THE VOICE OF INTERNATIONAL LITHUANIA

|

VilNews has its own Google archive! Type a word in the above search box to find any article.

You can also follow us on Facebook. We have two different pages. Click to open and join.

|

Author Archive

- Posted by - (0) Comment

“Our ancestors always whisper in our ears, they beg to be understood”

|

Last week we brought an article with the latest statistics from the World Health Organization, showing that Lithuania again is on top when it comes to suicides – with 61,3 men and 10,4 women per 100,000 inhabitants deciding to end their lives this sad way – annually.

Dainius Puras, a Lithuanian psychiatrist, explains how it is the uncertainty and unpredictability of the economic situation that have such a detrimental effect: "People don't like change,” he says, referring to Lithuania’s 20-year period of dramatic social and economic change since the fall of the Soviet Union in 1991”. |

Response from Vijole Arbas in Kaunas:

This cannot be the only explanation -- we are plagued by bad spirits of our past, we can't seem to "clean up", to make amends.

Jūratė Sučylaitė wrote a novel (can't recall the exact title Pokalbis su Ragana, somthing like that). Her thesis (if I may call it that) is that our ancestors always whisper in our ears. They beg to be understood. That does not mean to glorify but understand, realize why, forgive, make amends. People want to drown out those voices of the dead by alcoholism, suicide. It is a haunting story that rings very true to me.

On the other hand, the ancestors of American Lithuanians also whisper, also had the sins of betrayal against one's fellow man as well as of victimization. Why don't they hear those ghosts?

A film by V. Landsbergis Jr., When I Was a Partisan, also deals with this sort of concept.

|

Irene Simanavicius: There is so much more to this...so much more. Those of us that grew up in North America and have visited Lithuania got to know and love people we have met during our visits. People young and old shared some of the stories that were heart wrenching. I agree with Vijole Arbas 100 %. |

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (2) Comment

“Our ancestors always whisper in our ears, they beg to be understood”

|

Last week we brought an article with the latest statistics from the World Health Organization, showing that Lithuania again is on top when it comes to suicides – with 61,3 men and 10,4 women per 100,000 inhabitants deciding to end their lives this sad way – annually.

Dainius Puras, a Lithuanian psychiatrist, explains how it is the uncertainty and unpredictability of the economic situation that have such a detrimental effect: "People don't like change,” he says, referring to Lithuania’s 20-year period of dramatic social and economic change since the fall of the Soviet Union in 1991”. |

Response from Vijole Arbas in Kaunas:

This cannot be the only explanation -- we are plagued by bad spirits of our past, we can't seem to "clean up", to make amends.

Jūratė Sučylaitė wrote a novel (can't recall the exact title Pokalbis su Ragana, somthing like that). Her thesis (if I may call it that) is that our ancestors always whisper in our ears. They beg to be understood. That does not mean to glorify but understand, realize why, forgive, make amends. People want to drown out those voices of the dead by alcoholism, suicide. It is a haunting story that rings very true to me.

On the other hand, the ancestors of American Lithuanians also whisper, also had the sins of betrayal against one's fellow man as well as of victimization. Why don't they hear those ghosts?

A film by V. Landsbergis Jr., When I Was a Partisan, also deals with this sort of concept.

|

Irene Simanavicius: There is so much more to this...so much more. Those of us that grew up in North America and have visited Lithuania got to know and love people we have met during our visits. People young and old shared some of the stories that were heart wrenching. I agree with Vijole Arbas 100 %. |

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

Eurozone problems do not leave anybody cold

- Posted by - (0) Comment

![]()

Rūta Vainienė

A survey of the Lithuanian economy conducted by the Lithuanian Free Market Institute (LFMI) shows that eurozone problems do not leave anybody cold. Lithuania failed to join the eurozone in 2007 because it missed the inflation criteria by only 0.06 per cent. At the time, it was considered a big political failure. However, given the present vulnerability of the eurozone, it may look like a windfall success. The national currency, the litas, is pegged to the euro under currency board arrangement, so the litas remains very closely linked to the euro.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

New campus initiative – LCC International University in Klaipeda opens an Institute for Innovation Design.

- Posted by - (0) Comment

![]()

Eglė Songailienė and Vaidas Levickis, members of the Business Administration Faculty at LCC in Klaipeda.

LCC International University in Klaipeda has welcomed a new initiative on campus - the Institute for Innovation Design. The idea to launch this new project, which will contribute in transforming challenges into opportunities, was developed by Eglė Songailienė and Vaidas Levickis, members of Business Administration faculty.

The Institute will have a group of professional qualitative researchers, who will bring unique skills and competences to the project. Key activities of the Institute will include various researches and projects. The Institute will work with various organizations to help them better understand the needs and experiences of the people they serve and create innovative solutions.

The Institute will host 12 monthly sessions for leaders about the best innovation practices, the latest breakthrough ideas and transformative intellectual conversations in literature. It will also offer a summer internship program, which will provide students with unique hands-on work experience, in collaboration with faculty members.

The Institute for Innovation Design will not only work to help organizations better connect with the people they serve and design customer experiences with great value to business, but also offer new, creative initiatives for LCC students.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

Happy Stork Day!!

- Posted by - (1) Comment

|

The white stork (gandras) is usually felt to be the national bird of Lithuania. Lithuanians believe that storks bring harmony to the families on whose property they nest; they have also kept up the tradition of telling their children that storks bring babies. Stork Day is celebrated on 25 March with various archaic rituals: gifts for children, attributed to the storks, such as fruits, chocolates, pencils, and dyed eggs, which are hung on tree branches and fences; snakes are caught, killed and buried under the doorstep; straw fires are lit. Notably, Lithuania is a beneficial and important habitat for these birds: it has the highest known nesting density in the world! |

|

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

Lithuania has the world’s highest suicide rate

- Posted by - (0) Comment

Latest statistics from the World Health Organization show that Lithuania again is on top when it comes to suicides – with 61,3 men 10,4 women per 100,000 inhabitants deciding to end their lives this sad way – annually.

Dainius Puras, a Lithuanian psychiatrist, explains how it is the uncertainty and unpredictability of the economic situation that have such a detrimental effect: "People don't like change,” he says, referring to Lithuania’s 20-year period of dramatic social and economic change since the fall of the Soviet Union in 1991”.

He describes the reaction to freedom in 1989: "Many people could not manage to cope with this change, with this huge societal stress . . . [they] regressed to destructive or self-destructive behaviour." The stress, he says, prompted an unprecedented crisis of mortality, one that still exists. In Lithuania, with a population of just three million, 5,000 people die every year because of "external causes" - suicide, homicide, violence. He describes it as an epidemic.

Lithuania - a prophetic microcosm of the global crisis?

Puras sees Lithuania's experience as a prophetic microcosm of the global crisis: a society undergoing enormous stress because of the effects of a toxic system, culminating in an “explosion" in the form of a financial crisis. He also points out a strange trend: the more severe the threat to human life, the better societies and individuals seem to fare in their mental health. "History shows that when it is a real crisis like war, or when people are starving, there is a huge decrease in mental health problems, including suicide. During the war you have to survive physically; existential problems are not so important. Suicide is mainly the price we pay for civilisation."

Figures for the UK support his theory - during the First World War, the suicide rate dropped to 8.5 per 100,000. It then leapt to 13.5 in the interwar years, and fell again during the Second World War to 9.2. Immediate, life-threatening crisis, Puras says, creates a sense of purpose: there's not as much time to worry about yourself.

( From an article in “New Statesman”, by Sophie Elmhirst)

Lithuanian Suicide Hotline

Youth Psychological Aid Centre -Vilnius Youth Line

Jaunimo psichologinés paramos centras

Rasu g.20, LT-11351 VILNIUS

Hotline: 8-800 2 8888

Website: jppc.lt

Hours: Mon, Tues, Wed, Thurs, Fri, Sat, Sun: 16:00 - 07:00

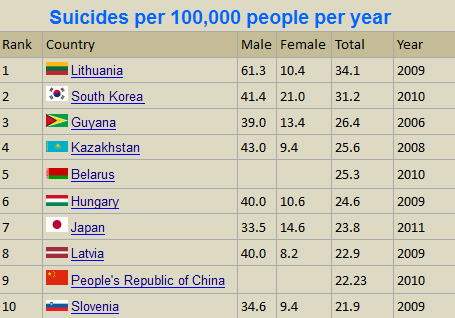

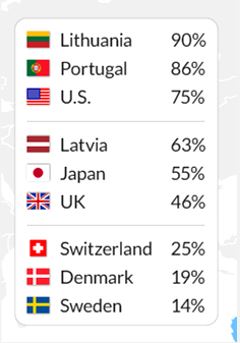

Suicides per 100,000 people per year

The following is a list of suicide rates by country according to data from the World Health Organization, in which a country's rank is determined by its total rate deaths officially recorded as suicides in the most recent available year, last updated in 2011.

Male and female suicide rates are out of total male population and total female population, respectively (i.e. total number of male suicides divided by total male population). The total rate of suicides is based on the total number of suicides divided by the total population rather than merely the average of the male and female suicide rates, because the gender ratio in most countries is not 1:1. Year refers to the most recent year that data was available for a particular country.

Other articles:

http://www.elnet.lt/psychoanalysis/psychoanalysis/Vilmos2.htm

http://eurpub.oxfordjournals.org/content/10/2/101.full.pdf

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

- Posted by - (3) Comment

Lithuania has the world’s

highest suicide rate

Latest statistics from the World Health Organization show that Lithuania again is on top when it comes to suicides – with 61,3 men 10,4 women per 100,000 inhabitants deciding to end their lives this sad way – annually.

Dainius Puras, a Lithuanian psychiatrist, explains how it is the uncertainty and unpredictability of the economic situation that have such a detrimental effect: "People don't like change,” he says, referring to Lithuania’s 20-year period of dramatic social and economic change since the fall of the Soviet Union in 1991”.

He describes the reaction to freedom in 1989: "Many people could not manage to cope with this change, with this huge societal stress . . . [they] regressed to destructive or self-destructive behaviour." The stress, he says, prompted an unprecedented crisis of mortality, one that still exists. In Lithuania, with a population of just three million, 5,000 people die every year because of "external causes" - suicide, homicide, violence. He describes it as an epidemic.

Lithuania - a prophetic microcosm of the global crisis?

Puras sees Lithuania's experience as a prophetic microcosm of the global crisis: a society undergoing enormous stress because of the effects of a toxic system, culminating in an “explosion" in the form of a financial crisis. He also points out a strange trend: the more severe the threat to human life, the better societies and individuals seem to fare in their mental health. "History shows that when it is a real crisis like war, or when people are starving, there is a huge decrease in mental health problems, including suicide. During the war you have to survive physically; existential problems are not so important. Suicide is mainly the price we pay for civilisation."

Figures for the UK support his theory - during the First World War, the suicide rate dropped to 8.5 per 100,000. It then leapt to 13.5 in the interwar years, and fell again during the Second World War to 9.2. Immediate, life-threatening crisis, Puras says, creates a sense of purpose: there's not as much time to worry about yourself.

( From an article in “New Statesman”, by Sophie Elmhirst)

Lithuanian Suicide Hotline

Youth Psychological Aid Centre -Vilnius Youth Line

Jaunimo psichologinés paramos centras

Rasu g.20, LT-11351 VILNIUS

Hotline: 8-800 2 8888

Website: jppc.lt

Hours: Mon, Tues, Wed, Thurs, Fri, Sat, Sun: 16:00 - 07:00

SUICIDE IN LITHUANIA

Lithuania Takes the Dubious Honor of Having Highest Suicide Rate in World

An article from year 2000, by LEYLA ALYANAK © Earth Times News Service, VILNIUS, Lithuania

This tiny former Soviet republic on the shores of the Baltic Sea has acquired a dubious distinction: It has the highest suicide rate in the world. Suicides have increased steadily since independence in 1990, especially among young men (up 195 percent) and women aged 50 to 59 (up 106 percent). In 1996 the suicide rate hit an all-time high of 46.4 per 100,000 people before settling at 44 in 1997. These figures compare with 38 per 100,000 in Russia, 34 in Estonia, 33 in Hungary, 20 in Switzerland, seven in Spain, and three in Greece.

According to one specialized report on suicide, more people kill themselves in Lithuania each day (four to five) than die in traffic accidents. But these figures are relatively new and suicide has never been a traditional characteristic here. Before World War II, suicide rates in Lithuania were far below those of many other Eastern European countries. Now, the Baltic States, with Lithuania up front, are leading the pack. "Suicide cannot be explained using only individual reasons," said Dr. Danute Gailiene, a psychologist and specialist in social issues. "It is the consequence of a complex process." That process includes decades of Soviet domination, a dramatic transition period, the amount of media coverage given to suicides, and a certain perceived helplessness toward all of the above. These factors are intensified by the absence of a national suicide prevention strategy and a lack of in-depth research into the problem of suicide. Experts say radical reforms in Lithuanian society have brought about a crisis in values, while growing economic unease has combined with increasing psychological and social insecurity and feelings of helplessness. Still, they cannot pinpoint specific causes. Dr. Gailiene, writing in Lithuania's 1999 Human Development Report, places part of the blame on the mass media.

Between 1991-1994, she said, media coverage of suicides increased 20-fold. Few facts were spared from articles in the newly unmuzzled press, which described successful suicides in searing detail. Conversely, few column inches were devoted to suicide prevention. Little was known about "danger signals" and how to respond to them. In reaction to the brazen media coverage of the early post-independence years, Lithuania has elaborated new guidelines for reporting suicides. This, government officials hope, will help cut back on the copycat effect. The editorial guidelines try to demystify suicide, steering clear of sensationalism and treating the issue like any other news item. Rather than gory details, the government suggests covering the psychological motives behind the act. It also encourages the dissemination of helpful information such as alternatives to suicide and how to seek help.

While there are no reliable figures on the impact of these guidelines, this "ultimate solution" is clearly a reflection of the wider ills Lithuanians face in their transition from Communism. Their lives have been turned upside down yet psychological support is virtually nonexistent, especially in rural areas, where the rate is highest. People with problems are left to fend for themselves. "On the one hand there is a lack of resources, which does not allow for the rapid establishment, development and maintenance of an effective system of psychosocial support. On the other is the inadequate understanding of the importance of the psychological health of the population by politicians," Dr. Gailiene said. Experts say that more information is needed about prevention strategies, with greater emphasis placed on crisis management and rehabilitation.

According to a study on suicides by the Estonian-Swedish Suicidology Institute, socioeconomic disruptions in nearby Estonia are key factors affecting suicides and also cause depression and anxiety. In Lithuania, these factors appear to have an even stronger effect. The country is feeling the brunt of transition policies and its demographic indicators are being affected. In 1970 the number of children exceeded the number of old people by 82 percent; by 1997 the gap had narrowed to 16 percent. In 1990 there were 9.8 marriages per 1,000, but in 1997 that figure had fallen to 5.1. Child illness is up by 26 percent since 1994, and in 1996 health care accounted for only 4.5 percent of GDP. More than a third of households consider themselves poor, and between 1989 and 1996 average real wages dropped by 35 percent. The country's social and economic fabric has been stretched to the limit.

Alcohol policies have also contributed to anxiety, depression and even hopelessness. Under the Soviet system, liberal alcohol laws were tightened by the Gorbachev administration, and consumption fell significantly during the 1980s. Those restrictions are no longer in place and, as a result, drunkenness is again quite common. On sunny days in Lithuania's cities and villages, small groups of unemployed men and women gather on street corners and gulp down low-cost liquor. If and when the liquor runs out, they too might be pushed to consider options, perhaps even final ones. Copyright © 1999 The Earth Times All rights reserved.

LIETUVOS RYTAS

A Gallup International poll showed Lithuanians were the most pessimistic people among 62 nations polled, with 53 percent of the country believing the year 2000 would be worse than the year 1999.

World Health Organization:

Suicides per 100,000 people per year

The following is a list of suicide rates by country according to data from the World Health Organization, in which a country's rank is determined by its total rate deaths officially recorded as suicides in the most recent available year, last updated in 2011.

Male and female suicide rates are out of total male population and total female population, respectively (i.e. total number of male suicides divided by total male population). The total rate of suicides is based on the total number of suicides divided by the total population rather than merely the average of the male and female suicide rates, because the gender ratio in most countries is not 1:1. Year refers to the most recent year that data was available for a particular country.

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

Preventing suicide

- Posted by - (0) Comment

If you or someone you know is living with depression or bipolar disorder (also known as manic depression), you understand all too well that the symptoms may include feelings of sadness and hopelessness. These feelings can also include thoughts of self-harm or suicide. Whether we have suicidal thoughts ourselves, or know a severely depressed person who does, there are ways that we can respond with strength and courage.

Understanding Suicidal Thinking

The most important thing to remember about suicidal thoughts is that they are symptoms of a treatable illness associated with fluctuations in the body’s and brain’s chemistry. They are not character flaws or signs of personal weakness, nor are they conditions that will just "go away" on their own. Depression and the depressive phase of bipolar disorder may cause symptoms such as the following:

- intense sadness

- hopelessness

- lethargy

- loss of appetite

- disruption of sleep

- decreased ability to perform usual tasks

- loss of interest in once-pleasurable activities

Taken together, these symptoms may lead someone to consider suicide. However, with proper treatment the majority of people do feel better and regain hope. Recovery is possible.

|

An article by the Depression and Bipolar Support Alliance (DBSA) |

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

Preventing suicide

- Posted by - (5) Comment

|

An article by the Depression and Bipolar Support Alliance (DBSA) |

If you or someone you know is living with depression or bipolar disorder (also known as manic depression), you understand all too well that the symptoms may include feelings of sadness and hopelessness. These feelings can also include thoughts of self-harm or suicide. Whether we have suicidal thoughts ourselves, or know a severely depressed person who does, there are ways that we can respond with strength and courage.

Understanding Suicidal Thinking

The most important thing to remember about suicidal thoughts is that they are symptoms of a treatable illness associated with fluctuations in the body’s and brain’s chemistry. They are not character flaws or signs of personal weakness, nor are they conditions that will just "go away" on their own. Depression and the depressive phase of bipolar disorder may cause symptoms such as the following:

- intense sadness

- hopelessness

- lethargy

- loss of appetite

- disruption of sleep

- decreased ability to perform usual tasks

- loss of interest in once-pleasurable activities

Taken together, these symptoms may lead someone to consider suicide. However, with proper treatment the majority of people do feel better and regain hope. Recovery is possible.

During severe depression, the systems that regulate emotion become disturbed. People in the middle of a severe depression often think only of things that are dark and sad. Physicians refer to this as “selective memory”—only remembering the "bad times" or the disappointments in life. This type of thinking is a symptom of the illness; it does not define who the person is. And with proper treatment, the individual will start to remember the good times and develop a more positive outlook. (top)

If You Are Feeling Suicidal

If you have begun to think of suicide, it’s important to recognize these thoughts for what they are: expressions of a treatable, medical illness. Don't let embarrassment stand in the way of vital communication with your physician, family or friends. Take immediate action and talk to somebody today. Remember, suicide is a permanent solution to a problem that is temporary.

When people don't understand the facts about suicide and depressive illnesses, they may respond in ways that can cut off communication and worsen their feelings. That's why it’s important to find someone you trust and can talk with honestly and openly. It's also why your mental health professional is an important resource in helping you—and your family. (top)

What You Can Do to Fight Suicidal Thoughts

- Keep a journal to write down your thoughts. Each day, write about your hopes for the future and the people you value in your life. Read what you've written when you need to remind yourself why your own life is important.

- Go out with friends and family. When we are well, we enjoy spending time with friends and family. When we’re depressed, it becomes more difficult, but it is still very important. It may help you feel better to visit, or allow visits from, family and friends who are caring and can understand.

- Avoid drugs and alcohol. Most deaths by suicide result from sudden, uncontrolled impulses. Since drugs and alcohol contribute to such impulses, it’s essential to avoid them. Drugs and alcohol also interfere with the effectiveness of medications prescribed for depression.

- Learn to recognize your earliest warning signs of a suicidal episode. There are often subtle warning signs your body will give you when an episode is developing. As you learn to manage your illness, you’ll learn how to be sensitive to them. They are signals to treat yourself with the utmost care, instead of becoming ashamed or angry with yourself. (top)

Create a “Plan for Life”

Many depression-related suicides occur during someone’s first three depressive episodes—before he or she learns that an episode of suicidal thinking is temporary. As people learn from experience that any given episode will eventually pass, the likelihood that they’ll actually act on suicidal impulses drops sharply. It’s important to have a course of action ready before thoughts of suicide occur. Some people find it helpful to develop a “Plan for Life.” This plan lists warning signs you should watch for, and actions to take, if you feel that you’re slipping into suicidal thoughts. Your “Plan for Life” may include:

- Contact information for your doctor, including back-up phone numbers (emergency services, pager and mobile phone).

- Contact information for friends and family.

- A description of your medical diagnosis (or diagnoses, if more than one)—not just depression but any medical problems you may have. Also include information about any medications you are taking.

- Health insurance information.

- Contact information for a local suicide hotline.

- Contact information for your local DBSA support group.

Click here to view a sample “Plan for Life.”

Educate those you trust about your condition before it becomes a crisis, so that they can be prepared if they’re called on to help. Provide key support people with your “Plan for Life” so they can act quickly, if needed. Carry a copy of your Plan for Life with you at all times so you can refer to it or pass it along to someone else who might be helping you in a time of crisis. With all your important phone numbers in one place, it will be easier for someone to help. (top)

How DBSA Support Groups Can Help

With a grassroots network of more than 1,000 support groups across the country, no one with depression has to feel alone. While DBSA groups do not provide suicide crisis programs, they do provide a caring environment for people to come together and discuss the challenges and successes of living with depression. They don’t offer group therapy, though many groups have a professional advisor (for example, a therapist, a psychiatrist or a psychologist) and all groups have appointed peer facilitators.

DBSA groups provide a forum for mutual understanding and self-discovery, help people stick with their treatment plans and gain support from others who have ”been there.” For information on DBSA support groups in your area, contact us at (800) 826-3632 or see our support group locator.

Facts About Treatment

There are many different medications and therapies available for the successful treatment of depression. Not all medications work the same for all people, so it may take some time for you and your doctor to develop a treatment plan that’s right for you. Stick with it, and recognize that your doctor is your partner in this search. (top)

Recognizing Warning Signs in Others

Sometimes, even health care professionals have difficulty determining how close a person may be to attempting suicide. As a friend or family member, you can't know for certain either. If you sense there is a problem, ask your friend or loved one direct questions and point out behavior patterns that concern you. Remind them that you care about them and are concerned. Talking about suicide with someone will not plant the idea in his or her head. If necessary, suggest that they make appointment to see their doctor and offer to go with them if you sense they would have difficulty doing it on their own. If you believe that immediate self-harm is possible, take them to a doctor or hospital emergency room immediately.

Warning signs may include the following:

- Feelings of despair and hopelessness

Often times, individuals with depression talk with those closest to them about extreme feelings of hopelessness, despair and self-doubt. The more extreme these feelings become, and the more often they’re described as "unbearable," the more likely it is that the idea of suicide may enter the person's mind. - Taking care of personal affairs

When a person is "winding up his or her affairs" and making preparations for the family's welfare after he or she is gone, there is a good chance the individual is considering self-harm or suicide. - Rehearsing suicide

Rehearsing suicide, or seriously discussing specific suicide methods, are also indications of a commitment to follow through. Even if the person's suicidal intention seems to come and go, such preparation makes it that much easier for the individual to give way to a momentary impulse. - Drug or alcohol abuse

Someone with worsening depression may abuse drugs or alcohol. These substances can worsen symptoms of depression or mania, decrease the effectiveness of medication, enhance impulsive behavior and severely cloud judgment. - Beginning to feel better

It might sound strange, but someone dealing with depression may be most likely to attempt suicide just when he or she seems to have passed an episode's low point and be on the way to recovery.

Experts believe there’s an association between early recovery and increased likelihood of suicide. As depression begins to lift, a person's energy and planning capabilities may return before the suicidal thoughts disappear, increasing the chances of an attempt. Studies show that the period six to 12 months after hospitalization is when patients are most likely to consider, or reconsider, suicide. (top)

Responding to an Emergency Situation

If someone is threatening to commit suicide, if someone has let you know they are close to acting on a suicidal impulse or if you strongly believe someone is close to a suicidal act, these steps can help you manage the crisis:

- Take the person seriously. Stay calm, but don't underact.

- Involve other people. Don't try to handle the crisis alone or jeopardize your own health or safety. Call 911 if necessary. Contact the individual's doctor, the police, a crisis intervention team or others who are trained to help.

- Express concern. Give concrete examples of what leads you to believe the person is close to suicide.

- Listen attentively. Maintain eye contact. Use body language such as moving close to the person or holding his or her hand, if appropriate.

- Ask direct questions. Find out if the person has a specific plan for suicide. Determine, if you can, what method of suicide he or she is considering.

- Acknowledge the person's feelings. Be understanding — not judgmental or argumentative. Do not relieve the person of responsibility for his or her actions.

- Offer reassurance. Stress that suicide is a permanent solution to a temporary problem. Remind the person that there is help and things will get better.

- Don't promise confidentiality. You may need to speak to the person's doctor in order to protect the person from himself or herself.

- Make sure guns, old medications and other potentially harmful items are not available.

- If possible, don't leave the person alone until you're sure he or she is in the hands of competent professionals. If you have to leave, make sure another friend or family member can stay with the person until professional help is available.

What You Can Do to Help Someone

Among the many things you can do to help someone who is depressed and may be considering suicide, simply talking and listening are the most important. Do not take on the role of therapist. Often, people just need someone to listen. Although this might be difficult, the following are some approaches that have worked for others:

- Express empathy and concern.

Severe depression is usually accompanied by a self-absorbed, uncommunicative, withdrawn state of mind. When you try to help, you may be met by your loved one’s reluctance to discuss what he or she is feeling. At such times, it’s important to acknowledge the reality of the pain and hopelessness he or she is experiencing. Resist the urge to function as a therapist. This can ultimately create more feelings of rejection for the person, who doesn't want to be "told what to do." Remain a supportive friend and encourage continued treatment. - Talk about suicide.

Talking about suicide does not plant the idea in someone’s head. Your ability to explore the feelings, thoughts and reactions associated with depression can provide valuable perspective and reassurance to your friend or loved one who may be depressed. Not everyone who thinks of suicide attempts it. For many, it's a passing thought that lessens over time. For a significant number of people, however, the hopelessness and exaggerated anxiety brought on by untreated or under-treated depression may create suicidal thoughts that they can’t easily manage on their own. For this reason, take any mention of suicide seriously.

If someone you know is very close to suicide, direct questions about how, when and where he or she intends to commit suicide can provide valuable information that might help prevent the attempt. Don’t promise confidentiality in these circumstances. It’s important for you to share this information with the individual’s doctor. - Describe specific behaviors and events that trouble you.

If you can explain to your loved one the particular ways his or her behavior has changed, this might help to get communication started. Compounding the lack of interest in communication may be guilt or shame for having suicidal thoughts. Try to help him or her overcome feelings of guilt. If there has already been a suicide attempt, guilt over both the attempt and its failure can make the problem worse. It’s important to reassure the individual that there’s nothing shameful about what they are thinking and feeling. Keep stressing that thoughts of hopelessness, guilt and even suicide are all symptoms of a treatable, medical condition. Reinforce the good work they’ve done in keeping with their treatment plan. - Work with professionals.

Never promise confidentiality if you believe someone is very close to suicide. Keep the person’s doctor or therapist informed of any thoughts of suicide. If possible, encourage them to discuss it with their doctor(s) themselves, but be ready to confirm that those discussions have taken place. This may involve making an appointment to visit the doctor together or calling the doctor on your own. Be aware that a doctor will not be able to discuss the person’s condition with you. You should only call to inform the doctor of your concern.

Whenever possible, you should get permission from your loved one to call his or her doctor if you feel there’s a problem. Otherwise, it could be seen as "butting in" and may worsen the symptoms or cause added stress. Of course, if you believe there is a serious risk of immediate self-harm, call his or her doctor. You can work out any feelings of anger the person has towards you later. - Stress that the person's life is important to you and to others.

Many people find it awkward to put into words how another person's life is important for their own well-being. Emphasize in specific terms to your friend or loved one how his or her suicide would devastate you and others. Share personal stories or pictures to help remind your loved one of the important events in life you’ve shared together. - Be prepared for anger.

The individual may express anger and feel betrayed by your attempt to prevent their suicide or help them get treatment. Be strong. Realize that these reactions are caused by the illness and should pass once the person receives proper treatment. - Always be supportive.

People who have thought about, or attempted, suicide will most likely have feelings of guilt and shame. Be supportive and assure them that their actions were caused by an illness that can be treated. Offer your continued support to help them recover. - Take care of yourself.

It’s not uncommon for friends and family members to experience stress or symptoms of depression when trying to help someone who is suicidal. You can only help by encouraging and supporting people through their own treatment. You cannot get better for them. Don’t focus all of your energy on the one person. Ask friends and family to join you in providing support and keep to your normal routine as much as possible. Pay attention to your own feelings and seek help if you need it.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

Drunk politician causes traffic accident, waives responsibility – so typical, so annoying…

- Posted by - (0) Comment

![]()

This week, the Lithuanian parliamentarian Vincas Babilius of the Liberal and Centre Union LiCS party caused a traffic accident while drunk, according to eyewitnesses.

The young man whose car was damaged in the accident, said that the member of the parliament seemed drunk and had offered him 25 thousand litas if he did not call the police.

After this, Mr. Babilius left the scene of the accident and went to hospital the next day.

Yet again a politician goes unpunished, writes www.diena.lt:

“Theoretically he could have waited for the police, paid the fine and – if he had been driving under the influence of alcohol – resigned his post as member of parliament. In practice, however, things have once again taken the usual course.

… If the victim of the accident is to be believed, the politician appeared to be drunk and offered him a large amount of money, which he refused. Then the parliamentarian dismantled his license plates and took a taxi home.

When the story came out the next day, Vincas Babilius was suddenly in hospital – for heart problems. So typical, so annoying,” writes the newspaper.

Vincas Babilius

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

By Valdas Samonis

The current Prime Minister Andrius Kubilius Government of Lithuania adopted a very ambitious (no IMF help even sought!) and a rather very harsh austerity modeled on the reigning traditional EU thinking in order to clean the Augean stable of Lithuania’s finance wrecked by the former Soviet nomenklatura hijacked governments that largely used “easy” EU money to place their cronies in plum jobs in LT and Brussels (to the exclusion of younger generation of course), “prikhvatize” real estate and keep it from any socially beneficial taxation, etc.

The Kubilius Government’s harsh austerity policies (the so called internal devaluation) cutting public sector wages, social expenditures (by about one third) and increasing some taxes, etc, in a national fiscal belt tightening (“diet”) that has probably been the steepest in recent memory globally. Predictably, the GDP collapse was horrible at some 20%. The LT people have been pretty much resigned to the fate, in a stark contrast to Greece.

Despite repeatedly proving the nation’s responsibility and sacrifice (investment) capabilities via austerity, etc, LT did not attract much European/Western direct investment so the productivity remained at low post-communist levels at the time when emerging Asia provides a stiff global competition.

Before they realized what is going on and who was robbing them, the Lithuanian people got clabbered by this new ambitious austerity policy and the younger ones started emigrating in catastrophic numbers, seeing no future in the country whose GDP was reduced (from a low post-Soviet level) by some 20% by the combination of the old nomenklatura rent-seeking policies and the continued global Great Recession. Lithuania is hollowing out, unfortunately.

While the Lithuanians made huge sacrifices and so “invested” in the future, the Greeks have been continuing the party here and now until the last bottle or perhaps they can get another one, and another :).

In the current state of European affairs, Greeks won, Lithuanians lost!

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

|

LITSHARES: |

|

A Strategy for Global Financing of Lithuania’s Development |

|

Dedicated to Those Dead or Alive Whose Blood and Brains Made Free Lithuania Possible |

|

|

|

By Valdas Samonis |

|

2/16/2012 |

|

ABSTRACT. Given the dangerous European and global economic and strategic predicaments, Lithuania (LT) needs to adopt very bold and innovative ways to “sell” to the world its extreme austerity sacrifices during the continuing period of global Great (D)Recession and its earlier periods of bold systemic transformations as well. This proposal is a new strategy to globalize LT financial-economic ties (optimal global integration) so that the nation is no longer badly cornered and unduly dependent on the moribund European Union (EU) which is distracted and disoriented by the cacophony of austerity/profligacy controversies, and actually rewarding free riders by default. By now it is rather clear that Europe alone cannot properly reward the financial virtue and sacrifice of the LT people for the sake of the future (investment) which is the most distinguishing trait of a responsible nation and a mature leadership; hence the need for LT to go before the entire “global village”. Globalization can provide huge and underappreciated benefits for a nation like LT. This litshares or litakcijos (LTS) proposal is still to be developed to a greater detail and “hands-on” policy relevance. In the first instance, LTS would appeal strongest to LT residents, diasporas, and other FOLK (Friends of Lithuania of All Kinds); then they would catch up globally rather fast. |

Introduction and Attributions

The basic insight which gave rise to my litshares (LTS) proposal for Lithuania (LT) stems from the Nobel level economist Robert J. Shiller who is the Arthur M. Okun Professor of Financial Economics at Yale University, USA, and the author of the forthcoming book entitled Finance and the Good Society (Princeton University Press) as well as the co-author (with Nobelist G. Akerlof) of my recently reviewed book Animal Spirits: How Human Psychology Drives the Economy and Why It Matters for Global Capitalism (Princeton University Press). I have gained a lot of inspiration and new understanding from my extensive discussions at The Institute for New Economic Thinking (INET), particularly interactions with the Reagan Era’s US Fed Chairman Paul Volcker and other top global experts at the INET Bretton Woods Conference in 2011. Research assistance by Ramune Samonis, University of Toronto, is gratefully acknowledged.

Right after the pinnacle of the disastrous financial crisis in 2008, The Queen Elizabeth II asked economists, “Why did no one see the credit crunch coming?” Three years later, a group of Harvard undergraduate students walked out of an introductory economics course and wrote, “Today, we are walking out of your class, Economics 101, in order to express our discontent with the bias inherent in this introductory economics course. We are deeply concerned about the way that this bias affects students, Harvard University, and our greater society.” What has happened? Rebellion from both above and below suggests that economists, who were recently at the core of power and social leadership in our society, are no longer trusted much. Not long ago, the principal theories of economics appeared to be the secular religion of society, writes Dr. Robert Johnson, Executive Director, The Institute for New Economic Thinking.

Nice Try, Europe!

Since 2007, in the five years of the continuing economic crisis, the European Union (EU) countries have been performing very badly: 22 of its 27 members incl. those from Central & Eastern Europe (CEE) have lost time as measured by several economic clocks (GDP levels, share prices, real estate values, etc). Asia has performed much more strongly but even it presents a mixed picture. In particular, the long road back for global shares as measured by the most important indices according to data by Prof. R. Shiller, The Economist, and Thompson Reuters, see Chart 1.

Chart 1: The Long & Winding Road Back to Zero for Global Shares

The theory of economic integration was developed over half a century ago by Jan Tinbergen, Bela Balassa, and other prominent scholars of integration. However, the house of the European integration has been built on flawed fundamentals. While the European integration fathers (Schuman, etc) were understandably in a rush to rebuild Europe on a different model as quickly as possible so it avoids the repetition of the disastrous 20th Century wars, the art and science of “architecture” in building the European integration (United States of Europe) were not properly understood and used. Simply copying the USA does not work in Europe, as we abundantly know now. With these fundamental problems, the diagnosis and prognosis for Europe does not look good at all.

With the European Central Bank/euro acting as the "new" gold standard and the current totally confused austerity/profligacy debates, Europe is probably repeating the most horrible mistakes of the bloody past. In the 1920s, after experiences of inflation and then huge and uncontrolled capital inflows, Germany lost productivity advantages in part due to uncontrolled wage growth in the environment of heavy leftist/communist propaganda. Capital inflows suddenly turned to a trickle, governments and banks were squeezed for money and credit, bank asset fire sales started, followed by runs on banks, deflation, Great Depression; the rest is history. Under the regime of the fixed exchange rates of the gold standard, this history was the logical outcome. John M, Keynes wrote in his book The Economic Consequences of the Peace back in 1919:

“Very few of us realize with conviction the intensely unusual, unstable, complicated, unreliable, temporary nature of the economic organization by which Western Europe has lived for the last half century. We assume some of the most peculiar and temporary of our late advantages as natural, permanent, and to be depended on, and we lay our plans accordingly. On this sandy and false foundation we scheme for social improvement and dress our political platforms, pursue our animosities and particular ambitions, and feel ourselves with enough margin in hand to foster, not assuage, civil conflict in the European family”.

Since 2000, the risks are even worse because of toxic assets (mortgage backed securities, other derivatives, etc) that spread around the world in and nobody knows the true financial health position of counterparties. In the near European future, we are likely to see similar credit crunch spasms, catastrophic collapses of exports/trade, and Europe's Great Depression 2: economic and political disintegration, beggar-thy-neighbor policies, conflicts, etc. The history does not repeat itself exactly though.

The USA may follow the unenviable example of Japan but at least that is a slow and gradual decline that gives opportunities for new bursts of the US "animal spirits" and new turnarounds, e.g. via increased immigration, new and exports-oriented manufacturing technologies, etc.

Without getting here into undue larger debates, it is sufficient to sum up that conventional European approaches fail to provide remedies to the great majority of the economic Greek Tragedies that afflicted the continent and the world, incl. the current Great (D)Recession; this rather sweeping assertion is not even controversial in early 2012. The reason it is so is that these standard economic theory approaches completely fail to account for the operation of “animal spirits”, a concept dating back to John M. Keynes. Animal spirits are our interpretations of finance, economics and the economy, our mental/psychological forces and constructs, spiritus animalis from the original Latin. They include: (non)confidence (with its Keynesian style multipliers), the issue of fairness in wage determination and other areas (like comparative pensions among nations), corruption and bad faith phenomena in the societies, money illusion that people usually operate under, and stories that are our practical and simplified ways of thinking about our economic and financial affairs.

Enter the Center: Lithuania

Located at the geographical center of Europe, Lithuania has been leading the postcommunist world in economic and political reforms, shedding development retarding legacies of the occupying power (USSR), and trying to re-join the global village after some half a century of the Soviet occupation and the resultant destruction of ties to the world. Since 1990 Declaration of Independence, LT has gained a unique global recognition, even admiration, for its valiant and peaceful freedom-seeking anticommunist revolution and thus amassed a lot of global political capital and global good will. In the interwar independence period that included the global Great Depression, LT had a second strongest currency in Europe, after the Swiss franc. The problem is that LT remains a very timid seller of its stamina, achievements, etc, seemingly resigned to sacrifices without getting much credit for them in this global village of ours.

Since the Annus Mirabilis 1989, the theory was that Central and Eastern Europe (CEE) would use its abundant and (relatively) educated labor force to grow faster and on a more sustainable and consumer-oriented (prosperity) basis due to a decisive shift to markets and European integration. The EU integration was supposed to anchor market reform achievements and help secure new sustainable growth as outlined in the now almost forgotten EU Growth and Stability Pact.

What got in the way is the theory of (rational?) expectations?

True, CEE did receive a sort of a very modest version of Marshall Plan from the EU. True to four EU freedoms, Western Europe has been opening in fits and starts to labor movements (emigration) from CEE. So when new CEE policymakers were implementing pretty liberal market reforms, they should have anticipated some outflows of labor force to much higher bidders in Western Europe due to simple demonstration effect. Poorly understood legacies of communism are at fault here.

What got in the way is the law of unintended consequences in complex processes?

When the British opened their labor markets to the East, they anticipated some 10-12 thousand immigrants from Poland, for example, what they got is some one million and rising. Who knows what the figure will be a longer time after Germany’s opening in 2011?

What got in the way is the paradigm of hard-to-calculate policy externalities?

The current Prime Minister Andrius Kubilius Government of Lithuania adopted a very ambitious (no IMF help even sought!) and a rather very harsh austerity modeled on the reigning traditional EU thinking in order to clean the Augean stable of Lithuania’s finance wrecked by the former Soviet nomenklatura hijacked governments that largely used “easy” EU money to place their cronies in plum jobs in LT and Brussels (to the exclusion of younger generation of course), “prikhvatize” real estate and keep it from any socially beneficial taxation, etc. The Kubilius Government’s harsh austerity policies (the so called internal devaluation) cutting public sector wages, social expenditures (by about one third) and increasing some taxes, etc, in a national fiscal belt tightening (“diet”) that has probably been the steepest in recent memory globally. Predictably, the GDP collapse was horrible at some 20%. The LT people have been pretty much resigned to the fate, in a stark contrast to Greece.

The Kubilius Government has been operating under the handicap of the currency board (CB) arrangement which is an alternative monetary arrangement to a central bank and a national monetary policy, e.g. using short-term interest rates. Against a better advice, CB was introduced as far back as 1994, even though LT has had very good interwar comparative experiences with running the second strongest currency of Europe in a classical central bank formula that fits the responsible nation like LT very well. As opposed to the classical central bank, CB allowed no room for monetary easing while doing harsh austerity. For all practical reasons, LT currency has been hard pegged to euro resulting in a quasi Eurozone membership of LT. The formal LT membership of the Eurozone was denied by Brussels on the flimsy grounds of miniscule short-term inflation targeting problems, while France and other Eurozone core countries have been rather openly violating the EU’s fundamental Maastricht Treaty and the Growth and Stability Pact. As we know from the world history (e.g. Argentina), CB regimes can be very destabilizing (incl. runs on banks, etc) during the kind of deep turmoil periods that Europe is experiencing since 2008.

Despite repeatedly proving the nation’s responsibility and sacrifice (investment) capabilities via austerity, etc, LT did not attract much European/Western direct investment so the productivity remained at low postcommunist levels at the time when emerging Asia provides a stiff global competition.

Thus, very unlikely EU countries, like the Soviet communist exploited and impoverished Lithuania, have long showed the way to Europe by adopting serious austerity policies that go almost to the point of "eating the dog food", to use a hyperbole. Unfortunately, this good model that Europe has been looking so desperately for (and could not find) is drowned in the cacophony of bureaucratic quarrels around bailing out Greece and other profligate countries that are, so far at least, the true winners in Europe. Theoretically, if the nation like LT adopts a conventional, hard austerity policy, a serious “diet” designed to improve public finances and the resultant “crowding out effect”, the nation should get into the global position of substantially improved financial reputation, presumably also the much lower cost of its longer-term capital.

However, it all comes to empirics and experiential learning. Theoretically, you can think of a hypothetic success story of "expansionary austerity". It would be due to the removal or reduction of the crowding out effect (COE) that government profligacy usually causes. The removal of COE should theoretically lead to productivity increases on the strength of the argument that business can innovate/do business better than government does; vide long economic history of postcommunist countries and of the world in general. However, the problem is the time horizon. If austerity leads to the catastrophic collapse of GDP, then emigration of hard-to-replace human resources and capital flight usually follow. In short, austerity can work in the long run provided that the long run exists at all; that is if the economy is not dead by that time, to paraphrase Keynes. Ultimately, economic policy is about experiential learning, empirics that are. When a nation’s economy contracts, as LT did by some 20%, and its debt continues to grow, a big problem develops for the taxpayers. This is why Europe is in turmoil right now. “Expansionary austerity” is an oxymoron, every bit as it sounds, in the mid-term at the very least.

Before they realized what is going on and who was robbing them, the Lithuanian people got clabbered by this new ambitious austerity policy and the younger ones started emigrating in catastrophic numbers, seeing no future in the country whose GDP was reduced (from a low post-Soviet level) by some 20% by the combination of the old nomenklatura rent-seeking policies and the continued global Great Recession. Lithuania is hollowing out, unfortunately.

While the Lithuanians made huge sacrifices and so “invested” in the future, the Greeks have been continuing the party here and now until the last bottle or perhaps they can get another one, and another:).

In the current state of European affairs, Greeks won, Lithuanians lost! This is the tale of two integrating nations: they are even related since ancient times according to a Greek Palemonas legend.

Litshares: The Conceptual-Analytical Framework for Globalizing Lithuania

Despite some serious problems with the first stage of globalization, it can provide huge and so far very poorly understood benefits for a responsible, thousand-year nation like LT. How about developing an innovative strategy to get some hard earned respect and actual long-term financial capital for sustainable development of LT from the global markets? Below is my proposed case for litshares or litakcijos (LTS) for LT.

Writing in the Harvard Business Review (HBR, January-February 2012), Prof. Robert Shiller suggested a simplifying assumption that a nation can be treated as a corporation from an investment and developmental point of view. Corporations use both debt and equity to finance their investments and operations; nations use only debt.

The logic goes that nations like LT should replace much of their existing national debt with shares in the “earnings” of their economies. This would allow them to better manage their financial obligations, present themselves better before global markets, and could help prevent future financial crises. It might even lower a nation’s borrowing costs in the longer run. LT paid something like 10% as a cost of capital in the recent past, usury really.

National shares would function much like corporate shares traded on stock exchanges of the world: London, Frankfurt, NYC, Hong Kong, Toronto, etc in the case of LTS. They would pay dividends regularly. Ideally, they would be in perpetuity, although a nation could always buy its shares back on the open market. The price of a share would fluctuate from day to day as new knowledge about a nation’s economy came out and have been digested by global analysts. The opportunity to participate in the uncertain economic growth of the new issuer nation (esp. “hidden gem” like LT) might excite investors, just as it does in the stock markets around the world.

Helped by Dr. Mark Kamstra, Prof. Shiller developed some insights on how these new national shares could work. In my proposed case of LT, these litshares (LTS) could pay a quarterly dividend equal to exactly one-billionth of the nation’s quarterly GDP (some 30 billion LTL in Q4, 2011), the simplest measure of national earnings. The fractional value of LTS could be different of course; but the important consideration in case of LT is to attract all the global investors, even smaller ones. The payoff would vary of course, depending on how well the nation like LT does, what the GDP growth is (over 100 billion LTL in 2011). If the economy surprised the investors on the upside, dividends would go up; if it declined, dividends would fall. The global markets would determine the price of an LTS which would be normally volatile. It would depend not only on the most recent dividend but also on the investors’ expectations for the future, which can change for the better precisely because of austerity “investments” by LT or any other nation, as opposed to profligacy of other nations, etc. There is s some evidence that a LTS might often be expensive relative to the dividend, which would be good for the national issuer. Prof. Shiller observes that shares of many US corporations and 10-year US Treasury notes sell for over 50 times their annual dividend. Since the growth rate of the real US GDP has been higher than that of real S&P 500 earnings in the past (3.1% annual GDP growth versus 2.5% annual S&P 500 growth over the past half century), such shares might sell for a multiple higher than 50.

Litshares Could Be Attractive Investments Globally

The advantage of keeping LTS equal to a billionth part of the economy is that people will know exactly what they are getting: one-billionth of a thousand-year old nation like LT is real and easy to understand for global investors. Such shares based on GDP have the great merit of being really clear, simple, and understandable to investors globally. Other measures of national earnings might seem to some analysts more appropriate than GDP but would sacrifice the great virtue of simplicity, clarity, transparency. This kind of simplicity and clarity encourages the development of badly needed confidence and trust that governments will not shirk their obligations at any time in the future. This is much better confidence and trust building strategy than any heavily advertised “magic” mechanisms like currency board that LT adopted against a better advice back in 1994.

LTS may appeal to international investors even more than corporate shares do because LTS would avoid the problem of the so called moral hazard. Here is the reason that Prof. Shiller stresses. If international investors ever acquired a good fraction of a nation’s corporate shares, the nation would have an incentive to raise the corporate profit tax on those shares or regulate them to reduce their value. If a nation did so, like the Kubilius Government rather erroneously did in LT, it would benefit without technically violating any promises. The issuance of LTS, however, would involve a strong and easily understandable promise of share in the value added (GDP) to global investors. If the shares paid dividends in the nation’s domestic currency like LTL, it would eliminate another moral hazard associated with the traditional debt. If the national shares strategy is adopted, the nation could not reduce its real obligations by creating inflation (e.g. via devaluation, as is already happening in some CEE countries), as they can with conventional government debt, because their nominal GDP would increase in proportion to the inflation thus created.

Speaking of Greece, Prof. Shiller asks what effect could national shares have had during the Great Recession and its aftermath? Greece’s real GDP fell 7.4% in 2010. If its shares were leveraged substantially, e.g. five to one, then the dividend paid on them would have fallen by about 40%. This would have done much to alleviate the crisis, making it easier for notoriously rebellious Greek taxpayers to bear. It would have given Greece a bailout without any scandal-ridden international controversies, loss of face and reputation or broken promises. After the fact, investors in Greek national shares would have been unhappy. But they still might have been willing to buy them, considering the very possible upside of such a leveraged investment. Global investors eagerly buy leveraged corporate stocks, so it is plausible that they would buy leveraged national shares as well. Global markets for national shares would fundamentally change the economic atmosphere (and confidence) in a nation like Greece or LT. An immediate market response would accompany every new governmental plan (strategy) affecting the future of the economy and society, generating discussions, free publicity, and a broader knowledge of each nation’s development plans, as well as much more energetic flows of global resources towards nations with plans that passed the transparent global markets test. This is much simpler and easier to understand for investors than the obscure and at times obviously disreputable work of traditional credit rating agencies or corrupt analysts.

In Lieu of Conclusions

With national share prices going up and down, LTS or other such shares might look to some analysts as an unwelcome extension of financial capitalism. Financial industry is in deep disrepute globally for causing this Great (D)Recession. But, in fact, the thoughtful implementation of disciplined financial capitalism has been the story of every successful nation in history. LT has made a very good headway. We should have real global markets for nations like LT; such “macro” markets would track their successes much more accurately and justly than stock markets usually do. And LTS would do the necessary justice to serious efforts and results of structural reforms and financial discipline like in LT. Stock markets trade only in claims on corporate earnings after corporate taxes, which is an unreliable measure of a nation’s success. We can do better, concludes Prof. Robert J. Shiller who was among the very few experts to have predicted this Global (D)Recession. He argues that, rather than condemning finance, we need to reclaim it for the common good. He makes a powerful case for recognizing that finance is one of the most powerful tools we have for solving our common problems as mankind, and increasing the general well-being of people. We need more financial innovation and more globalization that would be developed in the policy environment of proper risk and knowledge management. The acute need for modern risk/knowledge management arises because global markets do an excellent job of nurturing financial innovations that people want (rather than need); but they are much less useful for planning for when things go wrong, like in this Global (D)Recession.

With regard to my LTS proposal, in the first instance, LTS would appeal strongest to LT residents, diasporas, and other FOLK (Friends of Lithuania of All Kinds); then they would catch up globally rather fast. My LTS proposal is to be developed to a much greater detail and “hands-on” policy relevance.

Valdas Samonis

INET and SEMI Online

Toronto-New York City-Vilnius

For more on V. Samonis publications, please consult:

V. Samonis Author Page on Amazon.com

http://www.amazon.com/Valdas-Samonis/e/B0031SF300/ref=ntt_dp_epwbk_0

and/or search for the name Samonis (Val or Valdas) in Google.com.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

Lithuania is a cultural treasure the world still knows far too little about

- Posted by - (3) Comment

The Lithuania National Symphony Orchestra playing in the National Philharmonic Hall, Vilnius.

Conductor: Professor Juozas Domorkas. Photo: Michailo Raškovskio

Far too few people outside Lithuania know what a tremendous treasure of culture this country represents! Today Lithuanian art is not only flourishing at home but is also gaining recognition internationally. Though not every poster tells that a nightingale soprano, a graceful ballerina, or a divine cello player comes from Lithuania, the probability that you have just enjoyed a concert of a Lithuanian artist is great, whether it be New York, London, Berlin, or Vilnius.

Vilnius, a city with a population slightly more than half a million, is packed with art galleries and is full of posters inviting you to exhibitions, concerts and plays, both in traditional galleries and concert halls, but also in less traditional venues. The old town itself is like a spacious and cosy gallery of Baroque architecture.

And it is not only Vilnius that can boast of a rich cultural life. Nearly every bigger town has a professional theatre, concert hall and a tradition of regularly attending cultural events. Though the Lithuanian summer is short, the summer calendar is packed with festivals going on all around Lithuania.

For centuries Lithuania has been home to those of Slavic, Jewish, Karaite, and Prussian descent, along with those of other nations. This multiculturalism, along with the figurative expression in literature, theatre, cinema and fine arts, has become a hallmark of Lithuanian art. The link between history and the present is the feature pointed out most often by lovers of Lithuanian art in neighbouring European countries and more distant Asian countries...

“Užgavėnės” is a Lithuanian festivalthat takes place during the seventh week before Easter (Ash Wednesday). Its name in English means “the time before Lent”. The celebration corresponds to Roman Catholic holiday traditions in other parts of the world, such as Mardi Gras, Shrove Tuesday, and Carneval.

Europe is discovering Lithuania through its culture. Lithuanian art is not only flourishing in Lithuania but is also gaining recognition internationally. Though not every poster tells that a nightingale soprano, a graceful ballerina, or a divine cello player comes from Lithuania, the probability that you have just enjoyed a concert of a Lithuanian artist is great, whether it be New York, London, Berlin, or Vilnius.

Vilnius, a city with a population slightly more than half a million, is packed with art galleries and is full of posters inviting you to exhibitions, concerts and plays, both in traditional galleries and concert halls, but also in less traditional venues. The old town itself is like a spacious and cozy gallery of Baroque architecture.

It is not only Vilnius that can boast of a rich cultural life, but nearly every bigger town has a professional theatre, concert hall and a tradition of regularly attending cultural events. Though the Lithuanian summer is short, the summer calendar is packed with festivals going on all around Lithuania.

For centuries Lithuania has been home to those of Slavic, Jewish, Karaite, and Prussian descent, along with those of other nations. This multiculturalism, along with the figurative expression in literature, theatre, cinema and fine arts, has become a hallmark of Lithuanian art. The link between history and the present is the feature pointed out most often by lovers of Lithuanian art in neighboring European countries and more distant Asian countries. They also point to the tolerance and openness of Lithuania culture towards cultures of other nations.

Literature

Lithuanians are well-read nation. Enthusiastic participation in international book fairs has changed the attitude of foreign publishers towards Lithuanians writers and also of Lithuanians themselves. Earlier the leading role in Lithuanian literature was played by poetry, though international book fairs brought a revelation that should show more interest in and be proud of the modern prose by talented Lithuanian women writers like Jurga Ivanauskaitė, Renata Šerelytė, Vanda Juknaitė and gifted contemporary authors such as Sigitas Parulskis and Marius Ivaškevičius. The most pleasing fact is that despite global computerization, both translations and books by Lithuanian authors still top gift lists, and that the Baltic book fair in Vilnius is attended by nearly every second Lithuanian family.

Theatre

Meanwhile Lithuanian theatre could be called the most intriguing part of the general development of theatre happening worldwide. Moreover, stage directors from Lithuania have a huge following in many parts of the world: Eimuntas Nekrošius is a favorite of Italian drama ad opera theatres, Rimas Tuminas is beloved in the Nordic countries, and the festivals in Avignon and Edinburgh cannot be imagined without Oskaras Koršunovas. Lithuanian theatre performances are always a big event in Russia, and the number of Lithuanian theatre fans is rapidly growing in France, Germany, Italy, Spain, South Korea, Hong Kong, USA, Mexico, Canada, Columbia, Argentina and Brazil.

Opera star Violeta Urmana performs at famous theatres and concert halls all over the world, but few know that this top level soprano is Lithuanian. Similarly successful are other Lithuanian musicians, traveling and performing in concert halls all over the world, and winning awards at international festivals. They are performing not only popular or modern world classics, but also the music by famous Lithuanian composers – Onutė Narbutaitė, Raminta Šerkšnytė, Bronius Kutavičius, Osvaldas Balakauskas, Algirdas Martinaitis, Mindaugas Urbaitis and Anatolijus Šenderovas.

The Lithuanian National Opera and Ballet Theatre invites you to the performance of the 2011 Season . Keeping in mind that all tickets are usually sold out before the performance, we recommend you to book tickets beforehand.

Fine arts

Today exhibition halls show the pieces of fine arts painted a few decades ago, and which is referred to as „silent modernism“. It contributed to the maturity of the artists of the modern generation who freely communicate with the audience through their installations, performances and video art not only in the Contemporary Art Center in Vilnius, but also in Paris, Venice and New York. Pieces of art by Eglė Rakauskaitė, Paulius and Svajonė Stanikas, Deimantas Narkevičius, and Gediminas and Nomeda Urbonas, which have reached international audiences, provided a possibility for Lithuanians themselves to realize the unique nature of their art.

Every encyclopedia or reference book on art has an entry about Fluxus. But few of them mention that this influential movement was initiated by Lithuanian Jurgis Mačiūnas.

Who is Jurgis MAČIŪNAS?

Jurgis Mačiūnas, internationally known as George Maciunas, the father of Fluxus, (November 8, 1931- May 9, 1978) was born in Kaunas, Lithuania. As a young man he moved to Germany to escape the Soviet occupation of Lithuania.

What is FLUXUS?

Fluxus (from „to flow“) is an art movement noted for the blending of different artistic disciplines, primarily visual art, but also music and literature.

Fluxus included a strong current of anti-commercialism disparaging the conventional market-driven art world in favor of an artist-centered creative practice.

Among its early associates were Joseph Beuys, Dick Higgins, Nam June Paik and Yoko Ono.

Fluxus has also been compared to Dada and aspects of Pop Art and is seen as the starting point of mail art.

Paintings by Dalia Kasčiūnaitė, Ričardas Vaitiekūnas, Rūta Katiliūtė, Algis Griškevičius, Vilmantas Marcinkevičius, slupture Mindaugas Navakas, and many others are exquisite pieces in many foreign, private and even royal collections of art.

Cinema

Though Lithuanian cinema directors are yet not as known as Danish, French or Italian masters, they still have their audience, who appreciate Lithuanian cinema for deep insight into the human being and its poetic view towards life. Lithuanian short films by Giedrė Beinoriūtė, Ramūnas Greičius, Inesa Kurklietytė and documentaries by Audrius Stonys, Valdas Navasaitis and Arūnas Matelis have garnered international awards and numerous international film festivals.

Lithuanian films have also found their audience in Cannes, New York, Tokyo with cinema fans having already gotten acquainted with the names of Šarūnas Bartas, Algimantas Puipa, Janina Lapinskaitė and Kristijonas Vildžiūnas.

Jonas Mekas (born December 23, 1922 in the village of Semeniškiai) is a Lithuanian filmmaker, writer, and curator who has often been called “the godfather of American avant-garde cinema”. He was the founder of the Anthology Film Archives, The Film Makers Cooperative and Film Culture magazine. He wrote film reviews for The Village Voice since 1958. He was heavily involved with artists such as Andy Warhol, Nico, Yoko Ono, John Lennon, Salvador Dali and fellow Lithuanian George Maciunas.

During WWII, Mekas lived in displaced persons camps before emigrating to the United States with his brother, Adolfas Mekas, in 1949.

Though his narrative films and documentaries are still highly regarded, he is best known for his diary films, such as Walden (1969), Lost, Lost, Lost (1975), Reminiscences of a Voyage to Lithuania (1972), and Zefiro Torna (1992). In 2001, he released a five-hour long diary film entitled As I Was Moving Ahead, Occasionally I Saw Brief Glimpses of Beauty, assembled by hand from an archive of fifty years worth of recordings of his life.

He is also a highly regarded poet in Lithuania.

Whatever it is – a movie, a book presentation or a theatre performance – the label “LITHUANIA” means an opportunity to experience and universally enriching.

Source: http://lietuva.lt/en/culture

The painting “Harvest Girl” (Pjovėja) from 1844 by Kanutas Ruseckas (1800-1860) is probably the most popular painting in the Vilnius Picture Gallery - Lietuvos dailės muziejos.

- Bookmark :

- Digg

- del.icio.us

- Stumbleupon

- Redit it

Adomas Varnas – artist and banknote designer

- Posted by - (8) Comment

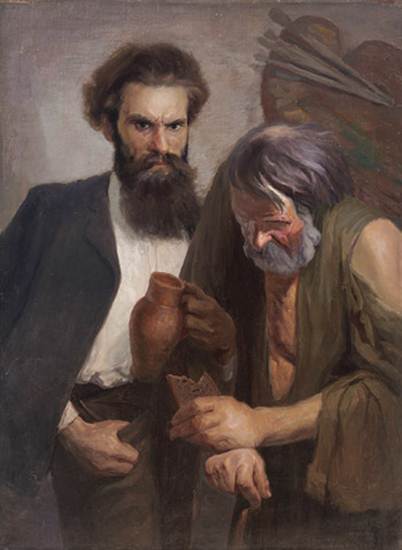

Adomas Varnas (1879-1979).

“Artist and beggar”, 1906-1908, oil on canvas, 115x80.

Čiurlionis National Art Museum

By Frank Passic, Albion, Michigan, USA

A few weeks ago in Vilnews there was an article about Lithuanian artist Adomas Varnas (1879-1979), which included an illustration of his 1953 masterpiece entitled “The Coronation of King Mindaugas.” Varnas’ lifespan far surpassed those of his counterparts, and his biography is extensive. Varnas was co-founder and the first president (1920) of the Association of Creative Artists, and helped organize Lithuanian art schools and galleries. He became well known for his collection of ethnographic material, particularly the wayside crosses. He also designed various Lithuanian stamps and banknotes.

Varnas escaped to the West during the summer of 1944, and in 1949 settled in Chicago, Illinois. Despite his old age, he remained active until the time of his death. He celebrated his upcoming 100th birthday on December 8, 1978 and was able to speak briefly at a banquet held in his honor in Chicago at the time.

In a bit of irony, the Lithuanian numismatist Dr. Aleksandras Rackus (1893-1965) wrote in 1949: