THE VOICE OF INTERNATIONAL LITHUANIA

|

VilNews has its own Google archive! Type a word in the above search box to find any article.

You can also follow us on Facebook. We have two different pages. Click to open and join.

|

Business, economy, investments

Dear readers,

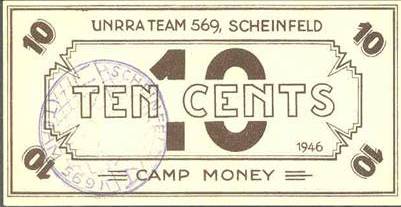

We are delighted and honored that Mr. Frank Passic has graciously offered to share with us his vast knowledge of Lithuanian numismatics. In this article he provides us with a very interesting look into how Lithuanians living in Displaced Persons camps, following World War II, dealt with the situation of currency to help them survive in their daily lives.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (0) Comment

KLAIPĖDA FREE ECONOMIC ZONE:

A magnet for

international companies

The Klaipėda Free Economic Zone (Klaipėda FEZ) was established in 1996 and opened officially in 2002. FEZ offers tax incentives to qualified investors that invest at least 1 million euros. In 2008, due to overcrowding the zone was expanded from 205 hectares (510 acres) to 412 hectares (1,020 acres) of developed land. As of March 2008, before expansion, FEZ had 22 investors: seven were operating, one just finished construction, six were under construction, and others in development stage.

www.fez.lt E-Mail: info@fez.lt

The Klaipeda Free Economic Zone (FEZ) was the first and is still the only fully functioning free economic zone in Lithuania. The two companies that first started operations in the zone was the Japanese company Yazaki Wiring Technologies Lietuva, and the Danish company A.Espersen A/S, which opened their fish processing factory here in January 2003. FEZ was established to provide favourable conditions for the development of business activities by offering a prepared industrial site with a ready physical and juridical infrastructure, support services and tax incentives.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

This country is steeped in corruption

- Posted by - (0) Comment

General Director Reidar Inselseth at the Espersen Fish Factory in Klaipeda

I sit with the director of the Espersen plant in Klaipeda, Norwegian Reidar Inselseth, in the new office building his firm has just built. The building is designed as the wheelhouse of a ship, with a shiny blue glass surface, and the 'bow, roof top and masts' in stainless steel.

Reidar has been director of this facility for four years now, and among other things, been responsible for extensive new investments and developments of the company. My first question to him is what he finds hardest by being entrepreneur and company leader in Lithuania.

"The lack of predictability," he replies immediately. "Unfortunately, that is something that to a far too high degree characterizes this country. For my company this is so serious that we hardly had chosen Lithuania for our production if we eight-nine years ago had known what we now know."

"This country is steeped in corruption, which we feel very directly when we often are subjected to strange inspections etc. from the authorities; something we do not see anything like in any of the other countries where we have fish processing plants. We are, for example, constantly subjected to unreasonable disclosure requirements and controls, even if we always follow highly acclaimed and transparent international principles of production, environmental control, bookkeeping and treatment of employees. It feels as if here in Lithuania companies like ours still have to prove their innocence instead of being greeted with open arms and cooperative attitudes."

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (0) Comment

Lithuania may delay

its euro-adoption

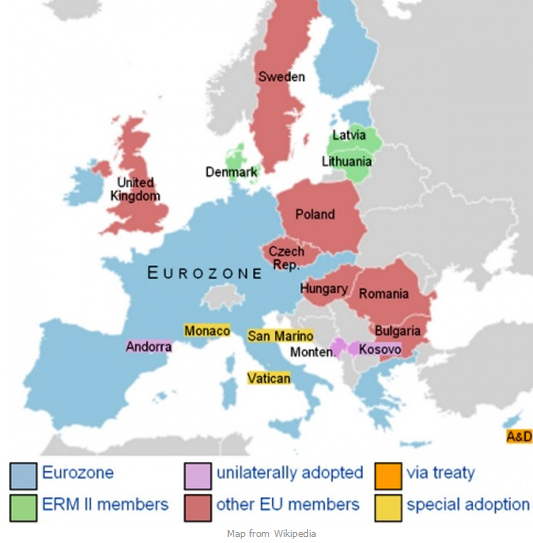

SWEDBANK: Lithuania may delay its euro-adoption goal beyond 2014 because the currency area’s debt crisis is worsening and its government lacks “political determination” before a parliamentary ballot.

Lithuania may be wary of providing aid to ailing euro-region members such as Greece, Swedbank economists Nerijus Maciulis and Lija Strasuna says in an e-mailed report. While it has a good chance of meeting entry criteria by next April, neighbouring Latvia has stronger political resolve to adopt the currency the following year, they write.

“There seems to be a more unanimous agreement to meet Maastricht criteria for the sake of stability, but not necessarily in order to adopt the euro immediately” in Lithuania, Swedbank says. “There’s a probability Lithuania won’t apply formally for euro adoption in 2014 -– much of this will depend on election results in October, as well as the euro area’s progress toward a sustainable solution.”

Latvia and Lithuania are likely to meet the Maastricht criteria in early 2013 and were both expected to join the euro zone in 2014.

Thus, by 2014, the two countries may be able to take full advantage of the benefits offered by the membership in Economic and Monetary Union, according to the Swedbank economists.

According to Chief Economist at Swedbank Nerijus Maciulis, Lithuanian politicians avoid making decisions and even discussing the subject because of the recent fall of the euro popularity and the public's trust in the future of the single currency.

However, the economist points out that the risk of the euro future is not high enough to forget a long-term strategic goal of Lithuania.

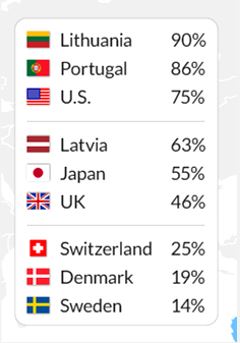

The passive attitude of the responsible Lithuanian authorities is also reflected in the survey of the Eurobarometer which reveals that 60% of residents in Lithuania say that they do not get enough information about the euro.

However, the study conducted by the European Commission shows that 44% of population support the euro adoption and 5% have not decided yet. Maciulis says that the euro benefits are tangible and easily measured.

"There seems to be a more unanimous agreement to meet Maastricht criteria for the sake of stability, but not necessarily in order to adopt the euro immediately" in Lithuania, Swedbank

economists Nerijus Maciulis and Lija Strasuna said in an e-mailed report.

Lithuania and Latvia are next in line to join the 17-nation Euro Area, while other Eastern European nations such as Poland and the Czech Republic show slow preparations as the debt crisis deepens.

In 2006, Lithuania became the only nation rejected for euro adoption after it missed an inflation target by 0.1 percentage point.

Estonia became the 17th member of the Euro Area in 2011.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

|

LITSHARES: |

|

A Strategy for Global Financing of Lithuania’s Development |

|

Dedicated to Those Dead or Alive Whose Blood and Brains Made Free Lithuania Possible |

|

|

|

By Valdas Samonis |

|

2/16/2012 |

|

ABSTRACT. Given the dangerous European and global economic and strategic predicaments, Lithuania (LT) needs to adopt very bold and innovative ways to “sell” to the world its extreme austerity sacrifices during the continuing period of global Great (D)Recession and its earlier periods of bold systemic transformations as well. This proposal is a new strategy to globalize LT financial-economic ties (optimal global integration) so that the nation is no longer badly cornered and unduly dependent on the moribund European Union (EU) which is distracted and disoriented by the cacophony of austerity/profligacy controversies, and actually rewarding free riders by default. By now it is rather clear that Europe alone cannot properly reward the financial virtue and sacrifice of the LT people for the sake of the future (investment) which is the most distinguishing trait of a responsible nation and a mature leadership; hence the need for LT to go before the entire “global village”. Globalization can provide huge and underappreciated benefits for a nation like LT. This litshares or litakcijos (LTS) proposal is still to be developed to a greater detail and “hands-on” policy relevance. In the first instance, LTS would appeal strongest to LT residents, diasporas, and other FOLK (Friends of Lithuania of All Kinds); then they would catch up globally rather fast. |

Introduction and Attributions

The basic insight which gave rise to my litshares (LTS) proposal for Lithuania (LT) stems from the Nobel level economist Robert J. Shiller who is the Arthur M. Okun Professor of Financial Economics at Yale University, USA, and the author of the forthcoming book entitled Finance and the Good Society (Princeton University Press) as well as the co-author (with Nobelist G. Akerlof) of my recently reviewed book Animal Spirits: How Human Psychology Drives the Economy and Why It Matters for Global Capitalism (Princeton University Press). I have gained a lot of inspiration and new understanding from my extensive discussions at The Institute for New Economic Thinking (INET), particularly interactions with the Reagan Era’s US Fed Chairman Paul Volcker and other top global experts at the INET Bretton Woods Conference in 2011. Research assistance by Ramune Samonis, University of Toronto, is gratefully acknowledged.

Right after the pinnacle of the disastrous financial crisis in 2008, The Queen Elizabeth II asked economists, “Why did no one see the credit crunch coming?” Three years later, a group of Harvard undergraduate students walked out of an introductory economics course and wrote, “Today, we are walking out of your class, Economics 101, in order to express our discontent with the bias inherent in this introductory economics course. We are deeply concerned about the way that this bias affects students, Harvard University, and our greater society.” What has happened? Rebellion from both above and below suggests that economists, who were recently at the core of power and social leadership in our society, are no longer trusted much. Not long ago, the principal theories of economics appeared to be the secular religion of society, writes Dr. Robert Johnson, Executive Director, The Institute for New Economic Thinking.

Nice Try, Europe!

Since 2007, in the five years of the continuing economic crisis, the European Union (EU) countries have been performing very badly: 22 of its 27 members incl. those from Central & Eastern Europe (CEE) have lost time as measured by several economic clocks (GDP levels, share prices, real estate values, etc). Asia has performed much more strongly but even it presents a mixed picture. In particular, the long road back for global shares as measured by the most important indices according to data by Prof. R. Shiller, The Economist, and Thompson Reuters, see Chart 1.

Chart 1: The Long & Winding Road Back to Zero for Global Shares

The theory of economic integration was developed over half a century ago by Jan Tinbergen, Bela Balassa, and other prominent scholars of integration. However, the house of the European integration has been built on flawed fundamentals. While the European integration fathers (Schuman, etc) were understandably in a rush to rebuild Europe on a different model as quickly as possible so it avoids the repetition of the disastrous 20th Century wars, the art and science of “architecture” in building the European integration (United States of Europe) were not properly understood and used. Simply copying the USA does not work in Europe, as we abundantly know now. With these fundamental problems, the diagnosis and prognosis for Europe does not look good at all.

With the European Central Bank/euro acting as the "new" gold standard and the current totally confused austerity/profligacy debates, Europe is probably repeating the most horrible mistakes of the bloody past. In the 1920s, after experiences of inflation and then huge and uncontrolled capital inflows, Germany lost productivity advantages in part due to uncontrolled wage growth in the environment of heavy leftist/communist propaganda. Capital inflows suddenly turned to a trickle, governments and banks were squeezed for money and credit, bank asset fire sales started, followed by runs on banks, deflation, Great Depression; the rest is history. Under the regime of the fixed exchange rates of the gold standard, this history was the logical outcome. John M, Keynes wrote in his book The Economic Consequences of the Peace back in 1919:

“Very few of us realize with conviction the intensely unusual, unstable, complicated, unreliable, temporary nature of the economic organization by which Western Europe has lived for the last half century. We assume some of the most peculiar and temporary of our late advantages as natural, permanent, and to be depended on, and we lay our plans accordingly. On this sandy and false foundation we scheme for social improvement and dress our political platforms, pursue our animosities and particular ambitions, and feel ourselves with enough margin in hand to foster, not assuage, civil conflict in the European family”.

Since 2000, the risks are even worse because of toxic assets (mortgage backed securities, other derivatives, etc) that spread around the world in and nobody knows the true financial health position of counterparties. In the near European future, we are likely to see similar credit crunch spasms, catastrophic collapses of exports/trade, and Europe's Great Depression 2: economic and political disintegration, beggar-thy-neighbor policies, conflicts, etc. The history does not repeat itself exactly though.

The USA may follow the unenviable example of Japan but at least that is a slow and gradual decline that gives opportunities for new bursts of the US "animal spirits" and new turnarounds, e.g. via increased immigration, new and exports-oriented manufacturing technologies, etc.

Without getting here into undue larger debates, it is sufficient to sum up that conventional European approaches fail to provide remedies to the great majority of the economic Greek Tragedies that afflicted the continent and the world, incl. the current Great (D)Recession; this rather sweeping assertion is not even controversial in early 2012. The reason it is so is that these standard economic theory approaches completely fail to account for the operation of “animal spirits”, a concept dating back to John M. Keynes. Animal spirits are our interpretations of finance, economics and the economy, our mental/psychological forces and constructs, spiritus animalis from the original Latin. They include: (non)confidence (with its Keynesian style multipliers), the issue of fairness in wage determination and other areas (like comparative pensions among nations), corruption and bad faith phenomena in the societies, money illusion that people usually operate under, and stories that are our practical and simplified ways of thinking about our economic and financial affairs.

Enter the Center: Lithuania

Located at the geographical center of Europe, Lithuania has been leading the postcommunist world in economic and political reforms, shedding development retarding legacies of the occupying power (USSR), and trying to re-join the global village after some half a century of the Soviet occupation and the resultant destruction of ties to the world. Since 1990 Declaration of Independence, LT has gained a unique global recognition, even admiration, for its valiant and peaceful freedom-seeking anticommunist revolution and thus amassed a lot of global political capital and global good will. In the interwar independence period that included the global Great Depression, LT had a second strongest currency in Europe, after the Swiss franc. The problem is that LT remains a very timid seller of its stamina, achievements, etc, seemingly resigned to sacrifices without getting much credit for them in this global village of ours.

Since the Annus Mirabilis 1989, the theory was that Central and Eastern Europe (CEE) would use its abundant and (relatively) educated labor force to grow faster and on a more sustainable and consumer-oriented (prosperity) basis due to a decisive shift to markets and European integration. The EU integration was supposed to anchor market reform achievements and help secure new sustainable growth as outlined in the now almost forgotten EU Growth and Stability Pact.

What got in the way is the theory of (rational?) expectations?

True, CEE did receive a sort of a very modest version of Marshall Plan from the EU. True to four EU freedoms, Western Europe has been opening in fits and starts to labor movements (emigration) from CEE. So when new CEE policymakers were implementing pretty liberal market reforms, they should have anticipated some outflows of labor force to much higher bidders in Western Europe due to simple demonstration effect. Poorly understood legacies of communism are at fault here.

What got in the way is the law of unintended consequences in complex processes?

When the British opened their labor markets to the East, they anticipated some 10-12 thousand immigrants from Poland, for example, what they got is some one million and rising. Who knows what the figure will be a longer time after Germany’s opening in 2011?

What got in the way is the paradigm of hard-to-calculate policy externalities?

The current Prime Minister Andrius Kubilius Government of Lithuania adopted a very ambitious (no IMF help even sought!) and a rather very harsh austerity modeled on the reigning traditional EU thinking in order to clean the Augean stable of Lithuania’s finance wrecked by the former Soviet nomenklatura hijacked governments that largely used “easy” EU money to place their cronies in plum jobs in LT and Brussels (to the exclusion of younger generation of course), “prikhvatize” real estate and keep it from any socially beneficial taxation, etc. The Kubilius Government’s harsh austerity policies (the so called internal devaluation) cutting public sector wages, social expenditures (by about one third) and increasing some taxes, etc, in a national fiscal belt tightening (“diet”) that has probably been the steepest in recent memory globally. Predictably, the GDP collapse was horrible at some 20%. The LT people have been pretty much resigned to the fate, in a stark contrast to Greece.

The Kubilius Government has been operating under the handicap of the currency board (CB) arrangement which is an alternative monetary arrangement to a central bank and a national monetary policy, e.g. using short-term interest rates. Against a better advice, CB was introduced as far back as 1994, even though LT has had very good interwar comparative experiences with running the second strongest currency of Europe in a classical central bank formula that fits the responsible nation like LT very well. As opposed to the classical central bank, CB allowed no room for monetary easing while doing harsh austerity. For all practical reasons, LT currency has been hard pegged to euro resulting in a quasi Eurozone membership of LT. The formal LT membership of the Eurozone was denied by Brussels on the flimsy grounds of miniscule short-term inflation targeting problems, while France and other Eurozone core countries have been rather openly violating the EU’s fundamental Maastricht Treaty and the Growth and Stability Pact. As we know from the world history (e.g. Argentina), CB regimes can be very destabilizing (incl. runs on banks, etc) during the kind of deep turmoil periods that Europe is experiencing since 2008.

Despite repeatedly proving the nation’s responsibility and sacrifice (investment) capabilities via austerity, etc, LT did not attract much European/Western direct investment so the productivity remained at low postcommunist levels at the time when emerging Asia provides a stiff global competition.

Thus, very unlikely EU countries, like the Soviet communist exploited and impoverished Lithuania, have long showed the way to Europe by adopting serious austerity policies that go almost to the point of "eating the dog food", to use a hyperbole. Unfortunately, this good model that Europe has been looking so desperately for (and could not find) is drowned in the cacophony of bureaucratic quarrels around bailing out Greece and other profligate countries that are, so far at least, the true winners in Europe. Theoretically, if the nation like LT adopts a conventional, hard austerity policy, a serious “diet” designed to improve public finances and the resultant “crowding out effect”, the nation should get into the global position of substantially improved financial reputation, presumably also the much lower cost of its longer-term capital.

However, it all comes to empirics and experiential learning. Theoretically, you can think of a hypothetic success story of "expansionary austerity". It would be due to the removal or reduction of the crowding out effect (COE) that government profligacy usually causes. The removal of COE should theoretically lead to productivity increases on the strength of the argument that business can innovate/do business better than government does; vide long economic history of postcommunist countries and of the world in general. However, the problem is the time horizon. If austerity leads to the catastrophic collapse of GDP, then emigration of hard-to-replace human resources and capital flight usually follow. In short, austerity can work in the long run provided that the long run exists at all; that is if the economy is not dead by that time, to paraphrase Keynes. Ultimately, economic policy is about experiential learning, empirics that are. When a nation’s economy contracts, as LT did by some 20%, and its debt continues to grow, a big problem develops for the taxpayers. This is why Europe is in turmoil right now. “Expansionary austerity” is an oxymoron, every bit as it sounds, in the mid-term at the very least.

Before they realized what is going on and who was robbing them, the Lithuanian people got clabbered by this new ambitious austerity policy and the younger ones started emigrating in catastrophic numbers, seeing no future in the country whose GDP was reduced (from a low post-Soviet level) by some 20% by the combination of the old nomenklatura rent-seeking policies and the continued global Great Recession. Lithuania is hollowing out, unfortunately.

While the Lithuanians made huge sacrifices and so “invested” in the future, the Greeks have been continuing the party here and now until the last bottle or perhaps they can get another one, and another:).

In the current state of European affairs, Greeks won, Lithuanians lost! This is the tale of two integrating nations: they are even related since ancient times according to a Greek Palemonas legend.

Litshares: The Conceptual-Analytical Framework for Globalizing Lithuania

Despite some serious problems with the first stage of globalization, it can provide huge and so far very poorly understood benefits for a responsible, thousand-year nation like LT. How about developing an innovative strategy to get some hard earned respect and actual long-term financial capital for sustainable development of LT from the global markets? Below is my proposed case for litshares or litakcijos (LTS) for LT.

Writing in the Harvard Business Review (HBR, January-February 2012), Prof. Robert Shiller suggested a simplifying assumption that a nation can be treated as a corporation from an investment and developmental point of view. Corporations use both debt and equity to finance their investments and operations; nations use only debt.

The logic goes that nations like LT should replace much of their existing national debt with shares in the “earnings” of their economies. This would allow them to better manage their financial obligations, present themselves better before global markets, and could help prevent future financial crises. It might even lower a nation’s borrowing costs in the longer run. LT paid something like 10% as a cost of capital in the recent past, usury really.

National shares would function much like corporate shares traded on stock exchanges of the world: London, Frankfurt, NYC, Hong Kong, Toronto, etc in the case of LTS. They would pay dividends regularly. Ideally, they would be in perpetuity, although a nation could always buy its shares back on the open market. The price of a share would fluctuate from day to day as new knowledge about a nation’s economy came out and have been digested by global analysts. The opportunity to participate in the uncertain economic growth of the new issuer nation (esp. “hidden gem” like LT) might excite investors, just as it does in the stock markets around the world.

Helped by Dr. Mark Kamstra, Prof. Shiller developed some insights on how these new national shares could work. In my proposed case of LT, these litshares (LTS) could pay a quarterly dividend equal to exactly one-billionth of the nation’s quarterly GDP (some 30 billion LTL in Q4, 2011), the simplest measure of national earnings. The fractional value of LTS could be different of course; but the important consideration in case of LT is to attract all the global investors, even smaller ones. The payoff would vary of course, depending on how well the nation like LT does, what the GDP growth is (over 100 billion LTL in 2011). If the economy surprised the investors on the upside, dividends would go up; if it declined, dividends would fall. The global markets would determine the price of an LTS which would be normally volatile. It would depend not only on the most recent dividend but also on the investors’ expectations for the future, which can change for the better precisely because of austerity “investments” by LT or any other nation, as opposed to profligacy of other nations, etc. There is s some evidence that a LTS might often be expensive relative to the dividend, which would be good for the national issuer. Prof. Shiller observes that shares of many US corporations and 10-year US Treasury notes sell for over 50 times their annual dividend. Since the growth rate of the real US GDP has been higher than that of real S&P 500 earnings in the past (3.1% annual GDP growth versus 2.5% annual S&P 500 growth over the past half century), such shares might sell for a multiple higher than 50.

Litshares Could Be Attractive Investments Globally

The advantage of keeping LTS equal to a billionth part of the economy is that people will know exactly what they are getting: one-billionth of a thousand-year old nation like LT is real and easy to understand for global investors. Such shares based on GDP have the great merit of being really clear, simple, and understandable to investors globally. Other measures of national earnings might seem to some analysts more appropriate than GDP but would sacrifice the great virtue of simplicity, clarity, transparency. This kind of simplicity and clarity encourages the development of badly needed confidence and trust that governments will not shirk their obligations at any time in the future. This is much better confidence and trust building strategy than any heavily advertised “magic” mechanisms like currency board that LT adopted against a better advice back in 1994.

LTS may appeal to international investors even more than corporate shares do because LTS would avoid the problem of the so called moral hazard. Here is the reason that Prof. Shiller stresses. If international investors ever acquired a good fraction of a nation’s corporate shares, the nation would have an incentive to raise the corporate profit tax on those shares or regulate them to reduce their value. If a nation did so, like the Kubilius Government rather erroneously did in LT, it would benefit without technically violating any promises. The issuance of LTS, however, would involve a strong and easily understandable promise of share in the value added (GDP) to global investors. If the shares paid dividends in the nation’s domestic currency like LTL, it would eliminate another moral hazard associated with the traditional debt. If the national shares strategy is adopted, the nation could not reduce its real obligations by creating inflation (e.g. via devaluation, as is already happening in some CEE countries), as they can with conventional government debt, because their nominal GDP would increase in proportion to the inflation thus created.

Speaking of Greece, Prof. Shiller asks what effect could national shares have had during the Great Recession and its aftermath? Greece’s real GDP fell 7.4% in 2010. If its shares were leveraged substantially, e.g. five to one, then the dividend paid on them would have fallen by about 40%. This would have done much to alleviate the crisis, making it easier for notoriously rebellious Greek taxpayers to bear. It would have given Greece a bailout without any scandal-ridden international controversies, loss of face and reputation or broken promises. After the fact, investors in Greek national shares would have been unhappy. But they still might have been willing to buy them, considering the very possible upside of such a leveraged investment. Global investors eagerly buy leveraged corporate stocks, so it is plausible that they would buy leveraged national shares as well. Global markets for national shares would fundamentally change the economic atmosphere (and confidence) in a nation like Greece or LT. An immediate market response would accompany every new governmental plan (strategy) affecting the future of the economy and society, generating discussions, free publicity, and a broader knowledge of each nation’s development plans, as well as much more energetic flows of global resources towards nations with plans that passed the transparent global markets test. This is much simpler and easier to understand for investors than the obscure and at times obviously disreputable work of traditional credit rating agencies or corrupt analysts.

In Lieu of Conclusions

With national share prices going up and down, LTS or other such shares might look to some analysts as an unwelcome extension of financial capitalism. Financial industry is in deep disrepute globally for causing this Great (D)Recession. But, in fact, the thoughtful implementation of disciplined financial capitalism has been the story of every successful nation in history. LT has made a very good headway. We should have real global markets for nations like LT; such “macro” markets would track their successes much more accurately and justly than stock markets usually do. And LTS would do the necessary justice to serious efforts and results of structural reforms and financial discipline like in LT. Stock markets trade only in claims on corporate earnings after corporate taxes, which is an unreliable measure of a nation’s success. We can do better, concludes Prof. Robert J. Shiller who was among the very few experts to have predicted this Global (D)Recession. He argues that, rather than condemning finance, we need to reclaim it for the common good. He makes a powerful case for recognizing that finance is one of the most powerful tools we have for solving our common problems as mankind, and increasing the general well-being of people. We need more financial innovation and more globalization that would be developed in the policy environment of proper risk and knowledge management. The acute need for modern risk/knowledge management arises because global markets do an excellent job of nurturing financial innovations that people want (rather than need); but they are much less useful for planning for when things go wrong, like in this Global (D)Recession.

With regard to my LTS proposal, in the first instance, LTS would appeal strongest to LT residents, diasporas, and other FOLK (Friends of Lithuania of All Kinds); then they would catch up globally rather fast. My LTS proposal is to be developed to a much greater detail and “hands-on” policy relevance.

Valdas Samonis

INET and SEMI Online

Toronto-New York City-Vilnius

For more on V. Samonis publications, please consult:

V. Samonis Author Page on Amazon.com

http://www.amazon.com/Valdas-Samonis/e/B0031SF300/ref=ntt_dp_epwbk_0

and/or search for the name Samonis (Val or Valdas) in Google.com.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (0) Comment

| More about money… | ||

|

Russian Rouble – invented in Lithuania? |

|

|

President Smetona on the 10-litas note |

|

|

1st and 2nd round of Lithuanian litas |

|

|

Vagnorkės – Talonas 20 years anniversary |

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (2) Comment

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (1) Comment

Numismatics in VilNews!

VilNews has a new contributor, Frank Passic from Michigan, USA, who will be sharing with us his vast knowledge about Lithuanian numismatics. The above photo shows Frank’s grandfather who came to USA from the Varniai area in Western Lithuania near Telšiai in 1911. He had just won a fishing contest and was very proud…

Dear readers, we are delighted and honoured that Mr. Frank Passic from Michigan, USA, has graciously offered to share with us his vast knowledge of Lithuanian numismatics. Frank has collected, researched, and written about Lithuanian numismatics for many years. His educational displays of Lithuanian money have won numerous awards at state and national coin shows in the United States. Of Lithuanian heritage, his maternal grandparents emigrated from Lithuania to America just prior to World War I. Frank may be contacted at: albionfp@hotmail.com

He is one of the founders of the Lithuanian Numismatic Association which we operated for 30 years beginning in 1978. Some of his major articles about Lithuanian money are found on the www.albionmich.com website. On the homepage on the right, click on "FRANK PASSIC, Albion Historian." Scroll down to where it says "LITHUANIAN ARTICLES" and click. You'll get a listing. Some articles of interest are: The medals of Petras Rimsa; Displaced Persons Camp Money, Lithuanian Lodge tokens of Chicago," and others.

There is also a book published by the Michigan State University Press in 2009 entitled "Lithuanians in Michigan" by Marius Grazulis which is interesting. It is still in print and available. It has a picture of Frank’s maternal grandfather Nikodemas Kulikauskas (1890-1975). He had come to America from Lithuania in 1911. He was from the greater Varniai area. The above photo of his grandfather is a classic photo of him when he worked at the local factory in Michigan. He had won a company fishing contest and he was so proud!

More articles to follow!

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (1) Comment

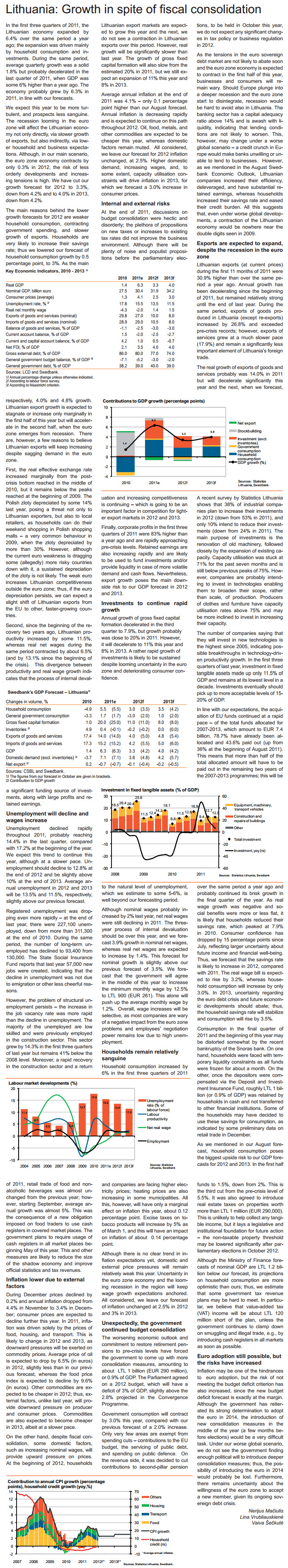

Lithuanian economy in 2012:

From swift recovery

to lower growth

Rokas Bancevičius, Senior analyst, DNB Bank.

This year we celebrate the independence day of Lithuania surrounded by the uncertain economic environment. Lithuania was one of the top growing economies in the EU in 2011 but we are not expecting more of the same in 2012. The key challenges for Lithuania this year will be escalations of debt crisis in the eurozone and the general elections in Lithuania this autumn.

Lithuania’s GDP expanded by an impressive 5.8% last year up from 1.4% in 2010. This result is second best in the EU as Lithuania is surpassed by Estonia only. Lithuanian exports expanded by 16% yoy in real terms in the first nine months of the year. However, the end of 2011 witnessed an economic slowdown as contracting EU economy and uncertainty over sovereign debt crisis started weighting on Lithuanian business. This effect was especially pronounced for exporters.

While 2011 was a successful year for Lithuania, future holds several major challenges. The most prominent is the Europe’s sovereign debt crisis that has already started weighting on the real sectors with EU’s economy contracting in the last quarter of 2011 by 0.3 per cent. This will affect Lithuania’s exports more than half of which goes to EU members. On the positive side, Lithuania mostly exports to countries with relatively good growth prospects - Germany, Poland, Latvia, Estonia and non-EU Russia. According to the survey of Lithuanian Manufacturers, undertaken by Lithuanian Manufacturers Confederation, 53 per cent of industry managers expect stable (neither higher nor lower) amount of export orders in 2012.

Another major concern when looking into 2012 is Lithuania’s refinancing risk. Government has to refinance c. LTL5.7bn (EUR1.65bn) of debt and to borrow additionally c. LTL3bn (EUR0.86bn) to cover budget deficit. Government has already raised c. LTL4bn (EUR1.15bn) by issuing a 10-year USD denominated bond at the yield of 6.75%. This sum is sufficient to meet all obligations in the coming months and to redeem EUR1bn bond maturing this May. Nevertheless, government will still have to tap international markets again later this year. Should market funding become too expensive, government might be forced to turn to IMF for an emergency loan. This could result in additional austerity measures and more output contraction. However, this risk was diminished by recent developments in Greece where politicians passed additional austerity measures.

Lithuania’s internal problems are as prominent as external ones. Labor market remains weak. While number of unemployed people fell by a fifth last year to 222 thsd. level of unemployment remained high at 13.9% at the end of 2011. This weighs on consumer confidence and limits growth of domestic demand. The problem is structural unemployment as companies report the lack of skilled labor force while majority of unemployed are not qualified or have liberal art degrees. This as well as emigration will have severe negative consequences on economic growth and state finances in the long-run. Nevertheless, the short-run economic developments will depend on the solutions of the Eurozone crisis and on the outcome of elections in Lithuania this autumn.

The risk of overspending by politicians in the pre-election cycle did not materialize in Lithuania as Government continued its budget consolidation in 2012. However, the uncertainty of the outcome of the new ruling coalition and the uncertainty whether the new Government continues with the current fiscal conservativism and strategic projects (LNG terminal and Visaginas power plant) makes it very difficult to forecast for 2013.

Overall, 2012 will be the year of slower growth and further stabilization in the economy. We expect Lithuania’s GDP to grow in the region between 2.5 – 3 per cent compared to 5.8 per cent in 2011. If Greece crisis is contained and Europe returns to growth at the second half of 2012 Lithuanian economy will end up growing at the higher rate of this range.

Rokas Bancevičius, Senior analyst

Rokas Bancevičius is an acting head of the DNB Economic Research Unit. He holds MSc in Economic and Social History from Oxford University and BSc in Economics from University of Birmingham.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (0) Comment

Lithuania is now a preferred

gateway to the EU for:

Japan – China – India

Lithuania is "China's important trading partner in the Baltic Sea region," He Guoqiang, member of the Standing Committee of the Political Bureau of the CPC Central Committee and secretary of the CPC's Central Commission for Discipline Inspection, said during this meeting with Lithuanian Prime Minister Andrius Kubilius.

The Lithuanian government has made several wise moves during the past year. One has connected ever-stronger ties to Scandinavia and Finland, another one is that there has been an increasing number of contacts made to Asian countries, especially with regards to China, India and Japan.

The agreements that are negotiated, or are under development, are highly significant and may give Lithuania a key position as a link between Asia and EU.

The agreements represent all win-win situations for bilateral relations between the three countries and Lithuania, since both sides have much to gain from the sort of bilateral cooperation that have been negotiated.

For Lithuania, these agreements are so important, economically, politically and with regard to growth in research, technology and communications, that they are likely to be perceived as a political boost for the incumbent government. The deals are simply so promising that they can get PM Kubilius re-elected in the parliamentary election this fall.

Among the news in the cooperation between the countries are worth mentioning:

- JAPAN: Cooperation for the construction of a new nuclear power plant in Visagino, and related technology transfer.

- CHINA: New rail connection from China to Klaipeda and on to Antwerp in Belgium, plus a brand new IT innovation centre at the University of Vilnius.

- INDIA: Lithuania as India's textile industry's gateway to the EU.

Aage Myhre

aage.myhre@VilNews.com

A handful interesting inks with regards to Lithuanian bilateral cooperation with:

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (0) Comment

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

Numerous warning lights – but who cares?

- Posted by - (1) Comment

We mention below three very distinct warning lights that Lithuanian authorities and control bodies should have reacted to long ago. These three are just the tip of the iceberg. There are many, many more...

WARNING LIGHT 1:

THE BRITISH FINANCIAL SERVICE USED STRONG WORDS ABOUT SNORAS BANK ALREADY 2 YEARS AGO

In 2009 the now nationalised Snoras bank applied to the British Financial Services Authority (FSA) to operate in the UK. The FSA refused permission to conduct business in the UK because the bank repeatedly gave “misleading and incomplete” answers to the regulator. These included failing to mention that it had been refused permission to take retail deposits in Russia and had been fined by the Lithuanian banking regulator. The FSA also attacked the record of Bankas Snoras’ largest shareholder and chairman of its supervisory board, Vladimir Antonov, whom it accused of withholding information. “These failures are not an isolated instance but are examples of an ongoing pattern of behaviour by institutions controlled by Mr Antonov,” the FSA said. These comments must have been known by the Lithuanian Central Bank (Lietuvos bankas) already by then. Why didn’t they react? And why didn’t Ernst & Young, Snoras’ auditor, react? The audit company is now conducting an internal investigation about its previous audits at the bank, but shouldn’t such an important investigation be done by a neutral party? We do, after all, talk about a scandal that will have a very negative impact for the economy of the country and its people…

Read more:

http://bnn-news.com/antonov-jailed-10-years-lithuania-3-years-latvia-41956

http://www.businessweek.com/news/2011-12-02/lithuania-borrowing-costs-to-surge-as-snoras-boosts-debt.html

WARNING LIGHT 2:

The new Lithuanian parliament hall. |

Irena Degutiene |

LITHUANIAN PARLIAMENTARIANS ARE AMONG THE BEST PAID IN THE ENTIRE EUROPEAN UNION!

BALTIC TIMES had an interesting article this week, telling that the Lithuanian parliamentarians’ 2,000 euro salary per month is at the bottom of the list of European legislator pay, but with all parliamentary allowances, benefits and salaries summed up, the entitlements skyrocket, catapulting Lithuanian legislators to a level with an average salary, on par with the very top of the best paid elected officials in the entire European Union, up to 10,000 euro per month!

“To be honest, I have never been aware of such benefits, even when I stayed at the wheel of the parliament. The Labor Party, whose deputy chairman I am now, stands for cutting down the excessive parliamentary benefits. However, I do not think this Seimas will have the guts to cut the fruitful branches it sits on,” Arturas Paulauskas, the former chairman of Naujoji Sajunga (New Union) and deputy chairman of the Labor Party presently, said to The Baltic Times.

The mid-November parliamentary deliberations over the draft on Parliamentarians’ Activity Guarantees have shown that Lithuanian legislators are far from considering any constraints on their lavish parliamentary incentives – the draft has been rejected and sent for improvements.

“I am really surprised by the legislators’ decision. Frankly, I thought the bill, upon introduction, with certain amendments and improvements would be passed. To reject it the way the parliamentarians did, walking out before the crucial vote or abstaining during the vote, means withdrawal from solving the problem. I do not know whether the politicians who voted against the bill, or simply walked out before the vote, will seek a new Seimas tenure next year. If yes, it means they are willing to further traipse in the mud we have all been stomping in so long and tediously,” Irena Degutiene, chairwoman of the Lithuanian Parliament, said with unusually strong words to express her angst.

Degutiene, nevertheless, is hopeful in bringing the revised and supplemented bill for the MPs in spring 2012. “I hope that common sense will prevail and we pass the law,” she said.

Unlike in Lithuania, in the other two Baltic countries MP salaries are recalculated every year, and politicians receive parliamentary activity compensation for transport, office, representation and professional training. In that regard, Estonia has set it such that this kind of compensation cannot exceed 30 percent of the parliamentary salary, which is 3,353 euros.

Read more:

http://www.baltictimes.com/news/articles/30094/

WARNING LIGHT 3:

|

|

LITHUANIA HAS NOW EU’S WIDEST WEALTH GAP AND HIGHEST POVERTY RISK

Lithuania’s austerity measures, which are similar in size to those facing Greece, boosted income inequality to the widest in the European Union.

The CHART OF THE DAY in a BLOOMBERG article this week shows how the proportion of people at risk of poverty in Lithuania surged to the highest level among the bloc’s 27 members after state spending was cut. The lower panel shows the gap between the nation’s highest and lowest earners is the EU’s widest after budget savings hurt the poor.

Lithuania implemented austerity measures equal to 12 percent of gross domestic product in 2009-2010. Pension cuts may be reversed after the economy grew 6.7 percent in the third quarter, the second-fastest pace in the EU. Greece, where GDP contracted 5.2 percent in the same period, is in the midst of budget cuts worth 16 percent of economic output, data from the International Monetary Fund show.

“The blow was very painful to the poor,” said Vilija Tauraite, an economist for SEB Bank in the capital, Vilnius. “Lithuania’s fiscal discipline has been extremely severe in the past three years and it’s now crucial to ease the burden because these people are hanging on the precipice of poverty. Their quality of life is far worse than the situation of pensioners in southern Europe.”

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (1) Comment

The Global, Economic, Financial Crisis:

We need something new. A paradigm shift in our thinking

Dr. Ichak Adizes

A blog by Dr. Ichak Adizes

I am in Moscow. Watching the BBC. There is a live round table discussion with very prominent economists as to what to do about the global, financial, economic crisis, in the USA and in Europe. Their concerns: unemployment, declining economic growth, recession, potential for country defaults etc.

Around the table are the managing director of the IMF, the CEO of Pimco, a distinguished professor of economics from Chicago and another person with a heavy Italian accent whose name I failed to record.

To summarize what they are saying: there is a crisis of unemployment, the financial markets are sick and there is declining economic growth. Result: a serious crisis of a potential for a double dip recession and potential for a default by some countries.

They recommend different solutions how to solve the financial crisis, how to improve the rate of employment etc.

The common denominator to their solutions is that they are trying to get back to what we HAD before, which is full employment, healthy financial markets and economic growth.

It will not work.

If we succeed to go BACK, it will be only a temporary solution and the crisis will come back as a tsunami, much bigger, later on.

Why?

Let us analyze the problem.

Economic growth, unemployment, financial crisis, double dip recession, dangers of default…are not of equal nature.

My analysis is that the driving force is economic growth which provides for full employment and for which healthy financial markets are necessary. That means that economic growth is the goal and full employment and healthy financial markets are the means.

Double dip recession and dangers of default are manifestations of lack of economic growth.

The problem is with the goal. And from there stem the problems with the means.

What is the problem with the goal of economic growth? (My focus here is exclusively on developed nations. What to do with emerging, developing nations, will be addressed at the end of this insight.)

In order to have economic growth, we need to have growing markets.

How do you have growing markets?

One way is to have a growing population. That apparently is not enough. Businesses create markets by creating needs, needs markets did not know they had. Look at the choices offered to consumers on any product in a supermarket. Or a department store. Furthermore, to create markets, to create demand, products are produced with planned obsolescence in mind.

But what is the result of having continuously growing markets as a goal?

It is not sustainable.

If we paraphrase Malthus and instead of population growth say “ economic growth,” and instead of food production say “ natural resources”, we can see that linear progression of economic growth MUST eventually bring us to a point where there are limits to growth: We ARE destroying the planet.

So the solution to the financial, economic, unemployment crisis is not more of what used to be, more economic growth. We need something new. A paradigm shift in our thinking.

Economic growth should not be our deterministic goal, a goal where more is better, a goal we are determined to maximize. Economic growth should now become a constraint goal: no less than x%, when the “ x” is determined by population growth and real needs, not by artificial needs generation.

What should be the deterministic goal than, if it is not economic growth?

Quality of life rather than the standard of living.

Who says we should have full employment? Why not have very early retirement? Why not have only three working days in a week? Earn enough to satisfy your basic needs. Not more and more and more. Just enough.

But a decimated demand and planned unemployment will dry the need for credit and for business growth and put the financial institutions in trouble.

I sure hope so.

The solution to our present problems is not going back to our past but creating a new future.

Now, what about developing, emerging, nations?

For emerging ones and especially those unfortunate to suffer from malnutrition, from lack of health treatment facilities etc there the need for economic growth is REAL.

There, the goal SHOULD BE economic growth but please notice: it is not going back for them. It is going forward. They need economic growth. They never had it.

Here the business community of the developed world should do its best to develop the market, satisfy the needs of the population.

“But there is no market there.” “No buying power will be the excuse.” Right. That is the true challenge to the business community. The true challenge. Not the artificial self created challenge of how to provide more of something people have too much of it already.

Sincerely,

Dr. Ichak Kalderon Adizes

Ref: http://www.adizes.com/blog/?p=990

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

World economy collapse explained in 3 minutes

- Posted by - (0) Comment

"If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered...

I believe that banking institutions are more dangerous to our liberties than standing armies... The issuing power should be taken from the banks and restored to the people, to whom it properly belongs."

- Thomas Jefferson (1743-1826).

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

How human psychology drives the economy

- Posted by - (1) Comment

A Review of: George A. Akerlof and Robert J. Shiller, Animal Spirits: How Human Psychology Drives the Economy and Why It Matters for Global Capitalism. Princeton: Princeton University Press, 2009. xiv+230 pages.

By Val Samonis

In over 30 years of my research, advising, and teaching globally, I have read and reviewed many very interesting and paradigm-changing books in economics and management. However, this book is one of a kind!

The book is nothing short of a revolution in how we think about economics and the real (global) economy in general. While the standard economic theory, rooted in the Adam Smith classical work, sprung up mainly from two abstract, simplified, and rather static ideas of Rational Expectations (RE) and Efficient Market Hypothesis (EMH), the powerful source of the Akerlof & Shiller story is the living and changing organism of the increasingly global economy; the Authors concentrate on the macroeconomic aspects, especially as they apply to the Great Recession started in 2008.

Critical to the analysis is the observation that RE and EMH approaches utterly fail to explain the great majority of the economic phenomena, incl. the current Great Recession in the US and globally; this sweeping assertion is not even controversial in early 2011. The reason it is so is that these standard economic theory approaches completely fail to account for the operation of “animal spirits”, a term dating back to John M. Keynes. Animal spirits are our interpretations of economics and the economy, our mental/psychological forces and constructs, spiritus animalis from the original Latin. They include: (non)confidence (with its Keynesian style multipliers), the issue of fairness in wage determination and other areas, corruption and bad faith phenomena in the society, money illusion that people usually operate under, and stories that are our practical and simplified ways of thinking about the economy and economics.

The answers to the eight basic questions in economics crucially depend on the animal spirits: Why do depressions occur? Why do central banks have real powers? Why do we have involuntary unemployment? Why is there a long-run tradeoff between inflation and unemployment? Why is saving so variable? Why do stock markets fluctuate so wildly? Why are the cycles in the housing market so large? And why is there continued minority poverty?

Very importantly, the book highlights frames of modern government roles in strategic management of the animal spirits for the benefit of our knowledge and our economy.

Even if (as some would claim) animal spirits cannot be modeled yet to produce empirically relevant outcomes (qualitative, quantitative, combined, etc) on the individual level or the aggregate level, it is probably only a question of a relatively short time before we can do so using new frontier research like neuronomics, business ethics, knowledge management, etc, to extend our knowledge.

The book is a great and compelling proposal for a new economic thinking, and a very practical one at that. Two years ago I adopted Akerlof & Shiller as the textbook for my MBA and Executive MBA teachings, incl. online teachings. My students (mostly adult professionals) provided lots of un-trivial opinions on how I was able to enthusiastically teach this new economic thinking and practically frame the animal spirits analysis for actionable understanding of the 21st century global economy.

The Akerlof & Shiller book is best used as the text for economic principles and/or related graduate level courses. I look forward to the second edition of this book; and an online teaching companion would be very useful for students and teachers alike.

Very powerful story, one of a kind indeed!

Val Samonis

Institute for New Economic Thinking, New York City

and SEMI Online, Toronto

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (4) Comment

First and second round

of Lithuanian Litas

Front and back of 1922, 50 Centai banknote.

Front and back of 1929, 5 Litai banknote.

Front and back of 1922, 100 Litai banknote.

Photos courtesy of Colnect.

AUKSINAS to RUSSIAN RUBLE to OSTMARK and OSTRUBLE to LITAS to SOVIET RUBLE to LITAS – THE FIRST and SECOND INTRODUCTION of the LITHUANIAN LITAS

The official currency of the Republic of Lithuania is the Litas. Twice it has been the official currency. The first period was during the inter-war years when Lithuania regained its independence from Imperial Russia and the second period began in 1993, after Lithuania regained its independence from Soviet Russia, and is still the official currency. We would like to share with you some interesting information about what was involved in the creation of the Litas and its reintroduction.

FIRST LITAS, 1922-1941

HISTORY

The first litas was introduced on 2 October 1922 to replace the German Ostmark and Ostruble, both of which had been issued by the occupying German forces during World War I. Interestingly the ostmark was known as the auksinas in Lithuania as the auksinas was the currency of Lithuania in the 17th century. Before the German Ostmark and Ostruble the currency used in Lithuania was the Russian Ruble as it was occupied by Imperial Russia.

Auksinas coin Russian ruble

Ostmark was the name given to a currency denominated in Mark which was issued by Germany in 1918 for use in a part of the eastern areas under German control at that time known as the Ober Ost area. This area included Lithuania, Latvia, Estonia, Belarus, parts of Poland and Courland, which were former territories of the Russian Empire.

The currency consisted of paper money issued on 4 April 1918 by the ‘Darlehnskasse’ in Kaunas and was equal to the German Papiermark. The Ostmark circulated alongside the Russian ruble and the Ostruble, with two Ostmarks equal to one Ostruble.

Ostruble was the name given to a currency denominated in kopeck and ruble, which was issued by Germany in 1916 for use in the Ober Ost area under German occupation and the Government General of Warsaw). It was initially equal to the Russian ruble. The reason for the issue was a shortage of rubles. The banknotes were produced by the "Darlehnskasse" in Posen (now Poznan) on 17 April 1916. From 4 April 1918, the Ostruble circulated alongside the Ostmark in the Ober Ost area. It was valued at 2 Ostmarks = 1 Ostruble. In the Government General of Warsaw the Ostruble was replaced by the Polish marka on 14 April 1917.

The intitial vale of the Litas was established at a value of 10 litas = 1 US dollar and was subdivided into 100 centai. Even with the world wide economic depression, the litas was quite a strong and stable currency, reflecting the negligible influence of the depression on the Lithuanian economy. One litas was covered by 0.150462 grams of gold stored by the Bank of Lithuania in foreign countries. In March 1923, the circulation amounted to 39,412,984 litai, backed by 15,738,964 in actual gold and by 24,000,000 in high exchange securities. It was required that at least one third of the total circulation would be covered by gold and the rest by other assets. By 1938, 1 U.S. dollar was worth about 5.9 litai, falling to about 20 U.S. cents just before its disappearance in 1941 following Soviet Russia’s invasion and occupation of Lithuania.

After Lithuania was annexed by the Soviet Union the litas was replaced by the Soviet ruble with 1 litas equal to 0.9 ruble. The actual “street value” though of the litas was about 3-5 rubles. Such an exchange rate provided great profits for the military and party officials. Trying to protect the value of the currency, people started to massively buy. This combined with a downfall in production caused by Moscow’s nationalization of all private businesses and industry resulted in severe shortages of many items. Withdrawals were then limited to 250 litai before the litas was completely abolished.

COINS

Coins were introduced in 1925 in denominations of 1, 2, 5, 10, 20 and 50 centai and 1, 2 and 5 litai, with the litas coins of silver. These coins replaced the banknotes of corresponding value. 10 litų coins were introduced in 1936. All these coins were designed by the famous sculptor Juozas Zikaras (1881-1944). The litas coins displayed Jonas Basanavičius and Vytautas the Great, which was replaced by a portrait of President Antanas Smetona.

Interwar 10 litas coin, depicting Vytautas the Great Interwar 10 litas coin, depicting Antanas Smetona

BANKNOTES

In 1922, the Bank of Lithuania issued notes in denominations of 1, 2, 5, 10, 20 and 50 centai, 1, 2, 5, 10, 50 and 100 litų. In 1924, 500 and 1000 litai notes were added. Banknotes below 5 litai were replaced by coins in 1925.

Front and back of 1922, 50 Centai banknote – Photos courtesy of Colnect

Front and back of 1929, 5 Litai banknote – Photos courtesy of Colnect

Front and back of 1922, 100 Litai banknote – Photos courtesy of Colnect

1993 - THE SECOND LITAS

In the previous article, we talked about Lithuania’s transition from the Soviet Ruble to the Talonas after independence was regained in 1990. The litas once again became Lithuania's currency on June 25, 1993, when it replaced the temporary Talonas currency at a rate of 1 litas to 100 talonas. You may find it interesting that officials had started to prepare for the introduction of the litas even before independence was declared. What is even more interesting is that it was even considered to introduce the litas alongside the ruble even if Lithuania remained a part of the Soviet Union. In December 1989, artists were asked to submit sketches of possible coin and banknote designs. Also, a list of famous people was compiled in order to determine who should be featured.

The Bank of Lithuania was established on March 1, 1990. Ten days later Lithuania declared independence. At first the Lithuanian government negotiated in vain with the famous French printing house Imprimerie Oberthür to print the banknotes. In November 1990 The Bank of Lithuania decided to work with the United States Banknote Corporation (now American Banknote Corporation). In late fall of 1991 the first shipments of litas banknotes and coins arrived in Lithuania.

In November 1991, the Currency Issue Law was passed and the Litas Committee was created. It had the power to fix the date for the litas to come into circulation, the terms for the withdrawal from circulation of the ruble, the exchange rate of the litas and other conditions. Officials waited for a while for the economy to stabilize to not to expose the young litas to inflation. About 80% of Lithuania's trade was with Russia and the government needed to find a way to smooth the transition from the ruble zone. Also, Lithuania needed to gather funds to form a stabilization fund.

GATHERING FUNDS

At first, Lithuania did not have gold or any other securities to back up the litas. Lithuania needed to find about 200 million U.S. dollars to form the stabilization fund. First, it sought to recover its pre-war gold reserves (about 10 tons) from France, United Kingdom, Switzerland, etc. In the interwar period Lithuania stored its gold reserve in foreign banks. After the occupation in 1940 those reserves were “nobody’s”, there was no Lithuania and most western countries condemned the occupation as illegal and did not recognize the Soviet Union as a successor. The Bank of England, for example, sold the reserves to the Soviets in 1967. However, in January 1992 it announced that this action was a “betrayal of the people of the Baltic states” and that it would return the originally deposited amount of gold, now worth about 90 million pound sterling, to the three Baltic states. Lithuania received 18.5 million pounds or 95,000 ounces of gold and remained a customer of the bank. Similarly, in March 1992 Lithuania reclaimed gold from the Bank of France and later from the Bank of Sweden.

April 29, 1992 Lithuania joined the International Monetary Fund. In October 1992, the IMF granted the first loan of 23.05 million U.S. dollars to create the stabilization fund. However, it is estimated that at the time of the introduction of the new currency, Lithuania managed to gather only $120 million for the stabilization fund. For a brief while it was kept a secret so as not to further damage the reputation of and trust in the litas.

DELAYS INTRODUCING THE LITAS

Journalists investigating the production of the litas found that for a while it was purposely held back. For example, 6 million litas designated to pay for printing the banknotes stayed in a zero interest bearing account for a year in a bank in Sweden. By 1992, the litas was ready for introduction, but the banknotes were of extremely low quality. It was felt that one could easily counterfeit them with a simple color printer, especially the 10, 20, and 50 litai banknotes.

Early litas lacked necessary security protection

Newly elected President Algirdas Brazauskas dismissed the Chair of the Bank of Lithuania, Vilius Baldišis, for incompetence just two months before the introduction of the litas. Baldišis was later charged for negligence that cost Lithuania $3,000,000. Some even claimed that the Russian secret services were behind the affair. Baldišis’ explanation was that he was trying to cut the costs of printing the banknotes and thus did not order better security features. The “U.S. Banknote Corporation” was also accused of violation of the contract terms.

Considering all the past problems with the quality of the banknotes, you would think that with the next issue all the quality concerns would have been resolved but when the new issue of litas banknotes was redesigned, reprinted, and introduced in June 1993, it was found that the quality of the money was still too low and the banknotes would have to be redesigned further in the future. All these scandals and the small backup of gold reserve (about $120 million instead of $200 million) damaged the reputation of the litas. Thankfully, the newly appointed chair, Romualdas Visokavičius, moved things quickly and managed to win the trust of the public. Unfortunately, in October he was asked to resign mostly because of his involvement with a private bank "Litimpex."

INTRODUCTION OF THE SECOND LITAS

The 1, 2 and 5 Litai banknotes were replaced in 1998 by coins

On June 25, 1993, the litas was finally introduced at the rate of 1 litas to 100 talonas. 1 U.S. dollar was worth 4.5 litai and decreased to about 4.2 a couple of weeks later. From April 1, 1994 to February 1, 2002, the litas was officially pegged to the U.S. dollar at the rate of 4 to 1 (the litas was stable around 3.9 for half a year before the pegging). The main reasons for this fixation was little trust in the emerging monetary system, fear of high fluctuations in currency exchange rates, desire to attract foreign investors, and International Monetary Fund recommendations. The peg was renewable every year. For a while a peg was considered to a basket of currencies: the European Currency Unit. At around this time Lithuania also established a currency board.

This 4 to 1 rate remained until Lithuania became a member of the EU and then the litas was the pegged to the Euro with the official Bank of Lithuania exchange rate of 1 Euro to 3,4528 litas. Even the introduction of the litas was followed by a scandal. The government allowed the changing of unlimited amounts of talonas to the litas without having to show the source of the talonas. This allowed criminal groups to legalize their funds. Also, due to poor banknote quality (both talonas and early litas) it was easy to counterfeit them. Most shops were forced to acquire ultra violet lamps to check for forgeries. For example, it is reported that one enterprising group of counterfeiters printed 500 talonas banknotes in Turkey. It was estimated that their notes totaled 140,000 litas.

In July, circulation of the talonas was stopped and on August 1, 1993, the litas became the only legal tender. Following the reintroduction of the litas, there was an effort to weed out U.S. dollars from the market. The talonas was never really trusted by the people and the ruble was very unstable. Thus, people started using U.S. dollars as a stable currency. Another alternative was the German mark, but it was not available in larger quantities. A lot of shops printed prices in several different currencies, including dollars, and the economy was very "dollarised" as it was legal to make trades in foreign currencies.

As one final measure, from April 1, 1994, the litas was fully backed by gold and other stable securities.

THE LITAS AND THE EURO

On 2 February 2002 the litas was pegged to the euro at a rate of 3.4528 to 1. This rate is not expected to change until the litas is completely replaced by the euro. After the peg, Lithuania became a member of the Eurozone de facto. Since 28 June 2004, the litas has been part of the ERM II which is the EU's Exchange Rate Mechanism. The design of Lithuanian euro coins is already prepared.

Lithuania has postponed its euro day several times, since the country does not meet the convergence criteria. A recent analysis of SEB bankas in Lithuania says that Lithuania could not adopt the euro before 2013 due to the high rate of inflation — which reached 11% in October 2008 — well above the Maastricht criterion of 4.2%.

COINS

In 1993, coins were introduced (dated 1991) in denominations of 1, 2, 5, 10, 20 and 50 centų, 1, 2 and 5 litai. The 1, 2 and 5 centai pieces were minted in aluminium, the 10, 20 and 50 centų in bronze and the litas coins were of cupro-nickel. In 1997, nickel-brass 10, 20 and 50 centų coins were introduced, followed by cupro-nickel 1 litas and bimetallic 2 and 5 litai in 1998. All have the obverse designs showing the Coat of Arms in the center and the name of the state "Lietuva" in capital letters.

Photo courtesy of BalticValue.com

The first coins were minted in the United Kingdom. Currently, all coins are minted in the state-owned enterprise "Lithuanian Mint", which started its operations in September 1992 and helped to cut the costs of introducing the litas.

FROM LITAS TO EURO

Lithuania still waits to join the Euro Zone. While many government and business leaders are still diligently working to achieve this goal many, perhaps even the majority, of the general public is of the mind – Who needs it. While our good friends in Estonia entered the Euro Zone 1 January 2011 and everything seems to be going well for them, many in Lithuania fear that entering the Euro Zone will escalate inflation and drive prices higher. This is of great concern for the people of Lithuania given that in the past few years the prices of everything have escalated out of control with out any one in control seemingly doing anything to try to control it.

PROTECTING THE VALUE OF THE LITAS

Another concern of the Lithuanian people is how the litas would be exchanged for the Euro. I will use the exchange rates of the largest bank in Lithuania to explain this concern.

Currently if you had an account with SEB Bankas in Lithuania you could walk into one of their banking centers or log into your account via the internet and exchange litas for Euros. If the exchange is done with banknotes the buy rate would be 3.442 Litas for 1 Euro. If the exchange is done via transfer of funds from your account the buy rate would be 3.4442 Litas for 1 Euro. Given that the official Bank of Lithuania currency rate is 3.4528 Litas for 1 Euro, the difference from the buy rate to the official rate is only .0108 and .0086 centai respectfully. This difference is absolutely miniscule and nobody would complain if when the time comes that Lithuania switches to the Euro that these would be the rates of exchange. The concern many people have is that when the time comes for the exchange, since it will now be “official” that the difference between the buy rate and official rate will be increased resulting in excessive loss of value in their Litas.

So now Lithuanians wait to see if the Litas will stay in place, will the Euro take its place and if the Euro does come will the government protect their life savings by keeping the exchange rate at a very expectable level as it is now.

Su pagarbe – Vincas karnila

Associate editor

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

VilNews e-magazine is published in Vilnius, Lithuania. Editor-in-Chief: Mr. Aage Myhre. Inquires to the editors: editor@VilNews.com.

Code of Ethics: See Section 2 – about VilNews. VilNews is not responsible for content on external links/web pages.

HOW TO ADVERTISE IN VILNEWS.

All content is copyrighted © 2011. UAB ‘VilNews’.

Click on the buttons to open and read each of VilNews' 18 sub-sections

Click on the buttons to open and read each of VilNews' 18 sub-sections

.jpg)