THE VOICE OF INTERNATIONAL LITHUANIA

|

VilNews has its own Google archive! Type a word in the above search box to find any article.

You can also follow us on Facebook. We have two different pages. Click to open and join.

|

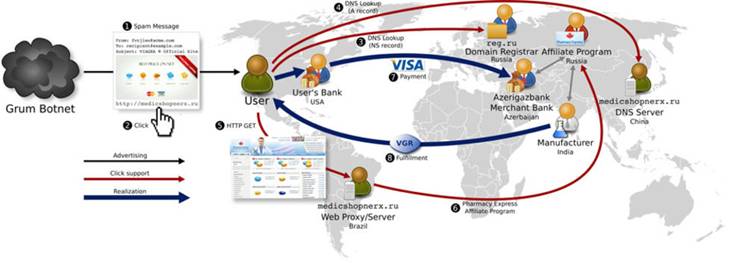

A new research study notes that only a small number of banks are willing to knowingly process what the industry calls "high-risk" transactions. In fact, just three banks, Azerigazbank in Azerbaijan, DnB NORD in Latvia and St.Kitts-Nevis-Anguilla National Bank in the Caribbean, provided the payment servicing for over 95 percent of the spam-advertised goods in the study. Norwegian DnB Nor owns the subsidiary DnB NORD bank in the Baltic States.

“Want to stop junk email? Block payments to spammers,” a new study tells. Researchers who have examined spam supply chains, find cutting off payments is the most effective way to stop influx of nuisance emails

Every day, people buy goods via automatic generated junk mails that offer cheap viagra pills, copies of art works, software, fashion clothing, medicine, fake handbags and everything else of illegal goods that can be obtained via the Internet. And people are buying lots of illegal and pirated goods, through criminal systems that have become a billion dollar industry.

In a new report by 15 scientists at Berkeley, San Diego International Computer Science Institute and the Budapest University of Technology and Economics appointed three banks as the main culprits.

The research notes that only a small number of banks are willing to knowingly process what the industry calls "high-risk" transactions. In fact, just three banks, Azerigazbank in Azerbaijan, DnB NORD in Latvia and St.Kitts-Nevis-Anguilla National Bank in the Caribbean, provided the payment servicing for over 95 percent of the spam-advertised goods in the study. Norwegian DnB Nor owns the subsidiary DnB NORD bank in the Baltic States.

The researchers even went as far as to purchase spam-advertised goods in order to find out who the payment processors are. Finding a way to stifle the operations of a payment processor would be a much more disruptive action than domain blocking, the researchers note.

"It is the banking component of the spam value chain that is both the least studied and, we believe, the most critical," researchers state in the paper. "Without an effective mechanism to transfer consumer payments, it would be difficult to finance the rest of the spam ecosystem."

"The replacement cost for new banks is high, both in setup fees and more importantly in time and overhead," the paper states. "Acquiring a legitimate merchant account directly with a bank requires coordination with the bank, with the card association, with a payment processor and typically involves a great deal of due diligence and delay.

The onus to stop payments would ultimately be on Western banks, the researchers conclude.

"If the U.S. issuing banks (i.e. banks that provide credit cards to U.S. consumers) refused to settle certain transactions (e.g., card-not-present transactions for a subset of Merchant Category Codes) with the banks identified as supporting spam-advertised goods, then the underlying enterprise would be dramatically demonetized. Furthermore, it appears plausible that such a "financial blacklist" could be updated very quickly (driven by modest numbers of undercover buys, as in our study) and far more rapidly than the turn-around time to acquire new banking resources - a rare asymmetry favouring the anti-spam community."

Information Director of DnB Nor, Thomas Midteide, admits to Norwegian DAGBLADET that DnB NORD has had problems with spam-customers. Photo: DNB NOR

In the work, the scientists followed the money, receiving spam from around theworld, making over 100 purchases for three months and found that three banks account for 95 percent of all waste transactions.

Illustration from the report.

Has thrown out spam customer

- This is as far as I know a group of students who completed about 70 transactions, and so on which banks were clearing bank. One of the banks that came up was thus DnB Nord, "says information officer of DnB Nor in Oslo, Thomas Midteide, to Dagbladet.

He admits that DnB NORD has had problems with spam-customers.

- We took over the Latvian bank in the New Year. They previously had a customer who had his share of the cash flow from the spam-related activities. This customer was terminated before we took over the bank, and is therefore not a customer of the bank anymore, "Midteide. He says that the exchange amount that went through this account was not big.

- Spam is a big problem for everyone using electronic channels, and we in the banks must also do our part to prevent this type of activity, "says Midteide to the newspaper.

China, India, USA and New Zealand

All booking software and 85 percent of medication orders used the correct Visa category code that identifies what is sold. The reason for this is that they can get huge fines from Visa when they put the wrong code to hide the fact that they are selling risk goods.

The sale was completed by 13 providers in four countries: USA, India, China and New Zealand. Most of the drugs came from India, most herbal products came from the U.S., probably because of weak regulation of this market in the U.S.

In order to stop selling fake goods researchers suggest that the attack on the infrastructure for payment. The options are few and switching infrastructure costs a lot. They suggest that the U.S. stock rules that make it illegal to carry out transactions for known sellers. They write that it is not working very helpful to keep track of suppliers of illegal goods.

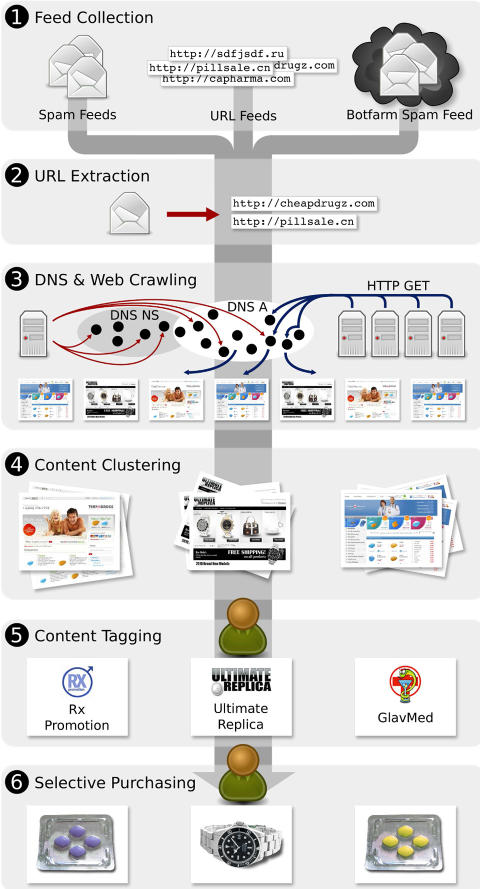

The infrastructure of a single chain URLs in the spam world.

Illustration from the report.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

VilNews e-magazine is published in Vilnius, Lithuania. Editor-in-Chief: Mr. Aage Myhre. Inquires to the editors: editor@VilNews.com.

Code of Ethics: See Section 2 – about VilNews. VilNews is not responsible for content on external links/web pages.

HOW TO ADVERTISE IN VILNEWS.

All content is copyrighted © 2011. UAB ‘VilNews’.

Click on the buttons to open and read each of VilNews' 18 sub-sections

Click on the buttons to open and read each of VilNews' 18 sub-sections

[…] Read more… Category : Featured / Front page […]