Section 12: BUSINESS, ECONOMY – INVESTMENTS

THE VOICE OF INTERNATIONAL LITHUANIA

|

VilNews has its own Google archive! Type a word in the above search box to find any article.

You can also follow us on Facebook. We have two different pages. Click to open and join.

|

- Posted by - (1) Comment

Professor Michael Spence,

recipient of the 2001 Nobel Memorial

Prize in Economic Sciences

A review of:

Michael Spence, The Next Convergence: The Future of Economic Growth in a Multispeed World. New York: Farrar, Straus and Giroux 2011. xvi+296 pages.

The book is a product of the independent High Level Commission on Growth and Development that completed its work in 2010. Members of the Commission included leaders of social and economic transformations internationally and top global experts such as Robert Solow, the father of modern growth theory, and Mohamed El-Erian, CEO of Pimco. Prof. Michael Spence, the 2001 Nobelist in Economics, chaired this unique effort.

The reading of this book is a humbling experience. The reader is immediately hit by the vast intellectual expanse of the topic and the Author’s Nobel winning theoretical brilliance combined with his “hands-on” practical-analytical, integrative, and simplifying capabilities keeping the argumentation both rigorous and free from the rather unnecessary technical jargon.

Valdas Samonis

Institute for New Economic Thinking, New York City

and SEMI Online, Toronto

- Posted by - (1) Comment

Text: Vincas Karnila, Associate editor

vin.karnila@VilNews.com

OK folks, the shoes will be 120

So that will be 80 Canadian Dollars and 80 Pound Sterling

How would you like to hear that from the cashier at you local shoe store the next time you are buying a pair of shoes? Could be a little confusing could it not? Believe it or not the people of Lithuania were hearing something similar to that in stores in the early 90s during the early days of their regained independence.

An interesting question pops up once a country gains, or in the case of Lithuania regains, its independence – What do you use for money???

With Soviet Russia’s forced annexation of Lithuania into the control of the Soviet Union, the currency of the country of course was then changed to the Soviet Ruble. Then On 11 March 1990 the re-establishment of Lithuanian independence was proclaimed and after fifty years of occupation, Lithuania was once again a free and independent republic. Obviously to be once again a free nation is a good thing but there was one factor that needed to be addressed – There was no “Lithuanian” currency!

- Posted by - (1) Comment

David Telky, Managing Director of Scottish-Lithuanian manufacturing company Pentland, has over 35 years in the clothing manufacturing industry. David was born in Glasgow, Scotland where he has carried on the family business of 90 years to present.

A personal thank you note to Lithuania from David Telky, Scotland

“20 years ago, after successful forays into China, Indonesia, Sri Lanka, Turkey, Poland ,Portugal, Belarus Egypt and a few not so successful, I found the right place, Lithuania - my search was over!”

This tells David Telky, Managing Director of the clothing manufacturing company Pentland, and he continues:

“The stress of all this had seen me in hospital with health problems, that linger to this day, so the expression "thank God for Lithuania ...without it I could be dead!" evolves from the joy of working with some of the best staff I have ever employed, combined with some of the finest and most loyal factories producing excellent products with an almost old fashioned loyalty and ethic that was so prevalent in the UK of my youth”.

“Altogether the move to Lithuania has not only been a work influenced move but the social aspect of the community of local and expats has opened my eyes to a life of harmony and peace that I thought was lost forever and fills me each day with happiness.”

“So Thank God for Lithuania in its helping me develop not only a great company Pentland , a sum of its fine employees ,but for giving me the chance to meet so many great and wonderful people…”

Palle Gravesen Jensen

A Danish expat to Lithuania, owner of two manufacturing companies, Electronic House and Metalco Baltic. Member of the board of the Danish Chamber of Commerce (DCC) in Lithuania. His family was one of the three families founding the Vilnius International School.

Text: Palle Gravesen Jensen

There are a number of issues to discuss with regards to Lithuania of today, the country I made my own 16 years ago, moving from my homeland Denmark.

One particular question, however, comes to my mind again and again: What is this country going to live on 20 years from now. It is a big question. My concern is there will not be much at all if nothing is done immediately.

- Posted by - (1) Comment

A new research study notes that only a small number of banks are willing to knowingly process what the industry calls "high-risk" transactions. In fact, just three banks, Azerigazbank in Azerbaijan, DnB NORD in Latvia and St.Kitts-Nevis-Anguilla National Bank in the Caribbean, provided the payment servicing for over 95 percent of the spam-advertised goods in the study. Norwegian DnB Nor owns the subsidiary DnB NORD bank in the Baltic States.

“Want to stop junk email? Block payments to spammers,” a new study tells. Researchers who have examined spam supply chains, find cutting off payments is the most effective way to stop influx of nuisance emails

Every day, people buy goods via automatic generated junk mails that offer cheap viagra pills, copies of art works, software, fashion clothing, medicine, fake handbags and everything else of illegal goods that can be obtained via the Internet. And people are buying lots of illegal and pirated goods, through criminal systems that have become a billion dollar industry.

In a new report by 15 scientists at Berkeley, San Diego International Computer Science Institute and the Budapest University of Technology and Economics appointed three banks as the main culprits.

The research notes that only a small number of banks are willing to knowingly process what the industry calls "high-risk" transactions. In fact, just three banks, Azerigazbank in Azerbaijan, DnB NORD in Latvia and St.Kitts-Nevis-Anguilla National Bank in the Caribbean, provided the payment servicing for over 95 percent of the spam-advertised goods in the study. Norwegian DnB Nor owns the subsidiary DnB NORD bank in the Baltic States.

- Posted by - (0) Comment

Communications Director Trond Bentestuen of DnB Nor showcases the new logo. The logo costs around one million euro.

Norwegian Snøhetta Architects have designed the large bank's new logo. Now the bank to will use around 20 million euros to change profile.

In November, the bank will change its name from DnB Nor to only DNB.

The management of DnB Nor group decided last year to collect and facilitate the company's brand. The name should be cut in half, and the Norwegian Post Bank and Vital insurance to be placed under the new name.…

Lithuania was very pleased and grateful when Norwegian Telecom installed a satellite telephone station in the Lithuanian parliament, making it possible for Landsbergis to stay in touch with the world when the Soviets re-invaded Lithuania in 1991. But the country did little to hold on to Telenor and other Western investors. "We don't need you," said former president Brazauskas.

Aage Myhre, Editor-in-Chief

To attract more foreign investors is often held up as a good way for Lithuania to follow – in order to achieve a more viable development, raise living standards and develop a more democratic, less corrupt society.

I began my personal efforts to assist Lithuania exactly 21 years ago, when Parliament President Vytautas Landsbergis announced that he would come to Oslo, on his first so-called official visit to a western country. I and a handful of others were ahead of his visit contacted by a presidential advisor and asked to put the best possible conditions for Landsbergis' visit to my home country Norway. That was how my long relationship to and with Lithuania started...

Landsbergis' visit to Oslo became a great success and our group was therefore soon thereafter invited to visit Lithuania.

One thing that we put the most of emphasis on, already when Landsbergis was in Oslo the summer of 1990 and during our group's initial visits to Lithuania, was to invite serious Western investors here.

Already during my very first visit here, in November 1990, we brought with us a representative of the governmental Norwegian oil company STATOIL, introducing the company to the Baltic States.

Just two years later STATOIL began developing the now well-known network of petrol stations across the Baltics and Poland. Our main contribution to STATOIL that time was to introduce them to representatives of governments, organizations and individuals we thought might be of help. The last substantial roles I had for the company was as an architect and facilitator of their offices here in Vilnius in the early 1990's, and to advise them when they later met on corruption and other problems.

The telephone satellite station that 'saved the Baltic States'

During my first visit to Vilnius I also negotiated a contract with Lithuania's communications minister, based on an agreement I had with the Norwegian Telecommunications Administration to provide a satellite telephone station as a gift to Lithuania, and to install it in the parliament here, Parliament President Vytautas Landsbergis had asked our group of ' Lithuania-helpers' about this support when he was on a visit to Norway the summer of 1990.

Not long after this satellite telephone system turned out as very useful when Soviet troops re-invaded the Baltic States and cut all other calling options with foreign countries.

As a 'thank you for your help' the Norwegian Telecom was offered to create the first network for mobile phones here, but they rejected because they thought the market here was too small. They were also very tired of the treatments they were given by local bureaucrats.

I remember that this deeply disappointed me and Telecom's export director, who I worked closely with for the above mentioned satellite station in 1990-1991, and later on when we both tried to position the Norwegian company in the Baltics.

During the years that followed, I invited and tried to set stage for a number of Western investors. Some of them accepted, and some are still in full operation and business here today, very successfully!

Important to offer 'concepts' not just 'projects' and investment objects to new investors

What I quickly discovered, already two decades ago, was the importance of having a good personal contact with representatives of those companies, speaking 'their language' and to help them with many different problems and challenges in this misguided country where Soviet laws, structures and modes of action was still largely in force, and corruption a very widespread phenomenon.

I also understood that it was very important to offer 'concepts' not just 'projects' and investment objects to new investors.

Unfortunately, I seldom saw true understanding and interest from the Lithuanian authorities during those years. Even the largest and most serious firms were most often met with a shrug. "What's in it for me personally," was the question that was often presented when we contacted representatives of local authorities and businesses.

I will never again put foot on the soil of the country I dreamed of and supported for all my lifetime

I will never forget when I in 1995 had lunch with Chicago's largest builder, in the Neringa Restaurant here in Gedimino Avenue, a Lithuanian-American who had returned to Lithuania four years earlier, full of optimism and dreams of a restored home country. The day he left he told me: "Aage, let me tell you frankly that they have all cheated me. I invested into business, production, a hotel and more. But they all cheated me – from the highest of politicians to the simplest of workers. I am sick and tired of seeing how these people have ruined my homeland, and I'm now leaving it all behind. I will never again put foot on the soil of the country I dreamed of and supported for all my lifetime."

I will also never forget that Lithuania's president and leader through much of the 1980s and 1990s, Algirdas Brazauskas, by then made it clear that Lithuania did not need foreign investments.

"We have enough money in this country, among our own investors and companies. We simply need no foreigners here," he said…

One could perhaps have thought that today's leaders would had learned, but the fact is that neither expatriates living here nor people within the country's own diasporas around the world are much asked for help, advice or contributions. And when the authorities ask, they often ask the wrong people and institutions.

Let me, finally, also share with you a passage from Steven Levy's book "How Google Thinks, Works and Shapes Our Lives".

President Brazauskas' attitude and the following description explains a lot about why both and Lithuania are still living in a European backwater. Another sad example of how little the leaders of these two countries understood by then – and very often also today...

Here's what Steven Levy writes:

"Google also made a priority to build centers overseas. Not long after she found the location in Atlanta, Cathy Gordon went to Europe, where Google wanted to build a giant data center similar to the one in the United States. Google had studied the laws and business practices of every country and narrowed the field to a few that might be able to provide the power and water required, as well as a friendly governmental hand. Some of the proposed locations were predictable – Switzerland, Belgium, France – but a couple were not.

One of those were Latvia, which Gordon had never visited before. The Google team flew into a ramshackle little airport and met the economic development committee, a cadre of what seemed to be stereotypical Soviet bureaucrats. Their host escorted them to the potential data centre site, an abandoned Soviet minibus factory. The building was cavernous and gloomy. In the centre of the building was a giant pit, and Gordon could not help but wonder whether any bodies were quietly decomposing in the stew. The group went to the area where the power facilities were located, and it looked to Gordon like they were on an old horror movie set, a 'Gulag Archipelago' version of Dr. Frankenstein's lab. One of the hosts leaned over and spoke in a confidential whisper, heavy with Slavic accent. "Don't go to near those things," he said. "Basically we don't know if they could kill you."

"We eventually ended up doing a deal in Belgium," says Gordon.

- Posted by - (0) Comment

- Posted by - (1) Comment

Photo: Dimitri Messinis / SCANPIX / AP

Despite the fact that Greece last year was allocated 110 billion Euros in crisis loan from the EU and the IMF, little has gone in the right direction for the embattled country.

More and more people believe that it is no longer question whether, but when Greece falls. Overall, Greece has total loans of 340 billion Euros.

Several experts expect a collapse in the next few days, writes Swedish Affärsvärlden.

British economist

Andrew Lilico

Andrew Lilico's predictions in 'The Telegraph':

It is when, not if. Financial markets merely aren't sure whether it'll be tomorrow, a month's time, a year's time, or two years' time (it won't be longer than that). Given that the ECB has played the "final card" it employed to force a bailout upon the Irish – threatening to bankrupt the country's banking sector – presumably we will now see either another Greek bailout or default within days.

What happens when Greece defaults. Here are a few things:

- Every bank in Greece will instantly go insolvent.

- The Greek government will nationalise every bank in Greece.

- The Greek government will forbid withdrawals from Greek banks.

- To prevent Greek depositors from rioting on the streets, Argentina-2002-style (when the Argentinian president had to flee by helicopter from the roof of the presidential palace to evade a mob of such depositors), the Greek government will declare a curfew, perhaps even general martial law.

- Greece will redenominate all its debts into "New Drachmas" or whatever it calls the new currency (this is a classic ploy of countries defaulting)

- The New Drachma will devalue by some 30-70 per cent (probably around 50 per cent, though perhaps more), effectively defaulting 0n 50 per cent or more of all Greek euro-denominated debts.

- The Irish will, within a few days, walk away from the debts of its banking system.

- The Portuguese government will wait to see whether there is chaos in Greece before deciding whether to default in turn.

- A number of French and German banks will make sufficient losses that they no longer meet regulatory capital adequacy requirements.

- The European Central Bank will become insolvent, given its very high exposure to Greek government debt, and to Greek banking sector and Irish banking sector debt.

- The French and German governments will meet to decide whether (a) to recapitalise the ECB, or (b) to allow the ECB to print money to restore its solvency. (Because the ECB has relatively little foreign currency-denominated exposure, it could in principle print its way out, but this is forbidden by its founding charter. On the other hand, the EU Treaty explicitly, and in terms, forbids the form of bailouts used for Greece, Portugal and Ireland, but a little thing like their being blatantly illegal hasn't prevented that from happening, so it's not intrinsically obvious that its being illegal for the ECB to print its way out will prove much of a hurdle.)

- They will recapitalise, and recapitalise their own banks, but declare an end to all bailouts.

- There will be carnage in the market for Spanish banking sector bonds, as bondholders anticipate imposed debt-equity swaps.

- This assumption will prove justified, as the Spaniards choose to over-ride the structure of current bond contracts in the Spanish banking sector, recapitalising a number of banks via debt-equity swaps.

- Bondholders will take the Spanish Banking Sector to the European Court of Human Rights (and probably other courts, also), claiming violations of property rights. These cases won't be heard for years. By the time they are finally heard, no-one will care.

- Attention will turn to the British banks. Then we shall see…

- Posted by - (0) Comment

|

|

|

By Nerijus Maciulis, Chief economist, Swedbank

The scenario described by Andrew Lilico is highly unlikely. Greece, Ireland and Portugal together constitute less than 6% of Euro area GDP – even if all of them restructure their debt at the same time, the effect will most probably be contained.

One of the reasons why ECB and European Commission keep resisting any kind of restructuring is to make sure that there will be no disastrous spill-over effects to financial sector. It is likely that ECB and EC are waiting for the results from bank stress tests before they take any decision on restructuring. But behind the closed doors there probably is a discussion on how to proceed with orderly and contained restructuring.

In case of the first (chaotic and contagious) scenario, the effects would be dramatic, despite Lithuania's weak links with euro area periphery. Increasing uncertainty and flight for safety would cause higher interbank interest rates and government borrowing costs. This would undoubtedly damage credit markets, which have not yet recovered from a previous blow. Lower confidence and higher interest rates would deter investments; consumers would increase savings and reduce spending. After global financial crisis the economy has adapted to different conditions and now households and companies are much less dependent on borrowed capital. However, current economic growth in Lithuania was mainly based on strong exports – a strong dent in foreign demand would slow down our recovery, if not cause another recession.

A more likely scenario is orderly restructuring (probably well before 2013, when European Stability Mechanism is introduced), which will cause some short-term volatility, but not significant damage to the real economy.

|

|

What could be the consequences for Lithuania if Greece falls? "Pretty little – we do not have any major exposure to Greece, not firm foreigh trade pattern. In default case, maybe Greece would become a top destination for vacation, which now is firmly taken by Turkey and Egypt." |

- Posted by - (0) Comment

![]()

http://www.thetrumpet.com/?q=8225.6887.0.0

Rates on Greek debt soared to an astounding 21 percent last week. The end game on the Greek debt crisis could be near. If Greece defaults on its debt, it could trigger a domino collapse across Europe. But do the strategizers behind the euro have a secret plan that could totally reform the union?

One thing for sure is that the Greek government cannot long afford to borrow money at such high rates. It is virtually locked out of the debt market. That means that sooner or later, somebody isn’t going to get paid. In this case it mostly means big banks in France, Germany, Austria and Belgium.

The consequences could easily go global. European Central Bank executive member Jurgen Stark warned on April 23 that Europe may be about to suffer a banking crisis worse than that of 2008. It “could overshadow the effects of the Lehman bankruptcy,” he warned.

Bigger than Lehman?

According to Stark, a default by Greece would be the worst option for the eurozone. This would trigger massive and immediate government spending cuts and the inevitable social unrest that would ensue.

More critically, it could easily cause lenders to balk at loaning money to other troubled states like Ireland and Portugal—causing interest rates to soar in those countries and causing them to default too. Even Spain and Italy could be pushed over the edge, which would throw the whole eurozone into question.…

- Posted by - (0) Comment

![]()

By Violeta Klyviene - Danske Bank

Today Lithuanian Statistics published the flash estimate of GDP growth for Q1 11. GDP unexpectedly accelerated to 6.9% y/y, significantly up from 4.8% y/y in Q4 10, seasonally-adjusted GDP increased by 3.5% q/q. The outcome was significantly higher than our and consensus forecast (5.1% y/y).

Details

Lithuanian GDP increased by 6.9% y/y in Q1 11, significantly up from 4.8% y/y in Q4 10. We expect the Lithuanian economy to grow by 4% y/y in 2011, but there is a clear upside risk to our forecast.

Assessment and outlook

The Lithuanian GDP outcome in Q1 11 was significantly higher than our and consensus forecast (5.1% y/y). Although detailed statistics have not been published yet, it looks like the Lithuanian recovery has become more broad based and was derived not only by robust export performance, but also by notable growth in private consumption. However, the impressive recovery was partially determined by the low base effect.

Regarding this year’s development we emphasise that growth might exceed our expectation (4% on average). However, Lithuanian quarterly national accounts data are characterised by significant corrections, so we are not changing our forecasts for this year until the publication of the final data for Q1 11.

The biggest risk to the economic recovery is still associated with the accelerated inflation, which is mainly determined by external factors and as a consequence cannot be handled effectively. Eurozone debt crisis risk remains relevant as well. Under the unfavourable scenario, Lithuanian will be unable to escape the negative effects of a full-scale sovereign debt crisis, but the economy fundamentally looks much stronger than a few years ago.

Otherwise such risk confirms the need to pursue fiscal consolidation targets in the medium term.…

- Posted by - (2) Comment

Before they realized what is going on and who was robbing them, the Lithuanian people got clubbered by PM Kubilius’ ambitious austerity policy and the younger ones started emigrating in catastrophic numbers, seeing no future in the country whose GDP was reduced (from a low post-Soviet level) by some 20% by the combination of the old nomenklatura rent-seeking policies and the global Great Recession. Lithuania is hollowing out, unfortunately.

Palemonas Legend: A Tale of Two EU Nations

Since the annus mirabilis 1989 the theory was that Central and Eastern Europe, CEE, would use its abundant and relatively educated labor force to grow faster and on a more sustainable and consumer-oriented (prosperity) basis due to shift to markets and euro-integration.

What got in the way is the theory of (rational?) expectations?

True, CEE did receive a sort of a very modest version of Marshall Plan from the EU. True to four EU freedoms, Western Europe is opening to labor movements (emigration) from CEE. So when new CEE policymakers were implementing liberal market reforms, they should have anticipated some outflows of labor force to higher bidders in Western Europe due to simple demonstration effect.

What got in the way is the law of unintended consequences in complex processes?

When the British opened their labor markets to the East, they anticipated some 10-12 thousand immigrants from Poland, for example, what they got is some one million and rising. Who knows what the figure will be when Germany opens this May?

The tale of two EU nations: What got in the way is the paradigm of hard-to-calculate policy externalities?

The current Kubilius Government of Lithuania adopted a very ambitious (no IMF help even sought!) and rather harsh austerity modeled on the reigning EU thinking in order to clean the Augean stable of Lithuania's finance wrecked fo by former Soviet nomenklatura hijacked governments that largely used EU money to place their cronies in plum jobs (to the exclusion of younger generation of course!), "prikhvatize" real estate and keep it from any taxation, etc. Consequently, Lithuania did not attract much Western direct investment so the productivity remained at low post-communist levels at the time when emerging Asia provides stiff global competition.

Before they realized what is going on and who was robbing them, the Lithuanian people got clubbered by this new ambitious austerity policy and the younger ones started emigrating in catastrophic numbers, seeing no future in the country whose GDP was reduced (from a low post-Soviet level) by some 20% by the combination of the old nomenklatura rent-seeking policies and the global Great Recession. Lithuania is hollowing out, unfortunately.

While the Lithuanians sobered rather in time, the Greeks have been continuing the party until the last bottle:)

Greeks won, Lithuanians lost! This is the tale of two integrating nations: they are even related since ancient times according to a Greek Palemonas legend.

Wishing you all the best, I remain

Yours Sincerely

Valdas Samonis, PhD, CPC

The Web Professor of Global Management(SM)

Institute for New Economic Thinking, New York City, USA

and Royal Roads University, Canada

Knowledge Management Editor, Transnational Corporations Review (TNCR)

Valdas Samonis www.samonis.com www.samonis.com |

Val Samonis, PhD, CPC, has worked with top business, technology, and policy leaders in many countries, e.g. Nobel Laureates in Economics and Finance (Tobin, Arrow, Solow, Leontieff, Klein) as part of The Stanford Economic Transition Group; Polish Deputy Prime Minister L. Balcerowicz, Czech Deputy Prime Minister P. Mertlik; other top experts globally; lectured internationally on trade, investment, corporate governance/finance and enterprise restructuring, competitiveness, and ICT & knowledge management (KM) in the global economy; and has been extensively published. |

THE WORLD LITHUANIAN ECONOMIC FORUM

VILNIUS 4 – 5 JULY 2011

There is over a million of people of Lithuanian origin living outside Lithuania. Having left their Motherland in different times and of different reasons they are now living and working in countries around the world. Many of them became successful businessmen: owners or managers of big corporations and companies or highly ranked experts in different fields.

Establishing of a closer relationship with Lithuanians living abroad should nowadays be one of the most important goals in the strategy of our government. The diasporas represent an invaluable source which can enrich Lithuania and help to create a better future of our country.

- Posted by - (0) Comment

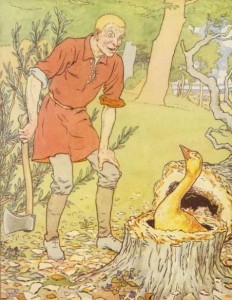

Once upon a time, there was a man named Gus. This was a very, very LONG time ago... And, somewhere long-since forgotten.

We do not know where this story begins. Some sources identify England or France, or more-central Europe, or even the far- or near-east. ‘Where’ is not so important as to the origin, because (as you will see later), in our ‘modern age’ the essential ‘situs’ (i.e., place) becomes several places in the world, which explain why the source is attributed to more than one place.

We do not know ‘when’ this story begins, but a general reference of time being ‘ancient-’ or ‘pre-’ history is ascertainable by the very beginning of the story...

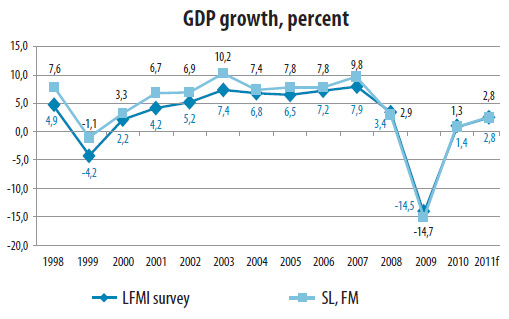

• According to the latest survey from Lithuania’s ‘Free Market Institute (LFMI)’, the economic situation in Lithuania will ameliorate in 2011: GDP will grow at a higher rate, exports will continue to rise, unemployment will fall and the financial situation of both households and companies will improve.

• Lithuania’s GDP grew by 1.4 percent in 2010. The economy is expected to rise by 2.8 percent this year. Although the country’s economy is gradually picking up, GDP growth remains low compared to the period before economic setback.

• According to the survey, the unemployment rate stood at 16.8 percent at the end of 2010. Market participants believe that unemployment will re- main still high this year. About 15 percent of job seekers of working age will be unemployed at the end of 2011.

• In 2010, Lithuania felt the recovery of its major export markets, and growing exports at least partially soft-pedalled the diminished demand on the domestic market. Market participants think that exports edged up by as much as 17 percent and imports climbed by 14 percent last year. Foreign trade will continue to grow rapidly this year. Both imports and exports are expected to increase by

• The LFMI survey indicates that after reaching record highs in 2010, the shadow economy will not start to contract this year. According to market participants, the share of the shadow economy approximated one-third of the entire economy, accounting for 28 percent of GDP.

VilNews e-magazine is published in Vilnius, Lithuania. Editor-in-Chief: Mr. Aage Myhre. Inquires to the editors: editor@VilNews.com.

Code of Ethics: See Section 2 – about VilNews. VilNews is not responsible for content on external links/web pages.

HOW TO ADVERTISE IN VILNEWS.

All content is copyrighted © 2011. UAB ‘VilNews’.