southern EU economies have lost ground to their

stronger trading partners in competitiveness. Their costs for making products

or even growing fruits and vegetables, especially for export, have increased

sharply and became uncompetitive The best measure, called Real Effective

Exchange Rate or REER index, calculated by the EEC for 35 nations, indicates

that the main culprit in the unbalance is the cost of labor. Since 1989, the

competitiveness ratings fell 9% for Greece, 16% for Spain and Italy, and 26%

for Ireland, which was renowned as a mighty exporter. Now, everyone of them is

struggling with costs that are between 16%

to 31% above the norm. According to the index, labor and other expenses in

Italy and Spain

are now one-third higher than in the UK.

The bottom line

The governments of Lithuania and Latvia appear to realize that they are dealing with a very fragile economic and geopolitical situation, but in their judgment, the quest for insuring security and protection of their countries’ sovereignty are worth many sacrifices and hardships. In their many speeches, the respective politicians suggest that success in dealing with the 2008-2012 world economic crisis is a living proof that the austerity measures taken were sufficient to navigate safely through extremely devastating situations, and that the recipes of the European Commission do work and helped to achieve the planned results.

If becoming eurozone members is a way for the Baltic countries to insure security and protection of their sovereignty, then it is a reasonable risk, provided it is guarded by good governance and sound administration of fiscal policies. Of most importance is that the Baltic politicians do not succumb to the lures of easy money and irresponsible spending. Even when debt is incurred, the borrowed funds should be invested in long-term economic growth and job creation, improved competitiveness, quality of work, and with focus of achieving positive balance of trade. The Baltic politicians need to realize that their small countries are not equipped and cannot compete in traditional mass manufacturing with highly industrialized countries. Rather the countries can excel by being frugal and competing through product uniqueness, excellence in quality, innovation and unexcelled services. Their success of rising from economic ashes of 2008-2012 is a proof of their ability to meet these challenges.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

Click on the buttons to open and read each of VilNews' 18 sub-sections

Click on the buttons to open and read each of VilNews' 18 sub-sections

Hiya, I’m really glad I have found this info. Nowadays bloggers publish only about gossip and web stuff and this is actually frustrating. A good site with interesting content, this is what I need. Thanks for making this site, and I will be visiting again. Do you do newsletters by email? http://www.sinidomino.org/ http://www.gadisjp.com/

bandar togel

With North America, Asia, etc, negotiating free trade agreements with Europe and other continents, regional/continental integration is rapidly becoming obsolete and harmful to modern economic progress; in such a situation, my globalization proposal is more effective in the long-term, see: https://vilnews.com/2012-11-17660

Great contribution, Stasys!

Re: Prof. Mundell

I recently asked him about this issue; he seems to be uncomfortable that most pundits tend to blame him for being the Father of (still-born) Euro.

Valdas Samonis

Canada Day, Toronto