THE VOICE OF INTERNATIONAL LITHUANIA

|

VilNews has its own Google archive! Type a word in the above search box to find any article.

You can also follow us on Facebook. We have two different pages. Click to open and join.

|

Business, economy, investments

Lithuania has become one of the biggest victims of the global economic crisis. The economy has shrunk dramatically and the hangover from Soviet rule continues to cast a long shadow over domestic politics and foreign affairs. Still, in a recent Hard Talk session with the BBC, Prime Minister Andrius Kubilius insisted that the country's economy is stabilising.

Most analyst believe that, in 2011, Lithuania’s GDP growth will be about 3 percent; exports will rise approximately 11 percent, while the average salary will go up 3 percent. The high unemployment rate will, however, remain one of the biggest problems. It will probably go down a bit, but it will remain high overall – about 16 percent. An unemployment decrease should be related to laying a general foundation for economic growth. It is very important not to adopt what at first sight seems attractive, but, at the end of the day could be situation-worsening decisions; this could be, for example, not to increase the minimum wage. The shadow economy will also remain a burning head ache for the government, and a very bright scenario for 2011 is therefore not likely.

Text: Torben Pedersen

Moderate optimism for 2011….,still a number of challenges to be addressed.

For the year 2011, she foresees record highs in Lithuanian exports, approximately 12 percent growth which, however, is a slower gain compared to last year. “Trends in exports will remain positive, as all our major export markets - Poland, Latvia, Russia and the Commonwealth of Independent States (CIS) - will grow faster this year than in 2010. Besides, the upcoming European Basketball Championship will prompt a positive impulse to service exports as well,” the Swedbank chief analyst maintained.

However, according to her, the labor market will recover slowly, both in creating new jobs and in salary growth. “In the new year, we predict job creation for 40,000 people, mostly in the private sector, which will decrease the current unemployment rate by 2 percent, to 15.5 percent. However, a slow salary increase, considering the speed of inflation and, consequently, price rises, will not be tangible,” Vrubliauskiene emphasized to The Baltic Times. She sets the inflation rate at 2 percent in 2011. As for household income this year, she sees it similar to the previous year’s level. “However, consumption recovery will be further induced by a slower savings rate due to the reduced savings interest rates. Lithuanian households have saved nearly 2 billion litas (579.7 million euros) over the two year crisis. Since unemployment risk is lessening and consumer trust is growing, household consumption will grow approximately 1 percent, particularly for non-primary necessity articles,” Vrubliauskiene pointed out.

In the short- and medium-term, she foresees the biggest domestic risk being related to the condition of the state’s finances and slowly proceeding structural reforms. “Though this year the budget deficit can be decreased up to 6 percent of GDP, it will surpass the 3 percent GDP level set by the Maastricht criteria and will be higher than the needed balanced budget level,” Vrubliauskiene said.

“Let’s do what we have done best for centuries – agricultural products”

Bronius Markauskas, chairman of Lithuania’s Chamber of Agriculture, is convinced that Lithuania ought to pursue what it has done best for centuries – grow agricultural products, produce food products and export them. “In 20 years, EU and world experts predict that food products, due to several important reasons, such as climate change, world population increase, economic growth and higher food product demand in Asia and Africa, will become strategic commodities. Will Lithuania take advantage of the developments and increase its agriculture product output? The positive response lies upon several conditions – whether Lithuania will have sufficiently high and stable procurement prices of agriculture production, proper general EU agriculture policies after the financial period is over in 2013, and the bureaucratic load decreasing for farmers,” Markauskas said.

He admits that agriculture production prices are very hard to predict. “In recent years, food provisions were getting more expensive in world markets. I reckon this year will be more stable in many senses. However, in the long term, food provision demand and, therefore, their prices should be increasing. As far as post-2013 European agriculture is concerned, we still have many unanswered questions. The European Commission has not made up its mind as to agricultural financing after 2013. Likely, we will find out about its decisions in the midst of next year. They will have a long-lasting effect not only for Lithuanian farmers, but for all EU farmers as well,” Markauskas asserted.

Despite brighter general assessments for Lithuania’s economy, “its very bright scenario for 2011 is unlikely.”

Vytautas Zukauskas, expert at the Lithuanian Free Market Institute (LFMI), says that, despite brighter general assessments for Lithuania’s economy, “its very bright scenario for 2011 is unlikely.” According to LFMI, in 2011, GDP growth will be about 3 percent; exports will rise approximately 11 percent, while the average salary will go up 3 percent. LFMI’s expert asserts the high unemployment rate will be one of the biggest problems for Lithuania this year. “It will go down a bit, but it will remain high overall – about 16 percent. An unemployment decrease should be related to laying a general foundation for economic growth. It is very important not to adopt what at first sight seems attractive, but, at the end of the day could be situation-worsening decisions; this could be, for example, not to increase the minimum wage,” Zukauskas said.

He emphasizes that the shadow economy will remain a burning problem in 2011. “Its share in the gross domestic product will reach approximately 27 percent this year. At least 36 percent of all households will do a part of their work activity in the shadows. Thus, the shadow economy scenery will not be much different from what we saw in 2010. We have to admit that the shadow economy, for a good many people, remains as an alternative to poverty and unemployment. Due to its vast spread during the crisis years, Lithuania has avoided major social unrest. It is the state’s concern to pull its inhabitants out from the shadows,” Zukauskas contended.

He claims that export growth will be one of the very few buoyant indicators in the Lithuanian economy in 2011. However, he cautions, it will affect positively only some enterprises. “It makes sense to take advantage of export possibilities; however, it cannot be a foundation for Lithuania’s economic recovery and growth,” the expert warned.

Zukauskas maintains that the state sector’s deficit and debt will be a burdensome issue in 2011. “The downturn has exposed a lack of flexibility in the public sector. It is estimated that in 2011, the state’s debt will make up 40 percent of GDP, while in 2008 it comprised only 16 percent. In comparison with other EU states, Lithuania’s debt is not very high. However, we should have in mind that, even during the double-digit GDP growth years during the economic boom, Lithuania was not capable of decreasing its debt. Since 1998 it has been constantly growing in Lithuania. Thus, it purports that Lithuanian officials are not good at managing it. Likely, with the recovery spreading, politicians may not be willing to handle it in 2011 either,” Zukauskas asserted.

Asked about euro introduction prospects, he answered, “The euro future will depend on how quick most economic hardship-stricken countries will be able to recover and see their economies growing.”

“2011 will be a bit better than 2010”

Gitanas Nauseda, advisor to SEB Bank’s president, and a notable financial analyst in the country, predicts that 2011 will be a bit better than the last year. However, he cautions, not to be excessive with expectations. “For 2010, we expected faster GDP growth, to be exact, about 4 percent, and domestic market recovery; however, expectations have failed. Domestic consumption was impeded not only by fundamental reasons, such as a high unemployment rate and salary decrease, but also by the pessimistic expectations that reflected the population’s tensions and uncertainty about the future. However, in 2011, the situation should improve, but slowly,” Nauseda said.

Asked about loan market prospects, he replied, “Crediting directly depends on client solvency.” The analyst contends that if the circle of clients, being able and willing to use financial services, does not expand considerably this year, it will be difficult for banks to enliven the market. “In the last months of 2010, there were observed tentative loan portfolio growth trends, which have become a good introduction to 2011. I think that credit resources should not get very expensive this year, as the European Central Bank will try not to stifle the frail economic recovery and will go ahead with a ‘cheap money’ policy. However, in the second half of 2011, EURIBOR interest rates will likely go up, counting in a possible base interest rate increase in 2012,” Nauseda predicted.

As for euro introduction in Lithuania, the analyst anticipates “it can be introduced in 2014 at best.” He warns that “In order to achieve this, it is necessary to decrease the fiscal deficit to 3 percent of GDP in 2012 and keep up a modest inflation, not allowing it to exceed that which is set by the Maastricht criteria. Considering that elections to the Seimas will take place in 2012, it will not be simple to follow strict fiscal discipline, as pressure for the ruling coalition to implement its given social promises, such as pension restoration to the pre-crisis level, will only increase.” Nauseda expects that exports in 2011 will keep growing, particularly to eastern markets and neighboring countries Latvia and Poland. However, he warns, it is important not to give up the positions that have been seized in Western markets in 2010.

“SEB Bank’s analysts see 2011 in a considerably brighter light than 2010”

Julita Varanauskiene, a SEB Bank analyst, says that households’ financial life started to return to normal in 2010. “Starting with the second half of 2010, there appeared more positive news for households – very slowly, but assuredly salaries began to grow, new jobs numbers started to increase, fractionally. Public polls also speak about lower pessimism,” Varanauskiene said. She says that SEB Bank’s analysts see this year in a considerably brighter light than last year. “According to the analysts, in 2011, unemployment will fall from 17.5 percent to 16 percent, while the average salary should increase by 3.5 percent. Therefore, household income will rise slowly and, likely, it will be easier to find a job this year. Increasing prices will diminish the positive effect of a larger income, though. Our analysts envisage price increases in the commodity and service basket by 2 percent in 2011. Due to a higher excise tax for fuel, energy resources may get more expensive in 2011. It also can be a result of increasing oil and gas prices in international markets. Therefore, prices of some commodities, including food products, may go up,” Varanauskiene guesses.

Viewing the data of 2010, she emphasizes that in some market sectors, for example, in the pharmaceutical industry, salaries have already increased by 14 percent, while in the computer, electronic and optics industries average pay has gone up by 12 percent. “Certainly, the crisis has been over in some market sectors. The trend will likely prevail in the new year,” Varanauskiene expected.

“Economic trends in Western and Eastern markets being served by Lithuanian haulers are favorable”

Algimantas Kondrusevicius, president of Lithuania’s National Road Carriers’ Association, asserts that economic trends in Western and Eastern markets being served by Lithuanian haulers are favorable. “However, our carriers frequently encounter with neighboring countries administrative hurdles. With the newly adopted order, load declaration procedures should be shortened to 5-10 minutes, facilitating our carriers’ work. However, in the domestic haulage market, I do not see much optimism. Due to the increased excise tax for diesel, load haulage and passenger transport will become more expensive for all. Therefore, other merchandise and services will jump in price as well in 2011,” Kondrusevicius predicts.

Public opinion polls show returning optimism to Lithuanian households, which can probably be considered as the most anticipated sign for a better year and life.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

Again time to invest in Lithuania?

- Posted by - (0) Comment

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

Lithuania’s budget deficit will remain “high” for several years, because of swelling government debt, and weigh on the country’s credit ratings, Moody’s Investor Service concluded in 2010. Lithuania’s economic recession, the deepest since the fall of communism 20 years ago, is undercutting the government’s efforts to narrow the budget gap, which swelled to about 9.5 percent of gross domestic product last year. The government of Prime Minister Andrius Kubilius cut spending and raised taxes to save about 9 percent of GDP last year. “The government’s budget deficit is still very high, and will remain high for several more years, causing a significant increase in government debt,” Orchard said. “We continue to assess the evolution of both the economy and government finances to determine whether the rating should remain at Baa1 or be downgraded to Baa2.” Moody’s rates Lithuania’s sovereign debt Baa1, the third- lowest investment grade.

The Moody rating, which was cut twice in 2009, has a negative outlook.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

Inadequate financial markets

- Posted by - (24) Comment

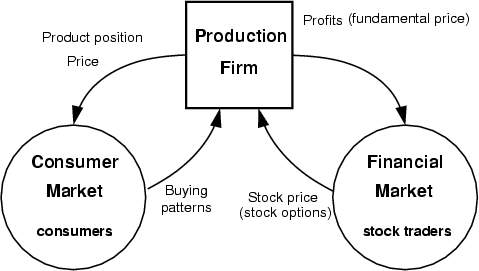

The Integrated Markets Model.

Consumers purchase products, and financial traders trade shares. Production firms link the consumer and financial markets, by selling products to consumers and offering their shares in the financial market.

Despite some progress in developing the domestic financial markets over the last two decades, the overall liquidity of the markets remain inadequate for any large scale development in Lithuania. At the same time, the corporate debt market remains negligible. Overall, among the potential factors hindering development of the securities markets in Lithuania are the small size of the domestic market, lack of institutional investors (pension funds, mutual funds etc.), prohibition of issuing debt securities denominated in foreign currencies domestically and a poor investment culture. For the above reasons the Lithuanian financial markets provide only limited resources for the private sector. For example, the value of private...

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

VilNews e-magazine is published in Vilnius, Lithuania. Editor-in-Chief: Mr. Aage Myhre. Inquires to the editors: editor@VilNews.com.

Code of Ethics: See Section 2 – about VilNews. VilNews is not responsible for content on external links/web pages.

HOW TO ADVERTISE IN VILNEWS.

All content is copyrighted © 2011. UAB ‘VilNews’.

Click on the buttons to open and read each of VilNews' 18 sub-sections

Click on the buttons to open and read each of VilNews' 18 sub-sections

.jpg)