THE VOICE OF INTERNATIONAL LITHUANIA

|

VilNews has its own Google archive! Type a word in the above search box to find any article.

You can also follow us on Facebook. We have two different pages. Click to open and join.

|

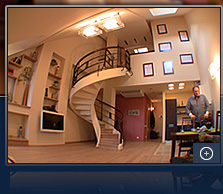

Luxury Residential Property Market in Lithuania

Text: Neringa Rastenytė-NEWSEC

Throughout the last decade residential property market has experienced one of the largest booms as well as one of the hardest falls among other property markets in Lithuania. Influenced by a strong growth of the economy and even stronger future growth forecasts, fueled by loosely controlled bank credit market and inexpensive lending as well as high future income expectations, the residential property market suffered from quick yet low-quality supply of new residential projects, bankruptcies of many of property developers and failures of many of the inhabitants who took mortgages, to repay or keep with the payment schedule.

However, many of the abovementioned issues, which strongly influenced the economy-class and medium class residential property markets, were not so in line with the developments in the luxury property markets in Lithuania.

Luxury Property Market

The luxury property market usually starts with around EUR 2300-2500 /m2 of residential property, and thus is only available to the most affluent part of the Lithuanian population. The properties considered as luxury are also highly sensitive to the nearest neighborhood, safety of the location, surrounding conveniences, such as convenient underground parking, quiet, clean neighborhood and respectable neighbors. A beautiful view from windows, high standards of architectural (and sometimes interior design) solutions, park/greenery close by are considered a must for a luxury properties as well.

A typical customer is usually 30 -50 years old, well (and usually abroad) educated, is married and has children. He or she is either a highly valued professional/manager or successfully manages own business, travels a lot and has business activities or worked abroad as well. In addition, market participants do not tend to take speedy decisions but rather analyze all offers available first. Speculative behavior is rarely observed in the market due to significantly higher transaction amounts than in the economy class or medium class residential properties. Furthermore, luxury properties are usually bought not as the first home, but as an improvement or extension to already owned properties, focusing on long term value of the property.

Market Hibernation

Due to a limited supply and the uniqueness of the objects as well as the selectiveness of the potential buyers, the luxury property market is much slower to react to the general residential market trends. Perhaps, the distinguishing feature of the luxury property market is the ability of the buyers and the sellers to wait, as usually it is not the first apartment or house of the purchaser and considerable resources are available already without external financing. Thus, the owners of the properties, unless distressed, do not tend to sell their properties “cheaply”.

Thus in 2009 the market entered into a phase of hibernation, where both the potential buyers and potential sellers were just viewing the properties and actual transactions were rarely concluded. If compared with 2008, the number of transaction in the luxury property market decreased by approximately a third, whereas it is very difficult to assess the changes in the price levels, as these were set on case-by-case basis. However, it can be noted that the most sensitive to price changes were properties, where despite seller claims of being a luxury property, there were considerable drawbacks (bad neighborhood, inconvenient location, parking or access to the property, bad quality of construction, speculative new projects of questionable value), where prices in many cases dropped down by around 30-40% to the levels of upper-class residential property prices, whereas the most prestigious luxury properties dropped by up to 20%, yet in many cases were not sold at all.

Scarce bank financing for mortgages was not considered as issue, whereas the need to finance own business needs was much more of a problem prevailing in the luxury property market in 2009.

In 2010, especially the second half of the year, market activity showed the first signs of improvement, with more frequent successful transaction conclusions. The price level, if compared to 2009, remained at a similar level. In both 2009 and 2010 there were some examples in the market of luxury properties sold at prices above EUR 4000 /m2 in Vilnius.

Location Puzzle

Whereas the price levels and the number of transactions varied in 2009-2010, top luxury locations in Vilnius remained the same. In Vilnius, Rotuse square, Didzioji and Pilies streets with select surrounding areas carried the top price tags, and together with Gaono, Stikliu, Saviciaus streets as well as some select spots in the old town area, such as “Mikalojaus ziedas” in Zemaitijos street, formed a luxury residential neighborhood.

Latviu and Ciurlionio streets as well as some residential individual-house neighborhoods, e.g. Valakampiai, are considered as luxury top spots as well, though not located directly in the city center or the old town.

Luxury Rent Market – an Unexpected Winner

Potential buyers, who were not able to find or purchase the desired properties, rented luxury properties, which became a more common trend in 2009-2010. This solution came handy to “check” the surrounding neighborhood as well. This behavior was atypical to the luxury property owners three or four years ago in Lithuania and was helped by the market rent level, which, in contrast to the sales prices, became approximately 40% lower if compared to the levels observed in 2007, thus more attractive to the market participants.

Sleeping Beauty is waking up The luxury property market, though having experienced a slowdown in the level of transactions in 2009-2010, is reacting very differently to the crisis, if compared with the general residential market. The past two years in many ways were the opposite, 2009 being full of uncertainty, cautious behavior and modest spending, whereas in 2010 the perceived stability in business and economic environment in Lithuania has brought the luxury property market up on feet, with buyers more willing to buy and sellers more willing to sell. The level of transactions is thus expected to improve in 2011, whereas the price level will most likely fluctuate around the same level.

Nevertheless, we should see more of rent transactions in the luxury property market as well. Typical owners perceive luxury properties more as an investment, thus an option to “check-out” the property before buying something in a similar location is attractive.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

VilNews e-magazine is published in Vilnius, Lithuania. Editor-in-Chief: Mr. Aage Myhre. Inquires to the editors: editor@VilNews.com.

Code of Ethics: See Section 2 – about VilNews. VilNews is not responsible for content on external links/web pages.

HOW TO ADVERTISE IN VILNEWS.

All content is copyrighted © 2011. UAB ‘VilNews’.

Click on the buttons to open and read each of VilNews' 18 sub-sections

Click on the buttons to open and read each of VilNews' 18 sub-sections