THE VOICE OF INTERNATIONAL LITHUANIA

|

VilNews has its own Google archive! Type a word in the above search box to find any article.

You can also follow us on Facebook. We have two different pages. Click to open and join.

|

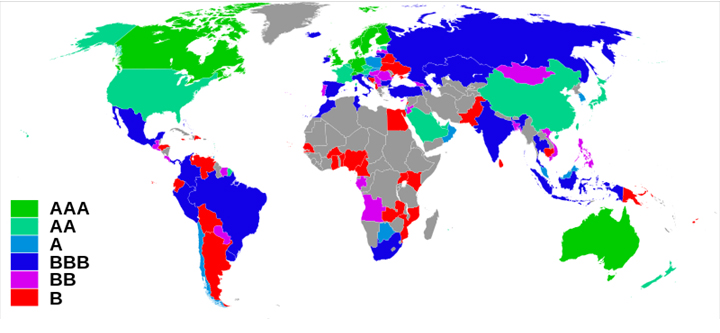

AAA rated nations worldwide:

8 of 10 top rated nations

located in North Europe!

| Rank | Previous | Country | Overall score |

| 1 | 1 | 90.37 | |

| 2 | 2 | 88.83 | |

| 3 | 3 | 88.03 | |

| 4 | 4 | 87.90 | |

| 5 | 4 | 86.79 | |

| 6 | 5 | 84.30 | |

| 7 | 7 | 84.26 | |

| 8 | 8 | 83.52 | |

| 9 | 9 | 83.07 | |

| 10 | 7 | 82.24 | |

It may surprise many that eight of the top ten countries in the world enjoying AAA rating from Standard & Poor’s are located in Northern Europe, and that all four Scandinavian countries are among these eight. The only non-European countries on this distinguished list are Canada and Singapore, while countries like the U.S., Japan and China have to accept lower rank.

Click on the map for higher resolution.

What is a 'credit rating'?

A credit rating evaluates the credit worthiness of a debtor, especially a business (company) or a government. It is an evaluation made by a credit rating agency of the debtor's ability to pay back the debt and the likelihood of default.

Credit ratings are determined by credit ratings agencies. The credit rating represents the credit rating agency's evaluation of qualitative and quantitative information for a company or government; including non-public information obtained by the credit rating agencies analysts.

Credit ratings are not based on mathematical formulas. Instead, credit rating agencies use their judgment and experience in determining what public and private information should be considered in giving a rating to a particular company or government. The credit rating is used by individuals and entities that purchase the bonds issued by companies and governments to determine the likelihood that the government will pay its bond obligations.

A poor credit rating indicates a credit rating agency's opinion that the company or government has a high risk of defaulting, based on the agency's analysis of the entity's history and analysis of long term economic prospects.

Sovereign credit rating

A sovereign credit rating is the credit rating of a sovereign entity, i.e., a national government. The sovereign credit rating indicates the risk level of the investing environment of a country and is used by investors looking to invest abroad. It takes political risk into account

The table above shows the ten least-risky countries for investment as of June 2012. Ratings are further broken down into components including political risk, economic risk. Euromoney's bi-annual country risk index monitors the political and economic stability of 185 sovereign countries. Results focus foremost on economics, specifically sovereign default risk and/or payment default risk for exporters (a.k.a. "trade credit" risk).

A. M. Best defines "country risk" as the risk that country-specific factors could adversely affect an insurer's ability to meet its financial obligations.

Short-term rating

A short-term rating is a probability factor of an individual going into default within a year. This is in contrast to long-term rating which is evaluated over a long timeframe. In the past institutional investors preferred to consider long-term ratings. Nowadays, short-term ratings are commonly used.

First, the Basel II agreement requires banks to report their one-year probability if they applied internal-ratings-based approach for capital requirements. Second, many institutional investors can easily manage their credit/bond portfolios with derivatives on monthly or quarterly basis. Therefore, some rating agencies simply report short-term ratings.

Credit rating agencies

The largest credit rating agencies (which tend to operate worldwide) are Dun & Bradstreet, Moody's, Standard & Poor's and Fitch Ratings.

Other agencies include A. M. Best (U.S.), Baycorp Advantage (Australia), Egan-Jones Rating Company (U.S.), Global Credit Ratings Co. (South Africa),Levin and Goldstein(Zambia),Agusto & Co(Nigeria), Japan Credit Rating Agency, Ltd. (Japan), Muros Ratings (Russia alternative rating agency), Rapid Ratings International (U.S.). and Credit Rating Information and Services Limited (Bangladesh)

Source: http://en.wikipedia.org/wiki/Credit_rating

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

VilNews e-magazine is published in Vilnius, Lithuania. Editor-in-Chief: Mr. Aage Myhre. Inquires to the editors: editor@VilNews.com.

Code of Ethics: See Section 2 – about VilNews. VilNews is not responsible for content on external links/web pages.

HOW TO ADVERTISE IN VILNEWS.

All content is copyrighted © 2011. UAB ‘VilNews’.

Click on the buttons to open and read each of VilNews' 18 sub-sections

Click on the buttons to open and read each of VilNews' 18 sub-sections