Section 12: BUSINESS, ECONOMY – INVESTMENTS

THE VOICE OF INTERNATIONAL LITHUANIA

|

VilNews has its own Google archive! Type a word in the above search box to find any article.

You can also follow us on Facebook. We have two different pages. Click to open and join.

|

- Posted by - (2) Comment

By Val Samonis

Given the dangerous European and global economic and strategic predicaments, Lithuania (LT) needs to adopt very bold and innovative ways to “sell” to the world its extreme austerity sacrifices during the continuing period of global Great (D)Recession and its earlier periods of bold systemic transformations as well. This proposal is a new strategy to globalize LT financial-economic ties (optimal global integration) so that the nation is no longer badly cornered and unduly dependent on the moribund European Union (EU) which is distracted and disoriented by the cacophony of austerity/profligacy controversies, and actually rewarding free riders by default. By now it is rather clear that Europe alone cannot properly reward the financial virtue and sacrifice of the LT people for the sake of the future (investment) which is the most distinguishing trait of a responsible nation and a mature leadership; hence the need for LT to go before the entire “global village”. Globalization can provide huge and underappreciated benefits for a nation like LT.

- Posted by - (0) Comment

| Country | Current account balance (BoP, current US$) | Inflation, consumer prices (annual %) | GDP growth (annual %) | GDP per capita, PPP (current international $) | GINI index () |

|---|---|---|---|---|---|

| United States | -470.902 | 1.64 | 3 | 47153.01 | 40.81 |

| Canada | -49.307 | 1.777 | 3.215 | 39050.17 | 32.56 |

| Estonia | 0.673 | 2.974 | 3.105 | 20663.43 | 36 |

| Lithuania | 0.534 | 1.318 | 1.33 | 18147.98 | 37.57 |

| Norway | 51.444 | 2.399 | 0.677 | 57230.89 | 25.79 |

| Sweden | 30.408 | 1.158 | 5.61 | 39024.17 | 25 |

BoP: Balance of Payments.

GDP: Gross Domestic Product.

GINI index: measures the extent to which the distribution of income or consumption expenditure among individuals or households within an economy deviates from a perfectly equal distribution.

The latest comparative data show that Lithuania has big trouble growing even with the unprecedented sacrifices of the austerity policies by the Kubilius Government; and from very low levels. This data confirms my earlier predictions of big financial-economic collapse in Lithuania: bank and company bankruptcies.

Val Samonis

Toronto, Canada

- Posted by - (11) Comment

|

To those who still believe that the EU can use cutbacks as a mean to achieve growth, the first major study of the policies that have been pursued in recent years, shows that the effect has been the opposite. Austerity policy has only made matters worse. Read today’s article from ‘The Guardian’ and the below opinion posts. |

Opinion: JP Hochbaum, Chicago

Opinion: JP Hochbaum, Chicago

The effects of the austerity medicine that Lithuanians

have been forced to swallow is brutal

Lithuania is in an economic conundrum. The politicians want to be a part of the EU to become more viable economically and to separate from Russia. At least that is what I take from this as a United States citizen, as I can only speculate from what I read and what other Lithuanians tell me. But the entrance into the EU takes away the ability for countries like Lithuania to control their own economy. They are forced to go through austerity and dismantle their energy output, in order to please the EU powers that be. It is time for Lithuania to set a shining example for Eastern Europe and become an economic power in their own right by shedding the shackles that the EU imposes on them.

Lithuania would be wise to separate from the EU and to remain a sovereign country, both monetarily and governmentally.

- Posted by - (0) Comment

Opinion: Irene Simanavicius, Toronto:

Opinion: Irene Simanavicius, Toronto:

Three decades ago, for example, the Brazilian government gave aircraft manufacturer Embraer lucrative contracts and various subsidies, recognizing that it could potentially find a niche in producing smaller, regional aircraft. Private investors were dubious of Embraer’s chances. Had it relied solely on private investment, the company probably would have failed; instead, it flourished, becoming the world’s biggest maker of regional jets.

My question is... What is Lithuania going to do to get top tier corporations to take Lithuania seriously? Lithuania needs to get on board especially now with the slow economic temperature in Europe, we need investors that will TRUST Lithuania. We need Lithuania to trust Lithuania. We need to be investing in the country, providing jobs for Lithuanians, introduce some level of security for Lithuania.

Lithuania NEEDS a strong economy!

- Posted by - (1) Comment

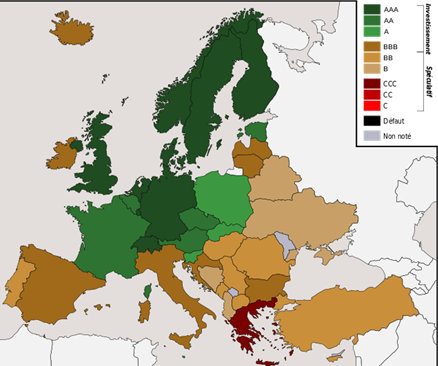

Lithuania’s sovereign credit rating was this week affirmed by Standard & Poor’s (S&P), which cited the nation’s commitment to budget policies that promote sustainable economic growth.

S&P kept its stable outlook on Lithuania’s BBB rating, its second-lowest investment grade, on par with Russia and Bulgaria.

- Posted by - (0) Comment

| Rank | Previous | Country | Overall score |

| 1 | 1 | 90.37 | |

| 2 | 2 | 88.83 | |

| 3 | 3 | 88.03 | |

| 4 | 4 | 87.90 | |

| 5 | 4 | 86.79 | |

| 6 | 5 | 84.30 | |

| 7 | 7 | 84.26 | |

| 8 | 8 | 83.52 | |

| 9 | 9 | 83.07 | |

| 10 | 7 | 82.24 | |

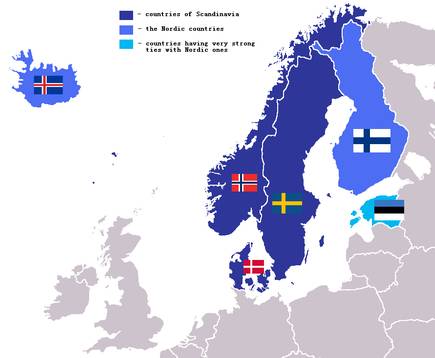

It may surprise many that eight of the top ten countries in the world enjoying AAA rating from Standard & Poor’s are located in Northern Europe, and that all four Scandinavian countries are among these eight. The only non-European countries on this distinguished list are Canada and Singapore, while countries like the U.S., Japan and China have to accept lower rank.

- Posted by - (0) Comment

“The whole Northern Europe and Estonia are some sort of an oasis. It’s a fact that other economies elsewhere are doing much worse than Scandinavia and Estonia. We are enjoying this situation and praying that is remains like that,” Jüri Käo, one of Estonia’s most powerful businessmen, told the newspaper Äripäev.

Käo added that he is fairly optimistic about the economy’s future. “The feeling is more positive because there are stronger signs that Greece will not bring about a collapse because this could turn everything upside down.”

Speaking of fourth quarter, Käo said that the sales are expected to be high in the fourth quarter. “This is when most sales companies earn their biggest income. Since people’s confidence is growing and income is increasing, I would dare to forecast even 3 percent growth,” he added.

Käo: Estonia is an economic oasis ![]()

Rehe: Estonia riding a Scandinavian wave ![]()

- Posted by - (0) Comment

3 UPCOMING CONFERENCES:

![]()

We would like to attract your attention to the international conference

„BALTIC DYNAMICS 2012 : THE ROLE OF SCIENCE AND TECHNOLOGY PARKS IN SUPPORTING ENTREPRENEURIAL COMMUNITY“

which takes place in Vilnius Radisson BLU Hotel (Konstitucijos 20) on September 13th and 14th, 2012.

The conference will present the newest facts on innovation and business / SMEs in the Baltic, as well as detailed discussions on public entrepreneurial support, the role of science and technology parks, intellectual property management, international cooperation in the field of innovation, among others.

- Posted by - (0) Comment

![]()

The annual World Lithuania Economic Forum (WLEF) this year takes place in Chicago September 21st. This year's conference is entitled Lithuania: Your Strategic Gateway to Europe.

The conference will convene business professionals from corporations that have operations in, or looking to establish operations in Lithuania; senior-level government officials responsible for attracting FDI to Lithuania; and entrepreneurs exploring opportunities in Lithuania.

- Posted by - (0) Comment

![]()

Mark your calendar to make sure you attend the first Baltic Region Investors Forum.

The two-day international event of the highest level for business international development, investment promotion and future economic prospects already presents over 30 prominent speakers.

For the first time in Baltics:

Dr. Nouriel Roubini,Co-founder and Chairman, Roubini Global Economics

Mr. Richard C. Koo,Chief Economist, Nomura Research Institute

- Posted by - (1) Comment

A main risk is related to the economic policy path that will be chosen by

the new government after the parliamentary election* on 14 October, where

the six political parties / leaders over are likely to gain support as shown

according to a poll from June on the website www.delfi.lt

Swedbank is out with a new ‘Economic Outlook’. These are some of their forecasts for Lithuania in 2012 – 2014:

• A main domestic risk is related to the economic policy path that will be chosen by the new government after the parliament

election on 14 October.

• Annual growth has bottomed out and will pick up slightly in the second half of this year.

• Lowered forecast for 2013 by 0.2 percentage point to 4.1%, mainly due to the bleaker outlook in the euro area, which will

be a drag on Lithuanian exports.

• Lithuanian economy to return to close to potential only in 2014, when GDP will expand by 4.5%.

• Slightly higher inflation next year, mainly due to an increase in regulated prices.

• Unemployment forecast estimated to 13.2% for 2012, 11.5% for 2013 and 9.3% for 2014.

• Domestic demand has in 2012 been supported by non-labour income – pensions were increased by 9.3% – and this effect

will ebb next year.

• The monopoly Lithuanian Gas has decided (and the regulator has agreed) to increase gas prices for households by about

22%...

- Posted by - (0) Comment

The new President of Lithuanian Industrialists' Confederation,

Robertas Dargis, about the financial crisis in Lithuania:

ROBERTAS DARGIS

Photo: Irmanto Gelūno/ www.15min.lt

“We took the easiest way – additional borrowing. The rate of change in our sovereign debt is enormous compared to other European countries. We had a debt of 17.4 billion litas (5 billion euros) and over the four years of the crisis, it has swollen to 51 billion (14.8 billion euros) – that's the figure we're having by the end of this year. Such a hike in debt is very dangerous to the state, so at least today, we must choose measures that make future predictable.”

The Lithuanian Industrialists Confederation (LIC) has elected a new president – businessman Robertas Dargis, CEO of the Eika Group. He says business is every country's engine for progress and not, as some imagine, a clique of self-seeking lobbyists.

Dargis, who runs a construction company, defeated a strong competitor in his running for presidency – Visvaldas Matijošaitis, CEO of Vičiūnų Group. Dargis succeeds the previous LIC president, late Bronislavas Lubys, and will head the organization for four years.

- Posted by - (0) Comment

Kęstutis J. Eidukonis

1. The country is overtaxed

2. Because of these high taxes most small firms and individuals in Lithuania cheat and lie

3. One cannot hold accountable the various organs of government either

4. The lack of accountability in the government.

5. We have adapted all the bad attributes of Greece

Rokas Masiulis,

General Manager of Klaipedos Nafta

Rokas Masiulis has huge challenges, both behind and in front of him. As head of the giant oil terminal belonging to Klaipedos Nafta, he has had good success, and has this year also delivered remarkable economic performance for the company that in essence is owned by the Lithuanian State. Now it's planning and development of the increasingly well-publicized LNG terminal that lies in front of him. The president and the government have decided that the LNG venture will be a project of national concern..

- Posted by - (0) Comment

In the early 1990s Algirdas Brazauskas lectured the international body

of economists and management specialists that the Soviet system was

an equally good alternative to any Western market economy…

Valdas Samonis

Opinion: Valdas Samonis

- Posted by - (0) Comment

What would you think if you found out that experts believe that the Rouble did not originate in Russia? What would you think if you found out that these same experts believe the Rouble originated in Lithuania and then later migrated to Russia?

VilNews e-magazine is published in Vilnius, Lithuania. Editor-in-Chief: Mr. Aage Myhre. Inquires to the editors: editor@VilNews.com.

Code of Ethics: See Section 2 – about VilNews. VilNews is not responsible for content on external links/web pages.

HOW TO ADVERTISE IN VILNEWS.

All content is copyrighted © 2011. UAB ‘VilNews’.