Section 12: BUSINESS, ECONOMY – INVESTMENTS

THE VOICE OF INTERNATIONAL LITHUANIA

|

VilNews has its own Google archive! Type a word in the above search box to find any article.

You can also follow us on Facebook. We have two different pages. Click to open and join.

|

Dear readers,

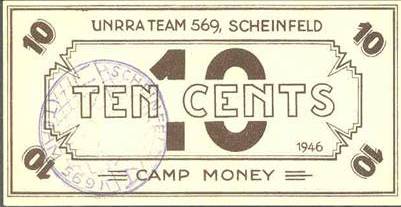

We are delighted and honored that Mr. Frank Passic has graciously offered to share with us his vast knowledge of Lithuanian numismatics. In this article he provides us with a very interesting look into how Lithuanians living in Displaced Persons camps, following World War II, dealt with the situation of currency to help them survive in their daily lives.

- Posted by - (0) Comment

The Klaipėda Free Economic Zone (Klaipėda FEZ) was established in 1996 and opened officially in 2002. FEZ offers tax incentives to qualified investors that invest at least 1 million euros. In 2008, due to overcrowding the zone was expanded from 205 hectares (510 acres) to 412 hectares (1,020 acres) of developed land. As of March 2008, before expansion, FEZ had 22 investors: seven were operating, one just finished construction, six were under construction, and others in development stage.

www.fez.lt E-Mail: info@fez.lt

The Klaipeda Free Economic Zone (FEZ) was the first and is still the only fully functioning free economic zone in Lithuania. The two companies that first started operations in the zone was the Japanese company Yazaki Wiring Technologies Lietuva, and the Danish company A.Espersen A/S, which opened their fish processing factory here in January 2003. FEZ was established to provide favourable conditions for the development of business activities by offering a prepared industrial site with a ready physical and juridical infrastructure, support services and tax incentives.

- Posted by - (0) Comment

General Director Reidar Inselseth at the Espersen Fish Factory in Klaipeda

I sit with the director of the Espersen plant in Klaipeda, Norwegian Reidar Inselseth, in the new office building his firm has just built. The building is designed as the wheelhouse of a ship, with a shiny blue glass surface, and the 'bow, roof top and masts' in stainless steel.

Reidar has been director of this facility for four years now, and among other things, been responsible for extensive new investments and developments of the company. My first question to him is what he finds hardest by being entrepreneur and company leader in Lithuania.

"The lack of predictability," he replies immediately. "Unfortunately, that is something that to a far too high degree characterizes this country. For my company this is so serious that we hardly had chosen Lithuania for our production if we eight-nine years ago had known what we now know."

"This country is steeped in corruption, which we feel very directly when we often are subjected to strange inspections etc. from the authorities; something we do not see anything like in any of the other countries where we have fish processing plants. We are, for example, constantly subjected to unreasonable disclosure requirements and controls, even if we always follow highly acclaimed and transparent international principles of production, environmental control, bookkeeping and treatment of employees. It feels as if here in Lithuania companies like ours still have to prove their innocence instead of being greeted with open arms and cooperative attitudes."

- Posted by - (0) Comment

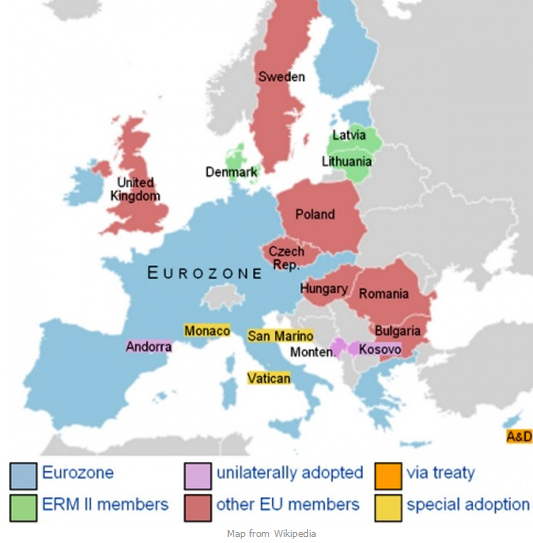

SWEDBANK: Lithuania may delay its euro-adoption goal beyond 2014 because the currency area’s debt crisis is worsening and its government lacks “political determination” before a parliamentary ballot.

Lithuania may be wary of providing aid to ailing euro-region members such as Greece, Swedbank economists Nerijus Maciulis and Lija Strasuna says in an e-mailed report. While it has a good chance of meeting entry criteria by next April, neighbouring Latvia has stronger political resolve to adopt the currency the following year, they write.

“There seems to be a more unanimous agreement to meet Maastricht criteria for the sake of stability, but not necessarily in order to adopt the euro immediately” in Lithuania, Swedbank says. “There’s a probability Lithuania won’t apply formally for euro adoption in 2014 -– much of this will depend on election results in October, as well as the euro area’s progress toward a sustainable solution.”

By Valdas Samonis

The current Prime Minister Andrius Kubilius Government of Lithuania adopted a very ambitious (no IMF help even sought!) and a rather very harsh austerity modeled on the reigning traditional EU thinking in order to clean the Augean stable of Lithuania’s finance wrecked by the former Soviet nomenklatura hijacked governments that largely used “easy” EU money to place their cronies in plum jobs in LT and Brussels (to the exclusion of younger generation of course), “prikhvatize” real estate and keep it from any socially beneficial taxation, etc.

The Kubilius Government’s harsh austerity policies (the so called internal devaluation) cutting public sector wages, social expenditures (by about one third) and increasing some taxes, etc, in a national fiscal belt tightening (“diet”) that has probably been the steepest in recent memory globally. Predictably, the GDP collapse was horrible at some 20%. The LT people have been pretty much resigned to the fate, in a stark contrast to Greece.

Despite repeatedly proving the nation’s responsibility and sacrifice (investment) capabilities via austerity, etc, LT did not attract much European/Western direct investment so the productivity remained at low post-communist levels at the time when emerging Asia provides a stiff global competition.

Before they realized what is going on and who was robbing them, the Lithuanian people got clabbered by this new ambitious austerity policy and the younger ones started emigrating in catastrophic numbers, seeing no future in the country whose GDP was reduced (from a low post-Soviet level) by some 20% by the combination of the old nomenklatura rent-seeking policies and the continued global Great Recession. Lithuania is hollowing out, unfortunately.

While the Lithuanians made huge sacrifices and so “invested” in the future, the Greeks have been continuing the party here and now until the last bottle or perhaps they can get another one, and another :).

In the current state of European affairs, Greeks won, Lithuanians lost!

- Posted by - (0) Comment

| More about money… | ||

|

Russian Rouble – invented in Lithuania? |

|

|

President Smetona on the 10-litas note |

|

|

1st and 2nd round of Lithuanian litas |

|

|

Vagnorkės – Talonas 20 years anniversary |

- Posted by - (2) Comment

![]()

Nerijus Mačiulis, Chief Economist, SWEDBANK.

In the first three quarters of 2011, the Lithuanian economy expanded by 6.4% over the same period a year ago; the expansion was driven mainly by household consumption and investments. During the same period, average quarterly growth was a solid 1.8% but probably decelerated in the last quarter of 2011, when GDP was some 6% higher than a year ago. The economy probably grew by 6.3% in 2011, in line with our forecasts.

We expect this year to be more turbulent, and prospects less sanguine. The recession looming in the euro zone will affect the Lithuanian economy not only directly, via slower growth of exports, but also indirectly, via lower household and business expectations. Although, in our main scenario, the euro zone economy contracts by only 0.3% in 2012, the risk of less orderly developments and increasing tensions is high. We have cut our growth forecast for 2012 to 3.3%, down from 4.2% and to 4.0% in 2013, down from 4.2%.

- Posted by - (1) Comment

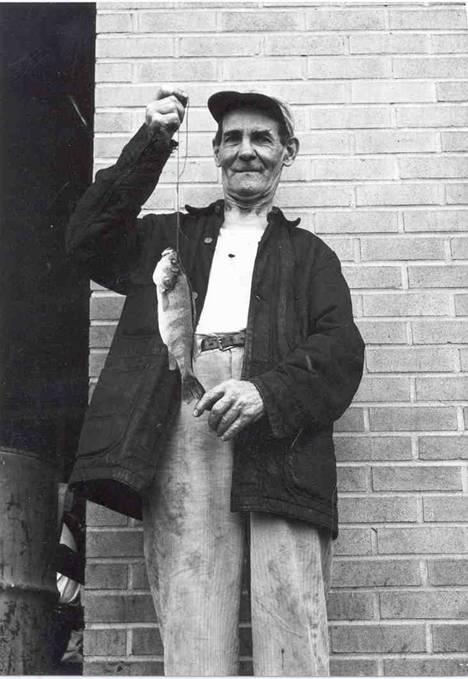

VilNews has a new contributor, Frank Passic from Michigan, USA, who will be sharing with us his vast knowledge about Lithuanian numismatics. The above photo shows Frank’s grandfather who came to USA from the Varniai area in Western Lithuania near Telšiai in 1911. He had just won a fishing contest and was very proud…

Dear readers, we are delighted and honoured that Mr. Frank Passic from Michigan, USA, has graciously offered to share with us his vast knowledge of Lithuanian numismatics. Frank has collected, researched, and written about Lithuanian numismatics for many years. His educational displays of Lithuanian money have won numerous awards at state and national coin shows in the United States. Of Lithuanian heritage, his maternal grandparents emigrated from Lithuania to America just prior to World War I. Frank may be contacted at: albionfp@hotmail.com

- Posted by - (1) Comment

Rokas Bancevičius, Senior analyst, DNB Bank.

This year we celebrate the independence day of Lithuania surrounded by the uncertain economic environment. Lithuania was one of the top growing economies in the EU in 2011 but we are not expecting more of the same in 2012. The key challenges for Lithuania this year will be escalations of debt crisis in the eurozone and the general elections in Lithuania this autumn.

Overall, 2012 will be the year of slower growth and further stabilization in the economy. We expect Lithuania’s GDP to grow in the region between 2.5 – 3 per cent compared to 5.8 per cent in 2011. If Greece crisis is contained and Europe returns to growth at the second half of 2012 Lithuanian economy will end up growing at the higher rate of this range.

- Posted by - (0) Comment

The Lithuanian government has made several wise moves during the past year. One has connected ever-stronger ties to Scandinavia and Finland, another one is that there has been an increasing number of contacts made to Asian countries, especially with regards to China, India and Japan.

The agreements that are negotiated, or are under development, are highly significant and may give Lithuania a key position as a link between Asia and EU.

The agreements represent all win-win situations for bilateral relations between the three countries and Lithuania, since both sides have much to gain from the sort of bilateral cooperation that have been negotiated.

For Lithuania, these agreements are so important, economically, politically and with regard to growth in research, technology and communications, that they are likely to be perceived as a political boost for the incumbent government. The deals are simply so promising that they can get PM Kubilius re-elected in the parliamentary election this fall.

Among the news in the cooperation between the countries are worth mentioning:

- JAPAN: Cooperation for the construction of a new nuclear power plant in Visagino, and related technology transfer.

- CHINA: New rail connection from China to Klaipeda and on to Antwerp in Belgium, plus a brand new IT innovation centre at the University of Vilnius.

- INDIA: Lithuania as India's textile industry's gateway to the EU.

Aage Myhre

aage.myhre@VilNews.com

A handful interesting inks with regards to Lithuanian bilateral cooperation with:

- Posted by - (0) Comment

- Posted by - (1) Comment

We mention below three very distinct warning lights that Lithuanian authorities and control bodies should have reacted to long ago. These three are just the tip of the iceberg. There are many, many more...

WARNING LIGHT 1:

THE BRITISH FINANCIAL SERVICE USED STRONG WORDS ABOUT SNORAS BANK ALREADY 2 YEARS AGO

In 2009 the now nationalised Snoras bank applied to the British Financial Services Authority (FSA) to operate in the UK. The FSA refused permission to conduct business in the UK because the bank repeatedly gave “misleading and incomplete” answers to the regulator. These included failing to mention that it had been refused permission to take retail deposits in Russia and had been fined by the Lithuanian banking regulator. The FSA also attacked the record of Bankas Snoras’ largest shareholder and chairman of its supervisory board, Vladimir Antonov, whom it accused of withholding information. “These failures are not an isolated instance but are examples of an ongoing pattern of behaviour by institutions controlled by Mr Antonov,” the FSA said. These comments must have been known by the Lithuanian Central Bank (Lietuvos bankas) already by then. Why didn’t they react? And why didn’t Ernst & Young, Snoras’ auditor, react? The audit company is now conducting an internal investigation about its previous audits at the bank, but shouldn’t such an important investigation be done by a neutral party? We do, after all, talk about a scandal that will have a very negative impact for the economy of the country and its people…

Read more:

http://bnn-news.com/antonov-jailed-10-years-lithuania-3-years-latvia-41956

http://www.businessweek.com/news/2011-12-02/lithuania-borrowing-costs-to-surge-as-snoras-boosts-debt.html

WARNING LIGHT 2:

The new Lithuanian parliament hall. |

Irena Degutiene |

LITHUANIAN PARLIAMENTARIANS ARE AMONG THE BEST PAID IN THE ENTIRE EUROPEAN UNION!

BALTIC TIMES had an interesting article this week, telling that the Lithuanian parliamentarians’ 2,000 euro salary per month is at the bottom of the list of European legislator pay, but with all parliamentary allowances, benefits and salaries summed up, the entitlements skyrocket, catapulting Lithuanian legislators to a level with an average salary, on par with the very top of the best paid elected officials in the entire European Union, up to 10,000 euro per month!

“To be honest, I have never been aware of such benefits, even when I stayed at the wheel of the parliament. The Labor Party, whose deputy chairman I am now, stands for cutting down the excessive parliamentary benefits. However, I do not think this Seimas will have the guts to cut the fruitful branches it sits on,” Arturas Paulauskas, the former chairman of Naujoji Sajunga (New Union) and deputy chairman of the Labor Party presently, said to The Baltic Times.

The mid-November parliamentary deliberations over the draft on Parliamentarians’ Activity Guarantees have shown that Lithuanian legislators are far from considering any constraints on their lavish parliamentary incentives – the draft has been rejected and sent for improvements.

“I am really surprised by the legislators’ decision. Frankly, I thought the bill, upon introduction, with certain amendments and improvements would be passed. To reject it the way the parliamentarians did, walking out before the crucial vote or abstaining during the vote, means withdrawal from solving the problem. I do not know whether the politicians who voted against the bill, or simply walked out before the vote, will seek a new Seimas tenure next year. If yes, it means they are willing to further traipse in the mud we have all been stomping in so long and tediously,” Irena Degutiene, chairwoman of the Lithuanian Parliament, said with unusually strong words to express her angst.

Degutiene, nevertheless, is hopeful in bringing the revised and supplemented bill for the MPs in spring 2012. “I hope that common sense will prevail and we pass the law,” she said.

Unlike in Lithuania, in the other two Baltic countries MP salaries are recalculated every year, and politicians receive parliamentary activity compensation for transport, office, representation and professional training. In that regard, Estonia has set it such that this kind of compensation cannot exceed 30 percent of the parliamentary salary, which is 3,353 euros.

Read more:

http://www.baltictimes.com/news/articles/30094/

WARNING LIGHT 3:

|

|

LITHUANIA HAS NOW EU’S WIDEST WEALTH GAP AND HIGHEST POVERTY RISK

Lithuania’s austerity measures, which are similar in size to those facing Greece, boosted income inequality to the widest in the European Union.

The CHART OF THE DAY in a BLOOMBERG article this week shows how the proportion of people at risk of poverty in Lithuania surged to the highest level among the bloc’s 27 members after state spending was cut. The lower panel shows the gap between the nation’s highest and lowest earners is the EU’s widest after budget savings hurt the poor.

Lithuania implemented austerity measures equal to 12 percent of gross domestic product in 2009-2010. Pension cuts may be reversed after the economy grew 6.7 percent in the third quarter, the second-fastest pace in the EU. Greece, where GDP contracted 5.2 percent in the same period, is in the midst of budget cuts worth 16 percent of economic output, data from the International Monetary Fund show.

“The blow was very painful to the poor,” said Vilija Tauraite, an economist for SEB Bank in the capital, Vilnius. “Lithuania’s fiscal discipline has been extremely severe in the past three years and it’s now crucial to ease the burden because these people are hanging on the precipice of poverty. Their quality of life is far worse than the situation of pensioners in southern Europe.”

- Posted by - (1) Comment

Dr. Ichak Adizes

A blog by Dr. Ichak Adizes

I am in Moscow. Watching the BBC. There is a live round table discussion with very prominent economists as to what to do about the global, financial, economic crisis, in the USA and in Europe. Their concerns: unemployment, declining economic growth, recession, potential for country defaults etc.

Around the table are the managing director of the IMF, the CEO of Pimco, a distinguished professor of economics from Chicago and another person with a heavy Italian accent whose name I failed to record.

To summarize what they are saying: there is a crisis of unemployment, the financial markets are sick and there is declining economic growth. Result: a serious crisis of a potential for a double dip recession and potential for a default by some countries.

They recommend different solutions how to solve the financial crisis, how to improve the rate of employment etc.

The common denominator to their solutions is that they are trying to get back to what we HAD before, which is full employment, healthy financial markets and economic growth.

It will not work.

If we succeed to go BACK, it will be only a temporary solution and the crisis will come back as a tsunami, much bigger, later on.

Why?

Let us analyze the problem.

- Posted by - (0) Comment

"If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered...

I believe that banking institutions are more dangerous to our liberties than standing armies... The issuing power should be taken from the banks and restored to the people, to whom it properly belongs."

- Thomas Jefferson (1743-1826).

- Posted by - (1) Comment

A Review of: George A. Akerlof and Robert J. Shiller, Animal Spirits: How Human Psychology Drives the Economy and Why It Matters for Global Capitalism. Princeton: Princeton University Press, 2009. xiv+230 pages.

By Val Samonis

In over 30 years of my research, advising, and teaching globally, I have read and reviewed many very interesting and paradigm-changing books in economics and management. However, this book is one of a kind!

- Posted by - (4) Comment

Front and back of 1922, 50 Centai banknote.

Front and back of 1929, 5 Litai banknote.

Front and back of 1922, 100 Litai banknote.

Photos courtesy of Colnect.

Auksinas

to Russian Ruble

to Ostmark and Ostruble

to Litas

to Soviet Ruble

to Litas

– the first and second introduction of the Lithuanian Litas

The official currency of the Republic of Lithuania is the Litas. Twice it has been the official currency. The first period was during the inter-war years when Lithuania regained its independence from Imperial Russia and the second period began in 1993, after Lithuania regained its independence from Soviet Russia, and is still the official currency. We would like to share with you some interesting information about what was involved in the creation of the Litas and its reintroduction.

VilNews e-magazine is published in Vilnius, Lithuania. Editor-in-Chief: Mr. Aage Myhre. Inquires to the editors: editor@VilNews.com.

Code of Ethics: See Section 2 – about VilNews. VilNews is not responsible for content on external links/web pages.

HOW TO ADVERTISE IN VILNEWS.

All content is copyrighted © 2011. UAB ‘VilNews’.